Part 2: Overview of the remuneration policy

Remuneration philosophy

The objective of the remuneration philosophy is to align performance of company executives and fair reward with the company's commercial success and sustainability, simultaneously taking into account various stakeholders' perspectives and the affordability/cost to company.

The Remuneration Committee

Roles and responsibilities

The roles and responsibilities of the Remco are determined and approved by the Board, as explained in the corporate governance section of this integrated annual report, which deals with Board Committee structures and responsibilities. In accordance with its terms of reference the Remco's responsibilities are, inter alia, to:

- Propose, review and administer the broad policy for executive management remuneration on behalf of the Board and the shareholders, in accordance with best corporate practice. It ensures alignment of the remuneration policy with the overall business strategy, desired company culture, shareholders' interests and the sustainable commercial well-being of the company.

- Consider and make recommendations to the Board on the remuneration policy and on the quantum, structure and composition of remuneration packages of executive management and senior executives. It reviews general salary increases for management and the operation of the company's management incentive schemes. In addition, it oversees succession planning, retention, employment equity as well as localisation of skills in Mozambique and Zimbabwe.

The Remco meets at least twice a year and information relating to members and attendance has been presented here.

The remuneration report is available at www.tongaat.com/remco

Shareholder engagement

Where practical, the Remco continues to constructively engage with dissenting as well as other shareholders on matters related to disclosure, performance conditions and the structuring of remuneration packages.

A summary of the themes raised in the shareholder feedback and the corresponding actions taken in response thereto appears below.

In future, in the event that the Tongaat Hulett remuneration policy (as contained in part 2 of this report) or the remuneration implementation report (as contained in part 3 of this report) is voted against by 25% or more of voting rights exercised by shareholders, the Remco will take the following steps as a minimum:

- An engagement process to ascertain the reasons for dissenting votes.

- Appropriately addressing legitimate and reasonable objections raised, which may include amending the remuneration policy or clarifying or adjusting the remuneration governance and/or processes.

| Shareholder feedback | Actions taken and/or response to feedback |

| Additional disclosure requested on performance conditions - financial and non-financial targets/KPIs and ranges/thresholds compared to stretch. | Cognisance has been taken of this feedback and progress is disclosed in the current integrated annual report here. |

| More detail is required on the structure of STI (annual bonus) and its context within the total remuneration package, including the quantum of variable pay compared to fixed pay. | Cognisance has been taken of this feedback and progress has been disclosed in the current integrated annual report here. |

| Debate on the vesting scales of the Total Shareholder Return (TSR) component of the LTI, which has a 25% weighting in one of three share schemes.

Debate on the length of the vesting period of LTIs |

This is an ongoing consideration.

This is an ongoing consideration. |

| Questions have been raised on the CEO's package. | Specific contextual responses have been provided in the direct engagement process. In 2016/17 and 2017/18 the CEO elected to receive a 0% cash package increase. |

Key principles of the remuneration policy

In designing a remuneration policy which is fair, transparent and responsible, Tongaat Hulett considered the following factors:

- remuneration which motivates executive management to achieve Tongaat Hulett's business plan, business strategy and budgets;

- remuneration which creates a strong, performance-oriented environment for executive management and all employees;

- remuneration which rewards executives and all employees fairly based on their performance;

- the creation of an environment which encourages decision making that ensures that remuneration of the executive management is fair and reasonable in the context of overall employees;

- remuneration which attracts, motivates and aims to retain high-calibre talent while keeping within market benchmarked pay levels;

- remuneration which drives the performance of executive management and ensures alignment between management and shareholder interests to create shareholder value; and

- remuneration which promotes an ethical culture and responsible corporate citizenship.

Elements of remuneration

The remuneration structure at senior management level consists of:

Guaranteed package (fixed remuneration)

- This is made up of cash payments for all employees and benefits which are offered at executive management level.

Variable pay

- STI annual bonus schemes, which have set maximum levels;

- LTIs in the form of awards under various employee share incentive schemes including the Share Appreciation Right Scheme (SARS), the Long-term Incentive Plan (LTIP), the Retention Long-term Incentive Plan (RLTIP) and Deferred Bonus Plan (DBP).

Pay for performance

The company subscribes to the principle of pay for performance. Remuneration is therefore designed as competitive packages which are benchmarked to the market median on an annual basis using independent external remuneration surveys. Remuneration is linked to individual performance so that as a general principle, good performers are remunerated in line with the market median, with high achievers and exceptional performers being rewarded towards the market upper quartile. This is achieved through a process of self and manager assessment against documented strategic and business performance targets and a general overall assessment (using a four-definition scale ranging from unsuccessful to exceptional). Cash pay increase guidelines are determined with reference to this assessment within an overall company performance rating distribution that approximates a normal distribution curve.

To achieve the goal of remunerating fairly according to individuals' performance, financial and non-financial targets have been set at each level; these being company-level targets, operating entity specific targets, and team and individual performance targets. All top executives' targets are predetermined and approved by the Remco and the Board, and performance is assessed at the end of each performance period for the short-term and long-term incentives, in respect of annual targets and multi-year, long-term incentive targets.

The following table sets out the elements of the company's remuneration design and how they link to company performance and strategy:

| Remuneration element | Key features | Eligibility | Link to strategy |

| Guaranteed pay | Guaranteed pay is fixed remuneration which comprises both a cash pay element and benefits. These benefits are inclusive of membership of an approved company pension fund (compulsory for all management levels), provision of subsidised medical aid, gratuity at retirement and death and disability insurance. Housing and car schemes for qualifying employees are provided in Mozambique, Zimbabwe and Swaziland. The guaranteed pay for executive management and senior management is reviewed annually by the Remco and the Board, and is set with reference to relevant external market data as well as the assessment of individual performance and the role/profile of each employee. | All employees | Attraction, recruitment and retention of talented executives and competent employees to drive business performance. |

| STI:

Annual bonus scheme |

The primary purpose of the bonus schemes is to serve as a short-term incentive designed to provide executive, senior and middle management with the opportunity to earn an annual bonus.

It is based on a combination of the achievement of predetermined financial/operational targets and an assessment of the individual's overall general performance. The financial targets include measures of corporate and, where applicable, operational performance, and the non-financial (personal) targets include the achievement of individual and, where applicable, team performance, against predetermined objectives related to key business strategies and objectives, including non-financial KPIs. The annual bonus scheme has a threshold financial target below which no bonuses are paid to executives and senior management. All financial targets have an upper limit and a lower limit. When a lower limit is reached 25% of the amount attributable to that element is applicable and when the upper limit is reached or exceeded, 100% of the amount attributable to that element is applicable. If financial results are below the lower limit, zero points will be earned for the element concerned. |

From CEO to entry level management (latter effective 2017/18) | To reward successful achievement of company targets and personal performance and to act as an attraction and retention mechanism.

The company uses such metrics as operating profit, headline earnings, cash flow and return on capital employed to reward executives and management. These are, inter alia, linked to the strategic objectives such as increases in sugar production, large land sales and sweating the milling assets. |

| LTI:

SARS |

Participating employees are awarded the right to receive shares equal to the difference between the exercise price and the grant price, less income tax payable on such difference, once the right has vested. The employee therefore participates in the after-tax share price appreciation in the company. The extent of the vesting of the right is dependent on the achievement of performance conditions over a three-year performance period. | Executive management, senior management and qualifying professional employees | To strengthen the alignment of management with shareholder interests and assist in the attraction and retention of executive management. |

| LTI:

LTIP As amended at the AGM on 27 July 2010 to ensure compliance with Schedule 14 of the JSE Listings Requirements |

Annually, participating employees are granted conditional rights to shares (referred to as LTIPs). The extent of vesting of the rights are dependent on the achievement of performance conditions over a three-year performance period as set out in the table below on long term incentive plans.

Conditional retention awards (RLTIPs) can be granted under this LTIP, where a specific retention risk is identified, to assist with targeted key and high potential employee retention and talent management. These retention awards do not have performance conditions and vest after a four or five-year period whereby they are settled in shares. RLTIPs are a small quantum in relation to other share-based instruments |

Executive management, senior management and qualifying professional employees.

Targeted key and high potential employees for retention. |

To strengthen the alignment of management with shareholder interests and assist in the attraction and retention of qualifying executive management and senior managers who make a significant company impact. The company uses metrics such as operating profit, headline earnings, cash flow and return on capital to reward executives and management for increases in the strategic objectives of sugar production, large land sales and sweating the milling assets. |

| LTI:

DBP |

Participating, selected executives purchase shares in the company with a portion of their after-tax bonus. These pledged shares are held in trust by a third-party administrator for a qualifying three-year period, after which the company awards the employee a number of shares in the company which matches those pledged shares released from trust, provided the executive has not resigned (matching awards). | CEO, CEO direct reports and selected executives | To ensure alignment with shareholder and management interests and to encourage achievement of strategic business objectives.

The company uses DBP awards to motivate the executive management to focus on driving sustainable share price growth. |

2018/19 ANNUAL BONUS SCHEME PERFORMANCE CONDITION TARGETS-FINANCIAL AND OPERATIONAL METRICS

Following the recommendation of the Remco and with the approval of the Tongaat Hulett Board, the operation of the annual bonus scheme for middle management and upwards for the 2018/19 year is as set out below. Below this level there is a guaranteed bonus of 10% of annual basic salary.

| Short-term incentive: Annual Bonus Scheme | |||||

| Eligibility | CEO to entry level management | ||||

| Formula | The annual bonus is a cash payment at the end of the financial year, the value of which is determined according to a formulaic methodology. The formula is dependent on financial/operational and non-financial performance in the financial year, measured against pre-determined targets, expressed as a lower and upper limit/target. The outcomes of the financial/operational and non-financial performance are combined to assess the percentage of the maximum which each individual is eligible to receive. | ||||

| Gatekeeper | If Tongaat Hulett's headline earnings are below an agreed threshold, no bonuses will be payable in respect of all participation levels other than middle management (ie: the 10% to 20% schemes). Previously the gatekeeper provisions did not apply to management on the 30% scheme. | ||||

| Maximum value of bonus | The total amount of each individual's cash package which can be earned if the financial/operational upper limit performance conditions and specific non-financial performance KPIs are met is as follows: | ||||

| Level | Maximum as % of cash package | ||||

| CEO | 80% | ||||

| CFO/Executive leadership | 65% - 70% | ||||

| Senior management | 30% - 50% | ||||

| Middle management | 10% - 20% | ||||

| Elements of the annual bonus calculation | All executives are measured on financial and specific non-financial targets. For executives who perform an operational function, the financial component will also include operational targets.

Accordingly, the applicable weightings between the different elements are as follows (expressed in terms of the maximum): |

||||

| Financial targets - corporate | Financial targets - operational | Non-financial targets | Maximum bonus | ||

| Weighting % | 65% | 35% | |||

| CEO | 52% | 28% | 80% | ||

| Corporate executives: top-tier | 45% | None | 25% | 70% | |

| Corporate executives (operations): top-tier | 29% | 16% | 25% | 70% | |

| Financial performance measures | The performance conditions for the 2018/19 year include: | ||||

| Corporate | Operations | ||||

| Headline earnings | Operating profit | ||||

| Return on capital employed | Cash flow | ||||

| Cash flow | |||||

| Operational targets are set relative to each operation.

Relative to the expressed maxima, achievement of the lower/minimum level of performance will result in a 25% vesting for that measure, and achievement of the upper/maximum level of performance will result in a 100% vesting for that measure. Minimum and maximum target levels of performance are set relative to budget and/or with reference to prior financial results, and aim to reward out-performance (reflected by the upper/maximum) and guard against remunerating for poor performance by setting lower/minimum performance levels. The aim of the Remco is to set financial and operational targets in a manner where stretch/maximum level of performance represents the creation of shareholder value and strong performance against the strategic business outcomes. |

|||||

| Individual performance and non-financial KPIs | Performance on an individual level is assessed relative to two aspects:

The general personal assessment for top-tier executives is approved by the Remco, on recommendation of the CEO or Chairman of the Board as applicable, following formal performance discussions and evaluations. Examples of non-financial KPIs include those relating to:

|

||||

| Changes to the 2018/19 STI annual bonus scheme | The performance conditions for middle management have been amended to include a cash flow element in addition to profit from operations.

The gatekeeper proviso will now also include management on the 30% scheme so that if Tongaat Hulett's headline earnings are below an agreed threshold, no bonuses will be payable in respect of all participation levels other than middle management (i.e. 10% - 20% schemes). |

||||

2018/19 LONG-TERM INCENTIVE PLANS

| Long-term incentive plans | |

| Brief description of plans | Tongaat Hulett currently operates three separate LTI plans, referred to as "the Plans":

Under these Plans, executive management, senior management and qualifying professional employees of the company are awarded rights to receive shares in the company if certain performance conditions have been met (with the exception of Retention Shares), and in the case of the SARS, when the rights have been exercised. |

| Eligibility and allocation levels | Executive management, senior management and qualifying professional employees

The Remco makes a judgement each year regarding the allocation split between instruments. The current practice is to allocate SARS and LTIPs on a 45/55 split. The DBP allocation is linked to the actual value of the prior year's STI, which is determined by the extent to which the performance conditions are satisfied and personal KPIs are achieved. |

| Types of instruments | Annual awards under the LTIP take the form of conditional awards, SARS and Deferred Bonus Shares. These instruments are discussed in the table setting out the elements of the remuneration design and policy. |

| Maximum individual limits | The rules of the Plans provide that the annual fair value of the CEO's and CFO's allocations should not exceed 1 times cash package, and the market value of SARS and LTIP at grant date should not exceed 2 times cash package and the value of the DBP allocation shall not exceed 30% of cash package. In addition, the total unvested allocation for each should not exceed 1,2 million shares. |

| Performance measures and targets | For the awards that will be made in the upcoming year, the following performance conditions and periods are applicable:

LTIP awards will vest after a three-year period, and will be subject to:

The SARS will vest after a three-year period, subject to an increase in HEPS. The vesting will be on a sliding scale.

Performance conditions governing the vesting of the scheme instruments are determined at the time each annual award is made. The performance targets are set each year for the instruments granted that year, taking into account the prevailing circumstances and conditions at that time and relative to targets that are intended to be challenging but achievable. Targets are linked, where applicable, to the company's medium-term business plan, over three-year performance periods, with actual grants being set each year considering expected company performance, the job level and cash package of the participating employee, and appropriate benchmarks of the expected combined value of the awards. |

| Company limits | The maximum number of treasury or issued capital shares that may be issued and allocated under the LTIP, SARS and DBP shall not exceed 13 000 000 shares, which would represent approximately 9,6% of the number of issued shares. The company is currently well below this limit in terms of what could potentially be issued and allocated. Furthermore, all settlements to date have been through a third-party acquiring shares in the market and delivering the shares to employees. |

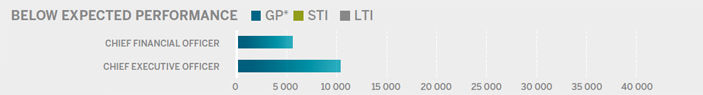

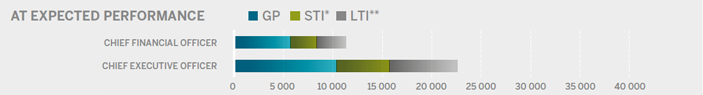

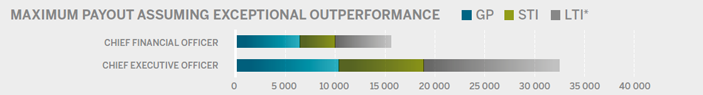

Pay mix (R000)

|

| * Guaranteed package |

|

| * On target performance assumed at 60% of maximum. ** Based on the average of the past 2 years awards. Indicative expected value on grant date. |

|

| * LTIP/DBP: Indicative expected value on grant date assuming the average allocation levels for the past 2 years and assuming full vesting. SARS: Indicative expected value assuming the average allocation levels for the past 2 years, a share price growth of 18% p.a. and full vesting.

The share price growth was based on an estimated Cost of Equiy plus a premium based on upper quartile returns and market practice. |

Termination policy

Executive management have contracts which define notice periods. In the event of a termination, the company has the discretion to allow the relevant employee to either work out their notice or to pay the guaranteed pay for the stipulated notice period in lieu of notice. For guaranteed pay, there are no contractually agreed upon balloon payments due on termination.

Furthermore, the various Plan rules clearly outline termination provisions under different circumstances, as set out below.

| Voluntary resignation, dismissal | Retirement, ill health disability | Retrenchment, death | |

| STI | Automatic forfeiture of award for current year. | Award is pro-rated. | Award is pro-rated. |

| LTIP and RLTIP | All unvested awards shall be forfeited in their entirety and will lapse immediately on the date of termination | If the participant retires, falls ill or is disabled prior to the vesting date, they shall remain entitled to the same rights and obligations as if they remained employed by the company. Retention awards are forfeited in cases of early retirement. | A pro-rata portion of the award shall vest within 3 months or longer of retrenchment as the Remco determines. In determining thepro-rata portion, Remco considers the extent the performance conditions are satisfied and the proportion of performance period expired.

On the date of death, a pro-rata portion of the award shall vest and reflect the expired portion of the performance period. |

| SARS | All unvested awards shall be forfeited in their entirety and will lapse immediately on the date of termination | If participants retire prior to the vesting date, they shall remain entitled to the same rights and obligations as if employed by the company. | A pro-rata portion of the award shall vest within 3 months or longer of retrenchment as the Remco determines. In determining the pro-rata portion, Remco considers the extent the performance conditions are satisfied and the proportion of performance period expired. On the date of death of a participant the executor may exercise the award within 1 year of death irrespective of the extent to which awards have vested or satisfaction of any performance condition. |

| DBP | The participant will not be entitled to any matching awards on the vesting date. | If participants retire prior to the vesting date, they shall remain entitled to the same rights and obligations as if employed by the company. | Upon termination, a pro-rata portion of the participant's matching awards vests at date of termination. The portion of the matching award to vest will reflect the proportion of the pledge period that has expired at the date of termination of employment or date of death. |

Recruitment policy

When recruiting executive management, the company considers the size, nature and complexity of the role and the availability of the executive's skills in the market, and seeks to balance internal equity and external competitiveness when making an offer. Where applicable, the Remco may make conditional sign-on awards.

Interests of the directors of the company in share capital

The aggregate holdings as at 31 March 2018 of those directors of the company holding issued ordinary shares of the company are detailed here.

Non-executive directors' remuneration

Non-executive directors receive fees for their services as directors of the Board and all committees including its Remco, which includes an attendance fee component. The directors' fees are benchmarked against data obtained from the latest integrated annual reports of companies in the TSR peer group and external consultants. Directors' fees are recommended by the Remco, considered by the Board, and proposed to shareholders for approval at each AGM.

Non-executive directors do not participate in either short-term bonus schemes or long-term incentive share schemes of the company.

As required by the Companies Act, the remuneration of non-executive directors will be authorised by special resolution at the AGM and is set out here in the integrated annual report.

Non-binding advisory vote on Remuneration Policy - Part 2

This remuneration policy is subject to an advisory vote by shareholders at the forthcoming AGM.

Shareholders will also be requested to cast an advisory vote on the remuneration implementation report as contained in part 3 of this remuneration report.