STRATEGIC POSITIONING AND THRUSTS

SOCIO-ECONOMIC POSITIONING

Partnering with local governments and other key stakeholders to grow and develop small-scale private farmers and create value for rural communities

- In Mozambique, some 2 735 indigenous private farmers on 6 155 private and leased hectares supplied sugarcane to Tongaat Hulett operations during the year under review.

- The SusCo project in Zimbabwe is ongoing and currently 813 farmers are actively farming on 14 000 hectares. At the conclusion of the SusCo project, 872 farmers will farm 15 880 hectares of land.

- The company is continuing with its efforts to increase the support that it provides to small-scale sugarcane private farmers in South Africa, with the business’s partnership through Operation Vuselela being an example of the model underway to contribute to skills transfer and the development of previously unemployed rural community members. Visit our website for more detail at www.tongaat.com

Developing and implementing a portfolio of land and property development approaches that are integral to the economic growth of the region

- Tongaat Hulett’s ongoing property developments in the KZN North Coast region are contributing to increased investment, infrastructure and job creation in the key growth nodes around Umhlanga, Ballito and the Airport region.

- Within Durban/eThekwini and adjacent municipalities, Tongaat Hulett’s attention is firmly on evolving as a partner of choice for social delivery around housing, infrastructure, jobs and economic opportunities. The Durban and Ballito area has a growing population of 3,9 million people and a housing backlog of some 400 000 units. These factors are contributing to ongoing expansion into Tongaat Hulett’s land holdings both to the north and west. This creates opportunity within the Durban/eThekwini Municipality and surrounding local and district municipalities for the business to respond proactively within its land conversion portfolio in formulating and implementing responses that maximise delivery in respect of the needs of communities of lower socio-economic status.

- Details of the business’s successful partnership with multiple spheres of government in the development of the Cornubia Integrated Housing Settlement, have been provided in this report and provide an indication of the models that can be implemented to successfully address the needs of people from lower socio-economic strata. Visit our website for more detail at www.tongaat.com

Maintaining and developing strong relationships with Tongaat Hulett’s stakeholders

- Tongaat Hulett has long standing relationships with many stakeholders including shareholders, private farmers, rural communities, representative bodies, governments, employees and suppliers. The company interfaces with its stakeholders in a transparent manner that seeks to understand the unique context within which each stakeholder grouping operates.

More information on Tongaat Hulett’s stakeholder engagement can be found here.

GROWING SUGAR PRODUCTION FROM 1,424 MILLIONTONS TO MORE THAN 1,800 MILLION TONS OVER THE NEXT FOUR YEARS

from existing installed milling capacity, through increasing the supply of sugarcane to milling operations

Sugar production - momentum established

Tongaat Hulett has increased its sugar production by 400 000 tons in the past three years to 1,424 million tons, with a target of more than 1,8 million tons by 2017/18. To achieve the targeted production, the priority remains to increase sugarcane supplies through the appropriate balance of a combination of improved cane yields, sugar recoveries and adittional hectares under cane.

- The focus remains on increasing the sugar that is contained in and extracted from the cane stalk, through improved farming practices, suitable fertilizer application, appropriate irrigation of cane, harvesting of cane at the correct age (which is normally every 12-13 months) and better mill performance.

- The business continues to use emerging possibilities for cane development to prioritise the establishment of indigenous black farmers in collaboration with communities, local governments and other relevant stakeholders, in all its areas of operation.

To put Tongaat Hulett’s sugar production into context, the world’s largest sugar company produces less than 5 million tons sugar per annum in a total market of some 180 million tons. The sugar industry is regionally-driven, with no dominant individual producers. Success is driven by capabilities in local agriculture and local/regional markets, together with socio-economic positioning.

Global production and consumption

Global sugar prices are volatile and continue to be impacted, inter alia, by surpluses or shortages. On the supply side, changes can happen rapidly based on farmer behaviour and weather patterns. Lower prices impact the extent of fertilizer and other inputs that are used by farmers, which in turn will affect future production. On the demand side, global demand for sugar has been consistently rising at two percent per annum. Growth in the global consumption of sugar is primarily driven by increasing demand in developing countries, which historically have a low per capita consumption as a result of limited availability and distribution capacity.

In the African context, there are many countries that are currently in a sugar deficit position, and therefore could benefit from Tongaat Hulett growing into its available milling capacity.

Africa, with more than one billion people, is an attractive sugar market with growing consumption.

Sugar Markets

Tongaat Hulett focuses primarily on the local markets in which the company has operations, and seeks to limit the extent of raw sugar imports into these countries.

The company supplies sugar into various regional African markets, particularly where sugar deficits exist and the per capita consumption continues to grow.

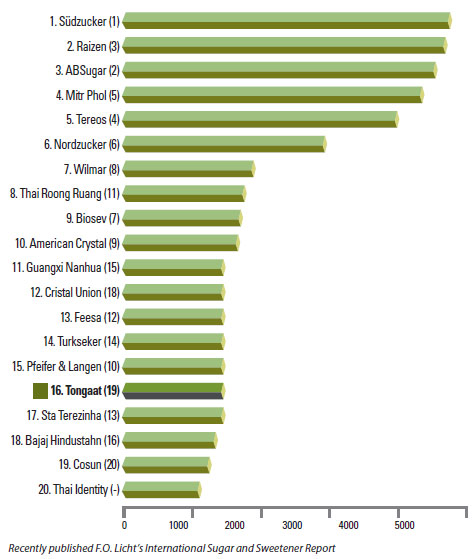

World sugar production by company

(1000 tonnes rv, 2013/14, figures in brackets = 2012/13 rank)

The Mozambique, Zimbabwe and Swaziland operations have “duty- and quota-free” access into the EU. The duty-free, quotafree access for sugar granted to ACP (African Caribbean Pacific) and LDC (Least Developed Countries)/EBA (Everything but Arms) countries will remain in place beyond October 2017. Tongaat Hulett has well established links into the EU together with a good customer base.

Maximise the benefit of owning the leading sugar brands and strong distribution networks in the SADC region

- The South African sugar market is the largest in the Southern African Customs Union (SACU). Tongaat Hulett with its leading Huletts® brand is well positioned to continue benefiting from any further growth in domestic consumption.

- The company is poised to benefit from future growth in consumption in Botswana and Namibia with its leading Blue Crystal® and Marathon® brands.

- The Huletts Sunsweet® brand is the leading sugar brand in Zimbabwe, and is well positioned to benefit when domestic consumption levels return to rates seen prior to hyper-inflation in the country.

- Mozambique has seen a 66 percent increase in it’s sugar consumption over the past ten years. The country’s per capita consumption is well below other countries in the region.

| GLOBAL SUGAR '000 Tons * |

2007/08 | 2008/09 | 2009/10 | 2010/11 | 2011/12 | 2012/13 | 2013/14 | 2014/15 projection |

| Sugarcane and beet production | 167 041 | 150 070 | 159 782 | 167 982 | 174 777 | 186 458 | 180 109 | 177 783 |

| Estimated consumption | 161 066 | 160 787 | 162 969 | 164 908 | 168 837 | 173 747 | 176 825 | 180 396 |

| Surplus/(Deficit) | 5 975 | (10 717) | (3 187) | 3 074 | 5 940 | 12 711 | 3 284 | (2 613) |

| Estimated world closing stock | 64 580 | 53 863 | 50 676 | 53 750 | 59 690 | 72 401 | 75 684 | 73 071 |

Reducing Costs of Production

- 80 percent of sugar milling costs are fixed, 90 percent of overhead costs are fixed and the majority of farming costs are fixed per hectare. Volume increases will lead to reductions in unit costs. The business will continue to ensure that it optimises the tons cane per hectare (tcph) that is derived from land that is under sugarcane. Loading and transport costs vary depending on the distance to the sugar mill, and generally mills are supplied by sugarcane that is farmed within a 100 kilometre radius. The growth in sugarcane supplies and subsequently sugar production will lead to a substantial reduction in the unit cost of production.

RENEWABLE ENERGY

A core pillar of the electricity planning of the South African

Department of Energy focusses on the development of renewable and co-generation electricity through

Independent Power Producers (IPPs). The electricity

procurement through IPPs is being aligned with the

government objectives to grow the economy significantly

and contribute to the potential for job creation on the scale

that government is targeting.

A core pillar of the electricity planning of the South African

Department of Energy focusses on the development of renewable and co-generation electricity through

Independent Power Producers (IPPs). The electricity

procurement through IPPs is being aligned with the

government objectives to grow the economy significantly

and contribute to the potential for job creation on the scale

that government is targeting.- Tongaat Hulett has the potential to generate around 300MW of electricity using the cane fibre available in its South African operations. The business is well advanced in the development of plans for its first 95 MW high efficiency electricity generation plant based on cane fibre in anticipation of the RFP process for co-generation.

- Tongaat Hulett is currently developing plans for a 120 million liter per annum fuel ethanol plant. This planning ties in with the projected increase in cane supply to the South African milling operations, and is based on the conversion of export sugar into ethanol.

GROWING STARCH AND GLUCOSE PRODUCTION

- Tongaat Hulett’s customers in the coffee and coffee creamer sectors are seeing increased demand for their product in the SADC region and beyond, and the company’s recent investment in its downstream capacity will ideally position it to further support this growth market.

- The world is continuing to evolve in terms of the selection of a feedstock for the production of sweeteners, with both maize and sugarcane being suitable alternatives. Tongaat Hulett’s significant investments in the production of sweeteners using both feedstocks will ensure that the business is well positioned to benefit from global developments in this area.

UNLOCKING SUBSTANTIAL VALUE IN THE LAND PORTFOLIO

Accelerating the pace of land conversion and cash flow, benefitting from the activities undertaken over the past few years

The central strategic thrust of Tongaat Hulett’s land conversion process is to create substantial value for all stakeholders.

The success of the process to date and the value to be created into the future is fundamentally underpinned by deep and constructive relationships with national, provincial and local spheres of government and with the various communities in the region. Tongaat Hulett’s profile as a locally-owned, active partner of government and communities in growing agriculture and creating sustainable livelihoods for rural communities in KZN is a unique advantage in ensuring that the highest value is created from this land conversion process.

Land conversion from an agricultural base to higher-intensity urban uses requires policy and planning leadership from the appropriate sphere of government. Tongaat Hulett has collaborative relationships with all spheres of government that are essential to maintain the momentum of infrastructural investment for the benefit of all stakeholders.

The nature and style of the land conversion process varies, depending on the potential usage and positioning of the land concerned. Currently, some of the key themes being focused on are: urban growth and consolidation in the Umhlanga region; coastal/lifestyle/leisure/high-end residential; the airport region– business and residential; urban expansion west of Durban; resort development in the coastal area north of Ballito; and integrated housing and development in the greater Durban areas for people from the lower socio-economic strata.

The Durban/eThekwini and kwaDukuza/iLembe/Ballito area has an expanding economy. Key expectations underpinning the accelerated pace of and increasing value creation from Tongaat Hulett’s land conversion processes in KZN are:

The increasing impact and acceleration of development in

Umhlanga as the prime location for real estate investment

in the Durban region, within which Tongaat Hulett is the

largest landowner, with some 1 100 developable hectares in

place for conversion to development over the next few years,

predominantly at the higher end of the value realisation

spectrum.

The increasing impact and acceleration of development in

Umhlanga as the prime location for real estate investment

in the Durban region, within which Tongaat Hulett is the

largest landowner, with some 1 100 developable hectares in

place for conversion to development over the next few years,

predominantly at the higher end of the value realisation

spectrum.- Durban’s international airport is ten kilometres north of Umhlanga. The attractiveness of this area for local and foreign fixed investment is increasing continuously. Tongaat Hulett is focussing on some 1 725 hectares of land in the region immediately surrounding the airport towards attracting investment over the next five years and is working actively with the KZN government, Dube TradePort company, ACSA, eThekwini, kwaDukuza and iLembe municipalities and other key stakeholders to establish the platform for this investment to start taking place.

- Tongaat Hulett owns a prime landholding of some 1 100 developable hectares at Ntshongweni, straddling the N3 highway west of Durban near Hillcrest, and is collaborating successfully with key government role-players to accelerate planning processes and unlock key infrastructure to introduce a new prime investment location into the Durban region within the next few years and open up a significant new and untapped market for Tongaat Hulett’s land conversion activities. The company anticipates seeing land sales coming out of some 296 developable hectares in this area during the next five years, including a new super-regional shopping centre and mixed use town centre, extensive light industrial and logistics parks and further residential growth of the Hillcrest area towards the N3 corridor.

- A prominent opportunity that offers substantial growth is the creation of a market product to address the significant demand for high-quality, well-located and affordable residential neighbourhoods, incorporating all the attendant social services such as education, healthcare and retail facilities. Tongaat Hulett is focussing on this market throughout it’s priority land areas.

- The coastal tourism, resort and lifestyle residential sectors in KZN remain constrained by a lack of available land and Tongaat Hulett is collaborating with various stakeholders to address this need from within it’s prime coastal landholdings north of Durban and Ballito.

More information on Tongaat Hulett’s land conversion activities can be found here.

SOCIAL SUSTAINABILITY AND INNOVATION

- Social sustainability and innovation are fundamental to the business as Tongaat Hulett seeks demonstrable and practical outcomes in terms of positive social transformation, environmental stewardship and community-upliftment. The evolution of Tongaat Hulett, in continuing to be regarded as a responsible corporate citizen, has also over many years seen the business continue to embrace good corporate governance by adhering to legal and accepted business practices as embodied in the principles of the King III corporate governance framework. The company continues to uphold the principles of Corporate Social Responsibility by demonstrating to society its commitment to philanthropic and empowerment initiatives within the communities in which it operates.

- The safety and welfare of all employees, which amounts to some 35 000 people during the peak milling period, remains a key priority as the business strives towards establishing an organisational culture with a zero harm approach.

- Tongaat Hulett has a substantial land footprint, with some 150 000 hectares of private land under maize supplying the four starch operations while in Mozambique, South Africa and Zimbabwe, more than 150 000 hectares of land supply cane to the business’s eight sugar mills. It is within this context that the company subscribes to principles of sustainable development, which encompass safety, health and environment.

- The business’s participation in various sustainability reporting initiatives, including the Carbon Disclosure Project (CDP), the CDP Water Disclosure Project, the Nedbank Green Fund and its listing on the JSE’s Social Responsibility Investment index for the tenth consecutive year, is testimony to Tongaat Hulett’s committment to sustainability and stakeholder value creation.