CHIEF EXECUTIVE'S REVIEW

The past year has seen the starch operation and the land conversion and development activities deliver record performances, while weather and market conditions adversely impacted the performance of the sugar operations. Significant progress was made in improving protection from imports and increasing sugar prices in the domestic markets, while further progress was made in the drive to reduce the cost of sugar production. The implementation of multiple actions related to the sugar operations’ intensive agricultural improvement programmes are on-going and, together with more regular growing conditions, will substantially improve sugarcane yields in the future.

Tongaat Hulett continues to focus its actions on the success drivers that will lead to increased profitability and cash generation. There has been substantial progress in achieving goals in key focus areas and further significant outcomes are targeted for the year ahead.

IMPROVING STARCH AND GLUCOSE PRODUCT AND MARKET MIX

The commissioning of the R135 million investment for the coffee creamer sector and further investments at the Meyerton facility have ensured that Tongaat Hulett’s starch operations are well-positioned to replace imported volumes and to continue to improve the mix of its product and market portfolios. In the coming year, these mix and volume improvements will provide some offset to the impact of higher South African maize prices, due to the impact of the current drought. A weaker Rand is also of benefit to the business.

Tongaat Hulett’s starch operation currently has about 15 percent of its installed up-stream wet-milling capacity available after servicing existing markets. The operation has a well-developed source of raw materials, a strong South African domestic market presence and access to regional markets, all of which are in an upward starch and glucose consumption phase.

During the 2015/16 financial year Tongaat Hulett and its customers imported 12 152 tons of glucose to support local production. The recent investment in the coffee creamer sector will allow for the replacement of these imports by local production and provide more effective use of the upstream capacity.

In addition to the investment for the coffee creamer sector, further improvements have been made at the Meyerton facility during the last year to increase starch production capacity and to commission new boilers. These investments will facilitate an increase in production of modified starches for the prepared food sector, for both the local and export markets during the current year. Market development is well advanced, with the products being approved by local and export customers.

The prevailing drought conditions are expected to result in a maize crop of 7,1 million tons (2015/16: 9,96 million tons) and will require South Africa to import maize during the 2016/17 season. Current expectations are that the worst affected areas in South Africa will be the white maize producing areas of the western and north-western parts of the country. Tongaat Hulett, which processes mostly yellow maize, sourced in the Mpumalanga area, will not be impacted to the same extent by the physical shortages as other maize users. The evolving sales contracting mix over the past few years has seen an increase from 33 percent to 45 percent in the proportion of customers who have sales pricing that is linked to movements in the maize price and whose pricing, in the current year, will reflect the higher maize prices.

The starch operation continues to prioritise improvements in efficiencies and capacity utilisation, following further improvements in the 2015/16 financial year, particularly in the area of protein recovery.

RECOVERING AND INCREASING RETURNS FROM THE EXISTING SUGAR ASSET BASE

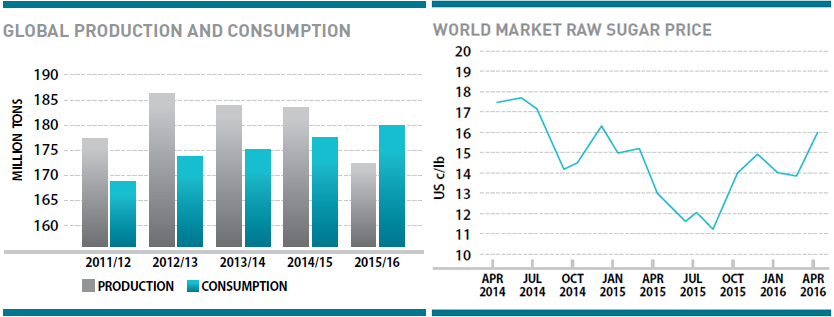

Global sugar markets and prices - the end of five years of surpluses

Following five years of surplus production a consensus of commentators’ views points to a deficit in global sugar production of some 5 - 10 million tons in the international production year to September 2016. International sugar market prices of late have begun to strengthen, as hedge funds anticipate the impact of the looming global production deficit, but remain below the levels required for sustainable farming and sugar production.

- On the demand side, global demand for sugar has been consistently rising at some 1,5 percent per annum, equal to some 2,7 million tons of additional demand each year. Growth in global consumption is primarily driven by increasing demand in developing countries, which historically have a low per capita consumption rate as a result of limited availability, affordability and distribution capability.

- Increases in sugar prices can happen rapidly based upon emerging farmer behaviour and weather patterns. The trend of declining prices over the past three years has impacted negatively on the replanting of cane and the extent of fertiliser and other inputs used by some farmers.

- The probability of sizable investments in sugarcane growing and milling assets being triggered, at current pricing levels, is remote.

Domestic markets, with superior realisations, ARE the primary focus for maximising the value that can be earned from sugar

Sugar is not a staple food and has one of the highest rates of job creation in agriculture, particularly in rural areas. Sugar industries therefore generally receive strong support from governments. In the domestic sugar markets in which Tongaat Hulett operates, governments have increasingly acted positively to protect local producers and grower communities against imports from surplus producers.

- In Zimbabwe, sales in the domestic market stabilised following the import protection measures that were implemented in 2014/15, despite trying macro-economic conditions. There is an import duty of 10 percent plus US$100 per ton and all imports require a permit.

- Sales over the past year in Mozambique regained ground lost to imports in the prior year following the implementation of enhanced import protection measures. The reference price used to calculate import duty on brown sugar has recently increased to US$806 per ton (36,6 US c/lb) and the reference price on white sugar is now US$932 per ton (42,3 US c/lb).

- In South Africa the reference prices for sugar is currently US$566 (25,7 US c/lb) per ton.

- The benefit of improved import protection and higher prices in the various local markets was largely not yet reflected in revenue earned in the 2015/16 year due to the timing of the increases.

- Measures continue to be implemented to strengthen non-tariff barriers as well as actively monitoring imports and adherence to import protection measures, thereby establishing domestic market prices that support development of sustainable cane growing communities.

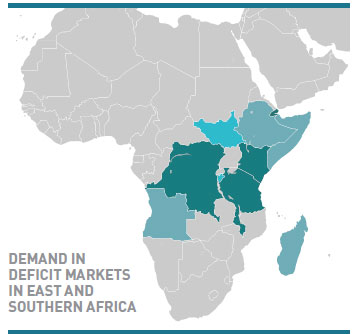

Domestic market sales will benefit from population growth, product availability and economic development.

- This is particularly relevant where low levels of per capita consumption are evident as is the case in Mozambique, where demand is at a low 8 kg per person per year as compared to neighbouring countries that are at 30 - 35 kg. Zimbabwe per capita consumption of 21 kg is lower than where it traditionally has been.

- In Mozambique, with its extensive geographic spread, and to some extent rural Zimbabwe, the non-availability of sugar is impeding consumption growth. Tongaat Hulett strategies to grow sales include how best it can increase the availability of small sugar pack sizes in rural communities, thereby improving consumers’ access to sugar and growing sugar consumption.

Tongaat Hulett continues to develop its premium Huletts®, Huletts SunSweet®, Blue Crystal® and Marathon® sugar brands in the domestic and regional markets to drive the value earned from the premium-priced domestic markets. Huletts® has been classified as one of the top five Icon Brands in the ASK AFRIKA survey over the past four years, attaining second place in the 2015 survey as well as being rated as the top brand in the

sugar category.

Tongaat Hulett continues to develop its premium Huletts®, Huletts SunSweet®, Blue Crystal® and Marathon® sugar brands in the domestic and regional markets to drive the value earned from the premium-priced domestic markets. Huletts® has been classified as one of the top five Icon Brands in the ASK AFRIKA survey over the past four years, attaining second place in the 2015 survey as well as being rated as the top brand in the

sugar category.

Tongaat Hulett has the flexibility to rapidly adjust export destinations and market positions to achieve best possible prices

- The business priority remains to first utilise installed existing capacity to supply increasing demand in its countries of operation before considering other markets.

- The current market mix is being adapted to achieve an optimal balance between the EU and the regional deficit markets.

Growing regional presence

- Tongaat Hulett has more than 30 years’ experience in the markets of south and south eastern Africa.

- Sales by Tongaat Hulett in the past year into the regional markets were impacted by lower sugar production levels in the South African Sugar Industry where quantities available for export were constrained by the lower levels of production. Market presence was partially maintained by importing sugar from Brazil for refining and subsequent export to the region.

- Good progress was made in accessing regional markets with sugar from Zimbabwe.

- Existing alliances are being deepened to better penetrate the markets more rapidly with increased volumes.

- Options to move down the value chain by establishing local packing, selling and distribution capabilities, similar to operations in Botswana and Namibia, are being developed.

- The company’s premium brands, already present in African markets, will be leveraged to further develop market penetration.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Tongaat Hulett continues to explore opportunities to become the strategic partner of choice for countries that have the potential to competitively expand their own sugar production.

Tongaat Hulett’s APPROACH TO THE EU MARKET

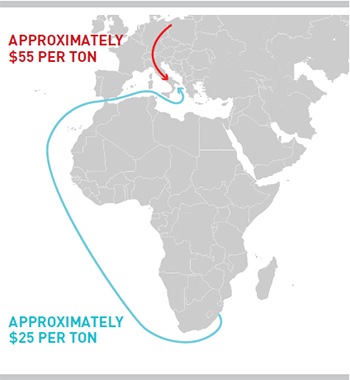

Prices in the EU market were under pressure and are increasingly moving in tandem with world market prices as the end of the current regime on 30 September 2017 approaches.

- The value associated with the on-going duty free access afforded by the EU to countries including Mozambique and Zimbabwe has been declining over the past 24 months.

- EU values present a premium, albeit variable, to world market realisations as the supply-side dynamics post-October 2017 continue to emerge.

- EU prices are likely to be at a considerable premium to world prices in times of sugar deficits.

- Lower shipping costs from southern Africa to some EU destinations, when compared to internal EU logistics costs, will continue to provide a premium selling price to raw sugar sellers. Tongaat Hulett will be able to take advantage of these premiums by reason of the continued preferential access to the EU sugar market that is available to the business.

- Tongaat Hulett is flexible and is steadily readjusting its market mix away from the EU to regional markets so as to achieve a better balance between end-market destinations.

- Tongaat Hulett has recently commenced delivering high value, special brown sugar to EU buyers from its two Mozambican sugar mills. Those products are expected to grow to a meaningful proportion of Tongaat Hulett’s deliveries of sugar to the EU in future.

HIGHER SUGAR PRODUCTION FROM THE CURRENT LOW POINT

The severe drought in KwaZulu-Natal together with poor growing conditions in Mozambique and Zimbabwe led to a low point in sugar production of 1,023 million tons in 2015/16. These conditions are masking the benefits from extensive agricultural improvement programmes that Tongaat Hulett is implementing in the four countries where it farms some 97 280 hectares under cane, including the planting of 21 428 additional hectares over the past five years (a further 8 346 hectares are still to be planted with funding received from the Jobs Fund). Given extended regular growing conditions, this should lead to annual sugar production of some 1,6 million tons.

The replacement cost of the unutilised capacity (2015/16) is more than R20 billion. Increased sugar production from existing cane land through better yields and sugar content has a low incremental cost of 4 to 6 US c/lb as milling and agricultural costs per hectare are mostly fixed.

| Tongaat Hulett sugar production |

2013/14 | 2014/15 | 2015/16 | 2016/17 Estimate |

Milling

Capacity |

| South Africa | 634 000 | 541 000 | 323 000 | 352 000 - 398 000 | > 1 040 000 |

| Zimbabwe | 488 000 | 445 000 | 412 000 | 379 000 - 440 000 | > 660 000 |

| Mozambique | 249 000 | 271 000 | 232 000 | 206 000 - 255 000 | > 340 000 |

| Swaziland (RSE) | 53 000 | 57 000 | 56 000 | 53 000 - 57 000 | > 60 000 |

| Total production | 1 424 000 | 1 314 000 | 1 023 000 | 990 000 - 1 150 000 | > 2 100 000 |

Agricultural improvement programmes

Substantial progress is being made on these programmes that have as their primary focus higher cane yields, improving sugar content and sugar extraction. Key themes include the following:

- Various initiatives to improve the quality and quantity of the cane have been implemented and include soil health, root management and crop nutrition, optimising soil moisture management, adjustments to match fertiliser application to soil and crop requirements, cover cropping/green manure (alternative crop to break mono cropping cycle) and additional measures to control weeds, pests and diseases. The work undertaken is also improving the crop age and positioning for optimal harvesting.

- Improving water efficiencies, including the implementation of more efficient irrigation methods and upgrades to drainage systems, particularly in Mozambique. This process has also included actions to improve the availability of equipment, particularly for items related to the irrigation of cane.

- Extensive training programmes have been implemented over a number of years to ensure that employees in the agricultural operations are equipped to diligently execute good farming practices. These programmes have been augmented with changes in management structures, including the appointment of additional field managers.

- Dissemination of best practices across operations.

- A common reporting framework, and the implementation of a peer review system is enabling benchmarking and improved management of operational efficiencies.

- An example of the success of the programme to date, is the company’s major sugar operation in Mozambique, the Xinavane mill, where a yield of 97,7 tons cane per hectare (tcph) was previously achieved. In 2015/16, the yields were down to 88,4 tcph, due to the weather and poor growing conditions. The agricultural improvement programmes should lead to yields of 105 tcph based on soil conditions, given regular growing conditions.

Area under cane supplying the mills

During 2015/16, 199 617 hectares (sourced from a combination of own estates, large-scale, small-scale and land reform farmers) supplied Tongaat Hulett's sugar mills. A further 8 346 hectares, utilising grant funding from the Jobs Fund in South Africa, is planned once weather conditions improve. Further additional cane expansion will depend on sugar price prospects going forward and whether attractive funding mechanisms can be found.

- The business continues to use existing and emerging opportunities for cane development, to prioritise the establishment of indigenous black farmers in collaboration with communities, local governments and other relevant stakeholders, in all its areas of operation.

Mitigating against the impact of periods with below-average rainfall

- The rainfall in the summer of 2016/17 will determine the size of the crop in the 2017/18 season, with a substantial recovery under regular growing conditions possible in South Africa. A recovery in the dam levels in Zimbabwe and Mozambique could see a substantial step-up in production in Zimbabwe and Mozambique in the 2018/19 season, with some improvement in 2017/18.

- In Zimbabwe and Mozambique, which are irrigated sugarcane growing operations, water availability and electricity supply are key elements to improving cane yields. It is estimated that the 1,8 million ML Tokwe-Mukorsi dam in the Lowveld of Zimbabwe will commence impounding water during the 2016 summer rainfall season. In Mozambique the building of the 760 000 ML Moamba dam, which will supply the Xinavane operation commenced in October 2015. Water supplies to the Xinavane operation will be further augmented by the current additions to the Corumana dam, which will result in the dam capacity being increased by 380 000 ML. The increasing stability in future water supply with new dams and diversified water catchment areas, in the short to medium term, will ensure that the Zimbabwean and Mozambiquan operations are less susceptible to adverse weather conditions in the future.

- In South Africa progress is being made to mitigate the impact of the lack of cane in adverse weather conditions by further developing the flex mill concept - the number of mills run during the milling season is based on the size of the cane crop. Application of the flex mill concept resulted in the Darnall mill not running in the 2015/16 season and for the 2016/17 season it is envisaged that the Amatikulu mill will not crush any sugarcane.

Tongaat Hulett is reducing the fixed cost component of its sugar operations, particularly during periods of low cane availability

Tongaat Hulett is re-examining the paradigm of what costs are considered to be fixed and what costs are variable. This is particularly relevant in instances where growing conditions are poor. An example of the actions underway to reduce costs in the South African operations, is the move towards a flex mill concept.

- In the 2015/16 season, the operation crushed one of its lowest crops and this highlighted the high fixed cost element of its milling operations.

- Building on the experience developed from running three of its four sugar mills in the 2015/16 season, the business has developed improved expertise and know-how to anticipate the potential crop size for the next season, based on the growing conditions in the summer months, and determine if milling resources (and costs) can be suspended, as well as determining the level of off-crop maintenance spend required.

- For the 2016/17 year, it is anticipated that the Amatikulu mill is not likely to crush cane due to the low crop. Tongaat Hulett is well-placed to execute the deployment of its Amatikulu staff into vacancies in other operations, while utilising some of the employees to carry out in-house engineering work, which would ordinarily have been contracted out to third parties.

Reducing the cost of the sugar production value chain, from cane growing to the delivery of sugar to the customer

Concerted, rigorous and intense cost reduction processes are underway, with substantial reductions in the cost base already having been achieved over the past three years.

- There is a particular focus on costs related to bought-in goods and services, transport, marketing, salaries and wages. Over the past three years an effective cost reduction equivalent to R1,39 billion in money of today has been achieved, together with the impact of lower volumes. This is calculated after adjusting for indicative price increases, salaries and wage rate increases and inflation over the years applicable to the costs.

- The implementation of the intensive agricultural improvement programmes is contributing to savings on electricity and fertiliser cost, in particular, as the benefits of improved irrigation and precision farming are realised.

- There is scope for further reduction in the flexible and non-value-add activities, as well as eliminating waste.

Volume cost relationship

Unit costs of production will benefit from future volume increases, given the high proportion of fixed costs inherent in sugar milling and cane growing activities.

- Generally, 85 - 90 percent of sugar milling and overhead costs are fixed. When sugar volumes increase, despite the total variable costs increasing, the unit cost of production decreases. On average the sugar milling and overhead costs account for 30 percent of the total cost of sugar production.

- Agricultural costs related to sugarcane farming are largely fixed or directly linked to the extent of hectares being farmed. Costs related to cane farming on average account for 50 percent of the total cost of sugar production.

- Harvesting, loading and transport costs vary depending on the distance to the sugar mill, and generally mills are supplied by sugarcane that is farmed within a 100 kilometre radius. On average these associated costs account for 20 percent of the total cost of sugar production.

Increasing value out of molasses and the fibre in sugarcane - animal feeds, ethanol and electricity

- Molasses, which is the liquid co-product arising from the production of raw crystal sugar at the sugar mills is a valuable component of the sugar value chain. Tongaat Hulett is in the process of moving from a local approach in the use of molasses to a regional approach in which the molasses arising from the various mills is utilised in the optimal way, taking account of the logistics costs involved in moving the product within the region. Currently, the majority of Tongaat Hulett’s molasses is being used in animal feed and ethanol production.

- Tongaat Hulett has been producing fuel grade ethanol in Zimbabwe for blending in the local market for the last few years, and is planning a significant increase in ethanol production for the 2016/17 production season. In South Africa, a decision by any of the sugar companies to invest in the production of fuel ethanol is dependent on regulatory certainty around the price support mechanism for sugar based ethanol and finalisation of all of the details around the regulatory framework. The Minister of Energy, in her budget vote speech, has stated that the policy paper on bio-fuels will go to the cabinet before the end of 2016, following which the industry will be in a position to access the viability of bio-fuel from sugar opportunities.

- In South Africa, progress on the renewable energy and cogeneration independent power producer procurement programme nationally has been slow in the last 18 months. The cogeneration independent power producer procurement programme implemented to date only caters for small, fast implementation projects and is not suitable for major projects. A cogeneration programme for major projects still needs to be issued by the Department of Energy. Tongaat Hulett and the South African Sugar Industry are continuing to engage with government at various levels to move the possibilities for electricity from cane fibre forward. It is not expected that any bidding will be possible in 2016.

- Both ethanol and electricity provide promise for significant rural development and job creation, and hence are very important for the future development of the industry.

- The combined impact of Tongaat Hulett’s Voermol operation and the co-product volumes produced by the starch operation, results in Tongaat Hulett having a significant footprint in the animal feeds industry. The business continues to explore opportunities to expand this footprint in the region, particularly at its Mozambique and Zimbabwe operations.

MOMENTUM IN LAND DEVELOPMENT

Tongaat Hulett is converting cane land to alternative uses where appropriate. The process takes many years and involves planning, release from agriculture, EIA application processes, zoning and infrastructure investment before the conversion can take place. Currently the momentum is growing and the conversion rate over the past three years has seen 488 hectares realise some R3,023 billion. Profit per hectare generated varies depending on usage and location. The land conversion process is undertaken in a manner that it creates substantial socio-economic benefit for societal stakeholders.

The momentum in land conversion and development activities continues to increase, with good progress on numerous activities that increase demand, unlock supply of land and increase value across the portfolio

- There are various demand drivers that differ according to numerous usage categories which include high-intensity urban mixed use; predominantly residential neighbourhoods; urban amenities for residential neighbourhoods; high-end markets; office market; warehousing, logistics, industrial, manufacturing and big box rental; and unique clusters of opportunity.

- Over the past three years, 488 developable hectares have been sold, generating operating profit of R3,023 billion while the net cash flow was R1,620 billion. The conversion of profits into cash varies with the nature of the transactions concluded and there have been a number of larger transactions that have a lead time before transfer.

- Sales in the 2015/16 financial year yielded operating profit of R1,115 billion from the sale of 121 developable hectares at a rate of R9,2 million per developable hectare. The profits achieved per developable hectare were in line with expected value ranges for various usage categories and demand drivers. Transactions concluded over the past year have been across a number of usage categories including mid-market residential, high-end residential, retirement, high-intensity mixed use, urban amenities for residential neighbourhoods, warehousing and business parks, offices, retail and business education. The affordable and government assisted housing and hotel and resort categories were not represented in the sales mix during the year.

The fourth edition of the portfolio of land for conversion in KwaZulu-Natal which provides further detail of the opportunities available to Tongaat Hulett within its land conversion and development activities, is circulated in hard copy accompanying this report and is available here.

The preparation of land for sale involves a number of processes to unlock supply side levers leading to land that is shovel ready. A major milestone in the past year was to increase the number of hectares with approval for release from agriculture for development, in terms of Act 70 of 1970, by 2 622 developable hectares to 3 085 developable hectares. EIA approvals were achieved over a further 245 developable hectares during the past year.

A wide range of stakeholders benefit substantially from Tongaat Hulett’s land conversion processes. Society at large is deriving increasing benefit, as Tongaat Hulett continues to improve its processes to attract fixed investment to the region and achieve urban spatial integration and integrated residential neighbourhoods. The land conversion process creates a platform for increased public sector income generation through rates and taxes, and maximises the returns from infrastructure investment, both financially, and in terms of enterprise development, job creation and local economic development.

KEY SOCIO-ECONOMIC OUTCOMES FOR SOCIETAL STAKEHOLDERS

- Attraction of fixed investment to the region

- Urban spatial integration linking communities, jobs and amenities

- Integrated residential neighbourhoods

- Triggers investment in new/additional agricultural development and enhances rural livelihoods

- Sustained public sector income generation through rates, taxation and user charges

- Catalysing local socio-economic development

- Job creation, skills transfer and enterprise development during construction phase

- Creation of permanent jobs

- Organised and empowered communities

- Co-ordinated and efficient infrastructure roll-out

- Efficient return on infrastructure investment

- Provides property solutions that enable new markets to be developed

The table below provides an update of the possible 5-year sales outcomes based on consideration of demand drivers and usage categories, progress on the supply of shovel ready land, achievements of the past year and an assessment of the sales approaches most appropriate for each usage category. The net cash profit per developable hectare varies with the usage category, in a range between R2 million and R39 million per developable hectare.

| DEVELOPABLE

HECTARES SOLD

IN THE YEAR TO 31 MARCH 2016 |

|

LATEST POSSIBLE 5-YEAR SALES OUTCOMES | ||||||

USAGE CATEGORY |

Range of developable hectares |

Range of Profit

per developable hectare |

||||||

| From | To | From | To | |||||

|

||||||||

| High Intensity Urban Mixed Use | 7 |  |

75 | 120 | 22.0 | 39.0 | ||

|

||||||||

| Predominantly residential neighbourhoods |

Mid-market neighbourhoods |

21 |  |

125 | 175 | 3.5 | 7.5 | |

| Integrated affordable

neighbourhoods |

- | 50 | 250 | 2.5 | 3.8 | |||

| Public sector facilitated residential neighbourhoods |

- | 150 | 450 | 2.0 | 2.4 | |||

|

||||||||

| Urban Amenities for Residential Neighbourhoods |

15 |  |

60 | 115 | 3.8 | 6.0 | ||

|

||||||||

| High-end Markets | City hotels and

residences |

- |  |

6 | 16 | 12.0 | 25.0 | |

| Coastal resorts catering to domestic, charter markets |

- | 10 | 50 | 3.5 | 5.0 | |||

| High-end residential

developments |

29 | 65 | 120 | 6.0 | 12.0 | |||

|

||||||||

| Office Market | 22 |  |

20 | 50 | 6.0 | 15.4 | ||

| Warehousing, logistics, industrial, business park, manufacturing and big-box retail | 13 |  |

100 | 300 | 5.0 | 9.5 | ||

|

||||||||

| Unique Clusters of opportunity | 14 |  |

25 | 100 | 4.0 | 7.5 | ||

|

||||||||

These sales are expected to be achieved primarily from within the 3 679 developable hectares in the areas and landholdings as tabulated below.

AREAS FROM WHICH THE RANGE OF POSSIBLE 5-YEAR SALES OUTCOMES

ARE EXPECTED TO COME - AS AT 31 MARCH 2016

| AREA | Developable hectares | ||||

| DURBAN TO BALLITO |

Urban Growth and Consolidation - UMhlanga Region | 927 | 2 942 developable hectares from a total of 4 384 |

||

| Ridgeside Remaining Precinct 1 | 8 | ||||

| Ridgeside Precinct 2 | 31 | ||||

| Ridgeside Precinct 4 | 0 | ||||

| uMhlanga Ridge Town Centre - Commercial | 1 | ||||

| uMhlanga Ridge Town Centre - Residential | 4 | ||||

| Izinga | 64 | ||||

| Kindlewood | 11 | ||||

| uMhlanga Ridge Extension - Cornubia New Town Phase 2 | 178 | ||||

| uMhlanga Ridge Town Centre Western Expansion | 25 | ||||

| N2 Business Park | 2 | ||||

| uMhlanga Hills | 43 | ||||

| Marshall Dam Residential | 12 | ||||

| Marshall Dam Town Centre | 39 | ||||

| Consolidating Urban | 43 | ||||

| Integrated Residential | 14 | ||||

| Cornubia Industrial | 6 | ||||

| Cornubia North | 624 | ||||

| Integrated Residential | 200 | ||||

| Medium Density Residential | 100 | ||||

| Consolidating Urban | 85 | ||||

| N2 Business Park | 69 | ||||

| Industrial | 170 | ||||

| Coastal/Lifestyle/Leisure/High-end Residential | 256 | ||||

| Zimbali Lakes | 48 | ||||

| Sibaya Node 1 | 30 | ||||

| Sibaya Node 5 | 76 | ||||

| Sibaya Node 4 | 103 | ||||

| Airport Region business and residential | 1 725 | ||||

| uShukela Drive - Airport Linked Industrial, Retail and Logistics | 49 | ||||

| Amanzimnyama - Office/Business/Industrial and Logistics Park | 345 | ||||

| Compensation (East) - Industrial and Manufacturing | 73 | ||||

| Compensation Western Expansion - Industrial and Manufacturing | 152 | ||||

| iNyaninga East - Industrial/Logistics/Manufacturing | 550 | ||||

| iNyaninga West, Lindokuhle, Aberfoyle, Dudley Pringle -

Residential and Urban Expansion of oThongathi (Tongaat) |

556 | ||||

| REMAINING SITES ON NEARLY COMPLETED DEVELOPMENTS | 34 | ||||

|

|

|

|

|

|

| WEST OF DURBAN |

Urban Expansion West of Durban | 467 | 467 developable hectares from a total of 1 086 |

||

| Ntshongweni - Residential Infill/Consolidation | 57 | ||||

| Ntshongweni - Retail and Urban Core | 64 | ||||

| Ntshongweni - Logistics and Business Park | 161 | ||||

| Ntshongweni - Integrated Residential | 185 | ||||

|

|

|

|

|

|

| COASTAL NORTH OF BALLITO |

Coastal North of Ballito | 270 | 270 developable hectares from a total of 2 500 |

||

| Tinley Manor South Banks – Resort | 270 | ||||

|

|

|

|

|

|

| GRAND TOTAL | 3 679 | 3 679 developable hectares from a total of 7 970 |

|||

|

AREAS FROM WHICH SALES IN THE RANGE OF POSSIBLE 5 YEAR SALES OUTCOMES ARE EXPECTED TO COME WITHIN WHICH | |||

|

AREAS WHERE SALES OR NEGOTIATIONS HAVE COMMENCED OR ARE ABOUT TO COMMENCE |

Increased new sales potential has been unlocked, opening up new development areas, with recent catalytic sales in node 1 of Sibaya at eMdloti, 14 hectares for a new retail centre as a catalyst for the Ntshongweni development west of Durban, the expansion of uMhlanga Ridge Town Centre westwards into Cornubia and on the sea facing slopes to the east in precinct 1 of Ridgeside and the new precinct 4. The decision to sell the 42 hectares in Ridgeside precincts 1 and 2 as multiple sales rather than a single sale is proving optimal.

The value created for all stakeholders is increasing through an integrated approach to land conversion and development. This reflects progress made on the various value unlocking activities underpinning the land conversion process together with government, related organisations and key stakeholders in the property industry. These activities are underpinned by on-going use of the land under agriculture throughout the development cycle and commence with collaborative planning with authorities on optimum use of land for all stakeholders, leading to release from agriculture and other development approvals, and simultaneously strengthening demand drivers and unlocking infrastructure at key points, while executing optimal sales and development strategies for the various parcels of land. An increasing number of significant black economic empowerment related land development transactions are taking place and further progress continues to be made to develop and grow the presence of black property developers, owners and service providers throughout the property value chain.

Notwithstanding suppressed economic conditions, the property market to the north of Durban has attracted significant investor interest, including many buyers who have responded well to Tongaat Hulett’s strategy of making available larger portions of land that will be developed over a number of years.

SOCIO-ECONOMIC POSITIONING AND CONSTRUCTIVE INTERACTIONS WITH GOVERNMENTS AND SOCIETY

Tongaat Hulett operates in a societal environment that is impacted by numerous developmental challenges. The company’s underlying philosophy is that, in partnership with society and government, it can contribute towards improving the prospects of a better life for many by making a substantial positive impact on multiple socio-economic challenges including job creation and security, transformation, attracting fixed investments, urban spatial integration, food security, youth development, infrastructure establishment and inclusive rural development.

The business has long-standing constructive relationships with rural communities, governments and other key stakeholders. The following are some examples of recent achievements:

- In Mozambique, where deep rural communities have limited access to healthcare and other basic facilities, Tongaat Hulett has played a significant role in improving the quality and extent of healthcare that is available to the communities that surround its Xinavane and Mafambisse operations. From the perspective of economic development of these rural economies, the number of small-scale indigenous farmers has grown from 249 in the 2007/08 season to 2 018 in 2015/16. During this time, sugarcane received from these farmers has grown from 45 528 tons to 334 715 tons. As a consequence of this growth, some R56 million was paid to small-scale farmers in the 2015/16 season.

- In South Africa, transformation, housing, job creation and rural economic development continue to be some of the primary developmental challenges. Tongaat Hulett is actively involved in numerous traditional authority areas in rural KwaZulu-Natal through various agricultural and socio-economic development initiatives. A prime example of the activities that the company is involved in, is its partnership with the Jobs Fund, which to date has resulted in the planting of 3 654 hectares of sugarcane, the creation of 905 new permanent jobs, 343 beneficiaries being trained and the establishment of 27 agricultural cooperatives across 15 traditional councils.

- In Zimbabwe, Tongaat Hulett plays a significant role in the provision of primary healthcare to over 250 000 people that surround its operations. The business continues to work with the government and local communities on the orderly development of sustainable indigenous private farmers in the south-eastern Lowveld. The extent of sugarcane supplied by indigenous farmers has grown from 532 000 tons in the 2011/12 season to just over 1 million tons in 2015/16. During this time, the cumulative number of jobs created by these farmers has increased from 4 750 to 7 363 people and this has substantially contributed to the economic development of the region.

- The starch operation is the third largest purchaser of maize in South Africa, and is therefore well-positioned to influence and play a leading role in the transformation of the maize industry, as well as increasing the supply of maize in southern Africa.

- Tongaat Hulett’s collaboration with numerous government, business and society groupings in converting agricultural land to optimum urban and tourism uses in KwaZulu-Natal is contributing to intensive and integrated urban development. This leads to increased investment, infrastructure, well-located and serviced housing and job creation in the key growth corridors north and west of Durban and on the coast north of Ballito. It also has the increasing opportunity to positively influence a change in the demographics of economic activity in this sector.

2007 BEE Transaction

As part of the company’s Broad Based Black Economic Empowerment deal in 2007, the Ayavuna and Sangena consortiums, rural communities via the Masithuthukisane and Mphakhathi trusts and company employees, via the ESOP and MSOP trusts, previously obtained voting and shareholder rights in Tongaat Hulett (see here for further information).

Striving towards establishing an organisational safety culture with a 'zero harm' approach and values the health of its people while limiting harm to the environment

Tongaat Hulett subscribes to the principle of ‘zero harm’. The ‘zero harm’ philosophy is embedded in the company’s business framework as a core value. The company’s safety performance improved substantially during the past decade having been built up on established safety management systems and various safety improvement initiatives. Tongaat Hulett has been consciously introducing targeted fatality risk control initiatives that are being reviewed regularly. This executive intervention approach has been attributed to a sustained safety improvement realised so far.

The safety and the welfare of all employees, which amounts to some 40 800 people during the peak milling period, remains a key priority as the business strives towards establishing an organisational culture with a 'zero harm' approach. A lost time injury frequency rate (LTIFR) of 0,073 per 200 000 hours worked, is the lowest recorded since SHE management systems were established more than 10 years ago. It displays a consistent improvement on the LTIFR statistic reflecting on the LTIFR of 0,085 achieved in 2014/15 and 0,087 achieved in 2013/14.

The safety programme is continuously reviewed and a new approach to further manage fatality risks is being adopted. Key elements of this emerging safety approach involve the following:

- A proactive approach of senior executive involvement in taking a ‘helicopter view’ of issues compromising the ability of operations to effectively manage associated fatality risks.

- Continuing with the programme of implementing critical controls for high fatality risk areas at all operations.

- Taking an ‘executive stand back review’ of the total business climate for operations experiencing business challenges (including production and financial) to analyse various disrupting forces affecting the operation which could impact on safety performance and identify necessary interventions required. Examples of such disruptive forces may include community, socio-economic, geo-political and people issues. This initiative is influenced by the view that at times poor business performance is believed to be correlated to poor safety performance.

Regrettably five employees lost their lives in separate incidents across Tongaat Hulett’s operations during the past year. Luis Joao Mutongopidua from the Mafambisse operation died while trying to board a moving trailer, Augustine Nyikadzino from Triangle Estate lost his life in a head on collision on a public road, Vinagran Ivan Pillay succumbed to injuries sustained while repairing a choke on a conveyor belt at the Amatikulu mill, Domingos Albano Saimone died when the grader that he was driving, in Mafambisse, veered off the road and David Nkambule from Tambankulu lost his life while repairing a cane grab loader.

Tongaat Hulett has malaria control programmes in place, at all of the operations where this is required. During the 2015/16 year, the actions underway in the Zimbabwe operations contributed to a nine percent reduction in the number of malaria cases reported.

All Tongaat Hulett operations retained certification to either NOSA 5 Star systems or OHSAS 18001 covering occupational health and safety. Of the 19 operations, 18 are certified to the ISO 14001 environmental management system with the remaining one being at an advanced stage of implementing its management system. During the year, Tongaat Hulett Namibia achieved certification to ISO 22000 for the first time. The starch operations, the Refinery and Triangle retained certification to FSSC 22000 on food safety management systems.

Social Sustainability and Innovation

Tongaat Hulett’s evolution in the priority area of social sustainability demonstrates innovation in a number of areas. This includes a holistic approach to socio-economic development and corporate social responsibility.

- Social sustainability and innovation are fundamental to the business as Tongaat Hulett seeks demonstrable and practical outcomes in terms of positive social transformation, environmental stewardship and community-upliftment.

- The evolution of Tongaat Hulett, in continuing to be regarded as a responsible corporate citizen, has also over many years seen the business continue to embrace good corporate governance by adhering to legal and accepted business practices as embodied in the principles of the King III. The company continues to uphold the principles of corporate social responsibility by demonstrating to society its commitment to philanthropic and empowerment initiatives within the communities in which it operates.

- Tongaat Hulett has a substantial land footprint, with some 120 000 hectares of private land under maize supplying the four starch operations while in Mozambique, South Africa, Swaziland and Zimbabwe, more than 190 000 hectares of land supply cane to the business’s eight sugar mills. It is within this context that the company subscribes to principles of sustainable development.

- The business’s participation in various sustainability reporting initiatives, including CDP, CDP Water, the Nedbank Green Fund and its listing on the FTSE/JSE Responsible Investment Index for the twelfth consecutive year are testimony to Tongaat Hulett’s approach to sustainability and stakeholder value creation.

FINANCIAL AND OPERATIONS REVIEW

FOR THE YEAR ENDED 31 MARCH 2016 |

financial CAPITAL |

|

|

|||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

The various sugar operations’ total operating profit reduced to R124 million, from R806 million in the prior year. Sugar production volumes in the year to March 2016 reduced by a further 291 000 tons to 1,023 million tons (2015: 1,314 million tons and 2014: 1,424 million tons), in line with previous communication. Volumes were impacted by lower cane yields due to the severe drought in KwaZulu-Natal and poor growing conditions with low rainfall and restricted irrigation levels in Mozambique and Zimbabwe as a result of low water and dam levels. Electricity availability has, at times, also impacted on irrigation in Mozambique and Zimbabwe.

The benefit of improved import protection and higher prices in the various local markets was largely not yet reflected in revenue earned in the 2015/16 year due to the timing of the increases. In addition to lower sugar volumes, export revenues were also impacted by a lower international sugar price, with regional deficit markets and EU exports linked to that price. There are multiple currency dynamics, with positive and negative effects compared to last year. The cane valuations at year end reflect increased domestic market realisations going forward and the impact of a roots fair value cost increase in South Africa and Mozambique, reduced by lower cane yields than were expected at March 2015, in line with current growing conditions.

There has been a significant decrease in the cost base of the sugar operations over the past three years which, together with the impact of lower volumes, has resulted in a reduction of some R1,39 billion in respect of the cost of goods, services, transport, marketing, salaries and wages, in real terms compared to 2012/13.

The South African sugar operations, including agriculture, milling, refining and various downstream activities have seen an operating loss of R5 million (2015: R261 million profit). As a result of the drought (including the Darnall mill not being opened in the 2015/16 season) production volumes were 323 000 tons (substantially below the 541 000 tons of last year and the 634 000 tons of the year before). The overall reduction in volumes was partly off-set by focused cost reductions and some improvement in local market pricing earlier in the year, with a reducing impact of imports into the local market. The animal feeds operation was negatively affected by the shortage of feedstock.

The Tambankulu Estate in Swaziland recorded operating profit of R40 million (2015: R29 million), which reflects the impact of improving sugarcane prices, with a raw sugar equivalent of 56 000 tons being produced (2015: 57 000 tons).

The Mozambique sugar operating profit reduced to R74 million (2015: R130 million) due to lower volumes and lower export sales prices. Sugar production was 232 000 tons compared to 271 000 tons last year. The 29 percent local market price increase only came into effect towards the end of the year.

The Zimbabwe sugar operating profit reduced to R15 million compared to R386 million in the prior year. Sugar production of 412 000 tons was below the 445 000 tons of the prior year. There were both lower export sales volumes and lower export prices. Domestic market sales volume levels have been maintained. The strength of the US dollar has exerted pressure, particularly in respect of US dollar based costs (such as wages and salaries) and Euro based revenues.

Finance costs of R680 million (2015: R617 million) were commensurate with the borrowing levels and prevailing interest rates.

Cash flow from operations was some R1,3 billion (2015: R2,5 billion), after the absorption of R989 million in working capital (R44 million in the prior year). Capital expenditure increased by R509 million, mainly as a result of the starch coffee/creamer production facility expansion, various boiler and electricity related upgrades and a SAP ERP system implementation. After taking all of the aforementioned into account, net debt at 31 March 2016 was R5,1 billion (2015: R4,0 billion).

Headline earnings attributable to Tongaat Hulett shareholders amounted to R783 million (2015: R945 million). A final dividend of 60 cents per share has been declared, bringing the annual dividend to 230 cents per share (2015: 380 cents per share). The annual dividend cover of three times is considered prudent in view of current sugarcane growing conditions.

OUTLOOK

| Tongaat Hulett will continue to enhance its strategic positioning, focusing on multiple strategic thrusts, all with a positive impact on earnings and cash flow, through the various cycles that the business experiences. |

Multiple Strong Sugar Market Positions with Protected, Growing Domestic MarketsPrices for sugar in the international market have been improving in the light of prospects for an increasing shortfall in global production after five years of surplus production, high stock levels and a low world price. Droughts in India and Thailand together with farmer behaviour worldwide, driven by low prices and input cost pressures, are exerting downward pressure on global sugar production levels. Global sugar consumption is predicted to continue to grow at a rate of some 1,5 percent per annum, with most of this growth coming from low per capita consumption in developing countries. The domestic markets in countries where Tongaat Hulett produces sugar remain its primary focus. They are increasingly protected from imports, with government support, given the high rural job impact of these industries. In Zimbabwe and Mozambique, sugar refining matters are being addressed, which should lead to the replacement of imported industrial white sugar. Growth is expected in consumption per capita, off a low base, particularly in Mozambique and partly in Zimbabwe, supported by distribution and marketing initiatives. In South Africa, with its current low sugar production level, Tongaat Hulett is having to procure other producers’ raw sugar for refining, to supply its local market white sugar position and plans to replace this with its own production in future. Tongaat Hulett has the leading sugar brands in South Africa, Zimbabwe, Botswana and Namibia. Tongaat Hulett has key market positions and experience in both the EU and the region (southern and eastern Africa) for the sale of its additional sugar. |

Growing Sugar Production from the Current Low PointCurrent weather and growing conditions are masking the substantial progress that is being made with intensive agricultural improvement programs, irrigation efficiency and power reliability. Tongaat Hulett has more than 2,1 million tons of installed milling capacity, which requires little capital expenditure to use the additional available capacity which has a replacement value of more than R20 billion. Production increases from higher yields on existing hectares under cane and using the existing installed milling capacity have a low marginal cash cost of some 4 to 6 US c/lb. The imminent completion in Zimbabwe of the Tokwe-Mukorsi dam and, in Mozambique (Xinavane), the raising of the Corumana dam wall and the construction of the new Moamba dam on the Incomati river will diversify the water catchment area and provide increased stability in future water supply. |

Reducing the Cost of Sugar ProductionThe sustained decrease in costs achieved over the past three years (equivalent to some R1,39 billion in real terms) provides a good base for the next steps in the concerted cost reduction process in the sugar operations, particularly focused on bought-in goods, services, transport, marketing, salaries and wages. There is scope for considerable further reduction, with man-hour reductions focusing on flexible components and natural attrition, at the same time as eliminating non value-add activities and areas of waste. The paradigms around costs that have traditionally been viewed as fixed are being challenged, to mitigate against future potential volume volatility. Unit costs of sugar production will reduce further as these cost reduction processes continue, benefitting from future volume increases. |

Growing Starch and GlucoseThe starch and glucose operation is well-positioned strategically and is focused on growing its sales volume, with an enhanced product mix, by reducing imports and on the back of customer growth, including into Africa. This is underpinned by improving use of its available capacity and the efficiency of its operations. The expansion project for the coffee/creamer sector, that will enable the replacement of imported glucose, has been commissioned and production is being ramped up. Capital expenditure, including new boiler facilities, completed at the Meyerton plant, will enable further growth in the production of value-added modified starches for use in the prepared foods sector. |

Value Creation from Land Conversion and DevelopmentThe momentum in Tongaat Hulett’s land conversion and development activities continues to increase, with good progress on numerous activities that increase demand, unlock supply of land and enhance value across the portfolio of 7 970 developable hectares in KwaZulu-Natal earmarked for development. A major milestone in the past year was to increase the number of hectares with approval for release from agriculture for development, in terms of Act 70 of 1970, by some 2 600 developable hectares to more than 3 000 hectares. An updated and enhanced land portfolio document is available here It gives details of these activities and includes an update of the possible 5-year sales outcomes, indicating a range of hectares for each demand driver. The net cash profit per developable hectare varies, depending on the use, ranging from R2 million to R39 million per developable hectare. The various residential categories are expected to be the largest demand driver. An integrated approach is being followed to ensure value creation for all stakeholders. Good progress is being made on the various value unlocking activities underpinning the land conversion process together with government, related organisations and key stakeholders in the property industry. These activities commence with collaborative planning with authorities on optimum use of land for all stakeholders, leading to release from agriculture and other development approvals, and simultaneously strengthening demand drivers and unlocking infrastructure at key points, while executing optimal sales and development strategies for the various parcels of land. An increasing number of important black economic empowerment related land development transactions are taking place. This all has a positive impact on economic development, including industrial, commercial, tourism and all levels of residential development in the Durban/KwaZulu-Natal North Coast area, and points to the potential for similar collaboration for rural development including new agricultural cane developments. |

The Year Ahead

| The next year should see Tongaat Hulett benefit substantially from improved local sugar market revenues (volumes and prices) following the import protection measures implemented in South Africa and Mozambique (higher US dollar based reference prices for the calculation of import duties) and Zimbabwe (import duties and import permit controls). Actions to reduce costs will continue. Total sugar production in 2016/17 is expected to continue to be impacted by the drought in KwaZulu-Natal and, in Zimbabwe, Mozambique and Swaziland, the quantum of irrigation has been reduced as a mitigation measure against poor rainfall and low dam levels. The estimate for sugar production in total for the 2016/17 season is between 990 000 and 1 150 000 tons, compared to 1 023 000 tons last year. Rainfall during the summer of 2016/17 will determine whether more regular production levels return in 2017/18. |

The recent investments in the starch and glucose production capacity, together with evolving product and customer mix improvements through the displacement of imports and new product development will partly mitigate the impact of the higher maize prices. The prevailing drought conditions have resulted in South Africa having to import maize for the 2016/17 maize season. Maize prices have risen to import parity levels since December 2015 and are expected to remain at these levels for the 2016/17 financial year. The evolving sales contracting mix has restricted the impact of these higher maize prices to 55 percent of the starch operations sales volumes which are not contracted on a formula basis. |

Increased land sales potential has been unlocked, opening up new development areas, with recent catalytic sales in node 1 of Sibaya at eMdloti, 14 hectares for a new retail centre as a catalyst for the Ntshongweni development west of Durban, the expansion of Umhlanga Ridge Town Centre westwards into Cornubia and on the sea facing slopes to the east in precinct 1 of Ridgeside and the new precinct 4. The decision to sell the 42 hectares in Ridgeside precincts 1 and 2 as multiple sales rather than a single sale is proving optimal. The land portfolio document details those areas where sales or negotiations have commenced or are about to commence. Over the past three years, 488 developable hectares have been sold, generating operating profit of R3,024 billion while the net cash flow was R1,620 billion. The conversion of profits into cash varies with the nature of the transactions concluded and there have been a number of larger transactions that have a lead time before transfer. |

Overall, Tongaat Hulett’s profit for the next year will continue to be influenced by a number of substantial and varying dynamics, both positive and negative, and the full impact is difficult to predict at this stage. Cash flow is expected to improve substantially, including a reversal of the working capital absorption of the 2015/16 year. |

Tongaat Hulett continues to focus on value creation for all stakeholders through an all-inclusive approach to growth and development, with its footprint in six SADC countries, its ability to process both sugarcane and maize, animal feeds thrust, electricity generation and ethanol opportunities, increased momentum in land conversion and its socio-economic positioning and constructive interfaces with governments and society.

ACKNOWLEDGMENTS AND CONCLUSION

I am privileged to lead an organisation that together with its multiple stakeholders has such a significant impact on the development of the region.

Tongaat Hulett employs some 40 800 people during its peak milling period, working on 27 sites in Botswana, Namibia, Mozambique, South Africa, Swaziland, and Zimbabwe. The business is benefiting from the commitment, loyalty and energy that every employee gives towards the achievement of the company's strategic objectives. We continue to work towards equipping and developing the talent in our emerging leaders, for the future benefit of the organisation.

The company’s profile as an agricultural and agri-processing business contributes to the extensive role that it plays in the rural communities that surround its operations, and the business continues to make a significant contribution to the growth and development of the areas that surround its landholdings through its land conversion activities. Tongaat Hulett values the relationships that it has established and remains committed to working together with small-scale and commercial private farmers, rural communities and governments to grow its contribution to job creation, rural development and an inclusive economy, thereby creating sustainable value for its stakeholders.

The support and input that Tongaat Hulett has received from its shareholders is greatly appreciated and the company is committed to regularly updating the investment community as it progresses delivery on its business objectives.

The on-going support and guidance that we have received from the Board and the Chairman are highly valued. Tongaat Hulett is fortunate to have a competent Board that provides ethical leadership.

![]()

Peter Staude

Chief Executive Officer

Amanzimnyama

Tongaat, KwaZulu-Natal

26 May 2016