chief executive's REVIEW

Tongaat Hulett is well positioned to benefit from its improved strategic positioning underpinned by substantial progress against the goals it has set itself in key focus areas. Further significant outcomes are targeted for the year ahead.

It is pleasing to report on a year where the starch operations delivered a record performance, the land conversion and development activities’ momentum continues to unlock substantial value and, in difficult market and weather conditions for the sugar operations, there were positive achievements in terms of cost reductions, securing the local market in Zimbabwe and future cane supplies. Operating cash flow exceeded R2,5 billion for the first time, an encouraging milestone.

The financial results for the year ahead will be influenced by a number of varying dynamics, the magnitude and impact of which are difficult to predict at this stage. It is likely that the sugar operations will remain under pressure, particularly in South Africa. Land development could have a record year. Starch volumes, mix, cost and exchange rate dynamics are likely to counter maize prices being closer to import parity.

GROWING STARCH AND GLUCOSE

Tongaat Hulett’s starch operation currently has about 15 percent of its installed up-stream wet-milling capacity available after servicing current markets. The operation has a well-developed source of raw materials, a strong South African domestic market presence and access to regional markets, all of which are in an upward starch and glucose consumption phase.

- Tongaat Hulett’s customers in the coffee and coffee creamer sectors are seeing increased demand for their product in the SADC region and beyond. The business’s current investment in this market will provide further support for growth in this market segment.

The starch operation continues to prioritise improvements in efficiencies and capacity utilisation. Some of the key achievements for 2014/15 include:

- Ongoing operational excellence programmes and efficiency investments led to an improvement in factory yields, along with improved co-product recoveries and a reduction in utility costs. This resulted in a reduction in manufacturing costs of R24 million during the period.

- The Kliprivier mill, which is the operation’s largest mill, improved wet-milling output by 14 percent.

BUILDING ON A NUMBER OF ACTIONS ALREADY UNDERWAY, THE MAIN FOCUS AREAS FOR THE STARCH OPERATION ARE:

- Supporting the growth in the coffee creamer sector through an investment of some R120 million in downstream capacity. This investment is expected to be commissioned in October 2015, and the production will replace imports of glucose for existing customers under long-term contracts.

- Capacity released by the coffee creamer expansion will be used to supply modified starch and glucose products to the confectionary industry.

- Selection of market mixes and the development of new product portfolios to maximise contribution and increase capacity utilisation.

- Ensuring a cost-competitive and sustainable source of raw materials.

- Optimising production capacity in downstream channels and overall plant utilisation.

- Improving plant efficiencies and manufacturing costs.

The previous South African maize crop, which has been confirmed at 14,31 million tons (harvested from May to July 2014), represents the largest crop harvested in South Africa’s history. The carry out of this crop is reducing the impact of the poor 2015/16 crop, which is currently estimated to be 9,76 million tons.

INCREASING RETURNS FROM THE EXISTING SUGAR ASSET BASE

GLOBAL SUGAR MARKETS AND PRICES - FIVE YEARS OF SURPLUSES

Following five years of surplus production, world prices are substantially below the levels required for sustainable farming and sugar production. The three major sugar-producing areas of the world are under severe pressure at these price levels and are seeking increased government support.

- On the demand side, global demand for sugar has been consistently rising at some 2 percent per annum, equal to some 4 million tons of additional demand each year. Growth in global consumption is primarily driven by increasing demand in developing countries, which historically have a low per capita consumption rate as a result of limited availability, affordability and distribution capability.

- Increases in sugar prices can happen rapidly based upon emerging farmer behaviour and weather patterns. The trend of declining prices over the past three years is likely to increasingly impact negatively on the replanting of cane and the extent of fertiliser and other inputs that are used by farmers, which in turn will affect future production. The Indian sugar industry is an example of the impact of sustained lower global sugar prices where currently millers owe farmers some US$3,2 billion in overdue sugarcane payments.

- The probability of sizable investments in sugarcane growing and milling assets being triggered, at current pricing levels, is remote.

DOMESTIC MARKETS, WITH SUPERIOR REALISATIONS, REMAIN THE PRIMARY FOCUS FOR MAXIMISING THE VALUE THAT CAN BE EARNED FROM SUGAR

In the domestic sugar markets in which Tongaat Hulett operates, governments have increasingly acted positively to protect local producers and growing communities against imports from surplus producers.

-

In Zimbabwe, sales in the domestic market reacted positively to the import protection measures that were implemented despite trying macro-economic conditions.

- Sales over the past year in Mozambique were negatively affected by the delay in implementing enhanced import tariffs. This heightened the awareness of all relevant parties and enabled good progress to be made towards improving local market protection, which now appears imminent.

- In South Africa, the reference price for determining the variable duty on imported sugar increased from US$358 per ton to US$566 per ton in April 2014.

The company continues to implement and support actions that are aimed at making certain that, as far as possible, import tariffs and other control measures such as import permits exist and are effective.

- Multiple actions are being undertaken which include lodging an application in South Africa for an increase in the reference prices for sugar and continuing to engage the government in Mozambique to implement the enhanced market protection measures that were proposed last year.

- Measures continue to be implemented to strengthen non-tariff barriers as well as to actively monitor imports and adherence to import protection measures, thereby establishing domestic market prices that support the development of sustainable cane-growing communities.

Domestic market sales will increasingly benefit from population growth and economic development.

-

Strategies to achieve sales growth include presenting product solutions that will allow all consumers to afford sugar in the monthly grocery basket and developing new routes to markets so that more consumers have access to sugar. This is particularly relevant where low levels of per capita consumption are evident, as is the case in Mozambique where demand is at a low 8kg per person per year as compared to neighbouring countries that are at 30-35kg.

ASK AFRIKA ICON BRANDS 2014/15

TOP 10 MOST USED BRANDS1. ALL GOLD TOMATO SAUCE 2. KOO BAKED BEANS 3. HULETTS SUGAR 4. ALBANY BREAD 5. COCA COLA 6. SUNLIGHT DISHWASHING LIQUID 7. ROBERTSONS SPICES 8. NOKIA 9. TASTIC RICE 10. BLACK CAT PEANUT BUTTER - Zimbabwe per capita consumption of 21kg is lower than where it traditionally has been and changes to pack sizes and improvements in product availability are some of the actions underway to increase domestic consumption.

Tongaat Hulett continues to develop its premium Huletts®, Huletts SunSweet®, Blue Crystal® and Marathon® sugar brands in the domestic and regional markets to drive the value extracted from the premium-priced domestic markets. Huletts® has been classified as one of the top five Icon Brands in the ASK AFRIKA survey over the past three years, attaining third place in the 2014/15 survey as well as being rated as the top brand in the sugar category.

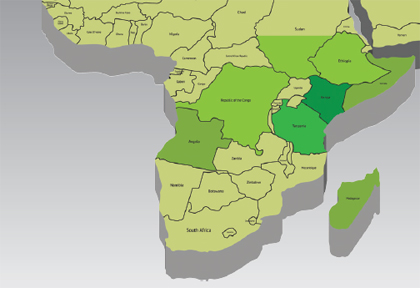

TONGAAT HULETT HAS THE FLEXIBILITY TO RAPIDLY ADJUST EXPORT DESTINATIONS AND MARKET POSITIONS

Sales by Tongaat Hulett into the regional markets have been flat over the past two years.

- Tongaat Hulett has more than 30 years’ experience in the markets of south and south eastern Africa.

- In the past year Tongaat Hulett sold some 93 000 tons of sugar from its South African business to multiple African markets predominantly in eastern and south eastern Africa. Volumes were in line with the prior year’s performance.

- Although sales values fell in tandem with global prices, premiums remained firm despite softening freight costs from competitive origins. The business also benefitted from the weakening of the Rand.

Tongaat Hulett is expanding its sales into the regional deficit markets to include sugar produced in Mozambique and Zimbabwe.

- Existing alliances are being deepened to better penetrate the markets more rapidly with increased volumes.

- Options to move down the value chain by establishing local packing, selling and distribution capabilities, similar to operations in Botswana and Namibia, are being developed.

- The company’s premium brands, already present in African markets, will be leveraged to further develop market penetration.

Tongaat Hulett has the ability to switch supply between the most favourable destination markets.

- The business priority remains to first utilise installed existing capacity to supply increasing demand in its countries of operation before considering other markets.

- The developing flexible capability to rapidly select the most favourable export markets will serve to maximise sales realisations.

- The current market mix will be gradually adapted to achieve an optimal balance between the EU and the regional deficit markets.

|

|

|||||

|

||||||

| Tons (‘000) | ||||||

| Country | 2014/15 | 2018/19 | Increase | |||

| Burundi | 41 | 50 | 9 | |||

| Eritrea | 106 | 128 | 22 | |||

| Ethiopia | 600 | 693 | 93 | |||

| Kenya | 820 | 992 | 172 | |||

| Rwanda | 51 | 77 | 26 | |||

| Somalia | 327 | 395 | 68 | |||

| South Sudan | 105 | 127 | 22 | |||

| Angola | 372 | 460 | 88 | |||

| DRC | 410 | 489 | 79 | |||

| Madagascar | 168 | 206 | 38 | |||

| Total | 3 000 | 3 617 | 617 | |||

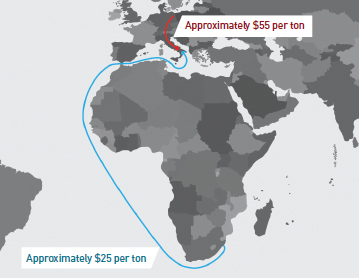

REALIGNING TONGAAT HULETT’S EU STRATEGY

Prices in the EU market are declining and are increasingly moving in tandem with world market prices as the end of the current regime on 30 September 2017 approaches.

-

The value associated with the ongoing duty free access afforded by the EU to countries including Mozambique and Zimbabwe has been declining over the past 24 months.

- EU values still present a premium, albeit variable, to world market realisations as the supply-side dynamics post- October 2017 continue to emerge.

- EU prices are likely to be at a considerable premium to world prices in times of sugar deficits.

- Lower shipping costs from southern Africa to some EU destinations, when compared to internal EU logistics costs, will continue to provide a premium selling price to raw sugar sellers. Tongaat Hulett will be able to take advantage of these premiums by reason of the continued preferential access to the EU sugar market that is available to the business.

- Tongaat Hulett is flexible and is steadily readjusting its market mix away from the EU to regional markets so as to achieve a better balance between end-market destinations. Sales volumes for 2014/15 into the EU were 34 percent less than the prior year and are expected to be at a similar level in the coming year.

REDUCING THE COST OF SUGAR PRODUCTION - LOWEST-COST QUARTILE OF WORLD SUGAR PRODUCERS

Brazil is often referred to as the lowest-cost large-scale sugar producer globally, producing some 38 million tons sugar annually out of global production of some 180 million tons. India and the EU, which recently produced some 31 and 20 million tons of sugar respectively, are higher-cost sugar producers (second and third quartile respectively of the top 68 producers globally that produce 79 percent of global production*). Thailand, which produces some 12 million tons of sugar annually is positioned in the lowest-cost quartile*. Zimbabwe and South Africa are positioned in the same lowest-cost quartile of global producers. Tongaat Hulett’s Mozambique operations are moving into the lowest-cost quartile.

The intense drive to further decrease costs across Tongaat Hulett’s operations is rigorous and relentless, with substantial reductions having been achieved over the past two years.

- There is a particular focus on costs related to bought-in goods and services, transport, marketing, salaries and wages. These costs currently total some R5,2 billion across all the operations. Over the past two years, an effective cost reduction equivalent to R950 million in money of today has been achieved. This is calculated after adjusting for indicative price increases, salary and wage rate increases and inflation over the two years applicable to these costs.

- Unit costs of sugar production benefit substantially from growth in volumes and better yields, as milling costs and many of the agricultural costs per hectare are mostly fixed. Some 80 percent of sugar milling costs are fixed, 90 percent of overhead costs are fixed and the majority of farming costs are fixed per hectare. Loading and transport costs are mainly volume and distance related. Mills are generally supplied by sugarcane that is farmed within a 100 kilometre radius.

- Going forward, the focus is on further reductions to the aforementioned R5,2 billion cost base, following the successful reductions achieved over the past two years.

GROWING SUGAR PRODUCTION BY SWEATING THE EXISTING ASSETS - MARGINAL COST OF ADDITIONAL SUGAR PRODUCTION FROM EXISTING HECTARES UNDER CANE IS 4 TO 6 US CENTS PER POUND

Tongaat Hulett has more than 2,1 million tons of installed sugar milling capacity. In the past four years, it has increased its sugar production by just over 300 000 tons to 1,314 million tons.

The business’s sugar production for the 2014/15 season was primarily impacted by the low rainfall in South Africa during the current year and the low dam levels in Zimbabwe during the 2013/14 year.

- The dry conditions which commenced in KwaZulu-Natal during early 2014 continued throughout the year and resulted in a 93 000 ton decline in sugar production in South Africa. The negative impact on sugar production in 2014/15 was substantially offset by Tongaat Hulett’s ongoing sugarcane planting initiatives, which have resulted in almost 29 000 hectares being planted to cane over the past four years.

- In Zimbabwe, lower sugarcane yields arising from lower irrigation being applied in the previous season and less sugarcane being available for harvesting (less sugarcane could be planted due to the water constraints in the previous season) were the major factors in the reduced sugar production for the year. In addition, the business did not receive any sugarcane supplies from the Chisumbanje Estate.

| Tongaat Hulett sugar production |

2010/11 | 2012/13 | 2013/14 | 2014/15 | 2015/16 Early estimate |

2015/16 Had growing conditions been regular |

| South Africa | 455 000 | 486 000 | 634 000 | 541 000 | <421 000 | 720 000 |

| Zimbabwe | 333 000 | 475 000 | 488 000 | 445 000 | 470 000 - 485 000 | 525 000 |

| Mozambique | 164 000 | 235 000 | 249 000 | 271 000 | 273 000 - 290 000 | 290 000 |

| Swaziland (RSE) | 54 000 | 58 000 | 53 000 | 57 000 | 55 000 - 59 000 | 59 000 |

| Total production | 1 006 000 | 1 254 000 | 1 424 000 | 1 314 000 | < 1 255 000 | 1 594 000 |

Tongaat Hulett’s sugar production for 2015/16 could have been close to 1,6 million tons of sugar, had growing conditions been regular. In current conditions, it is expected that sugar production will be lower than 1,255 million tons for the year. This is mainly as a result of ongoing severe drought conditions on the north coast of KwaZulu-Natal.

- Sugar production in South Africa is likely to be below 421 000 tons sugar, which is the lowest production by this operation for an extended period of time. In light of the ongoing impact of the drought, the Darnall mill, which was initially scheduled to begin crushing later in the season, will probably not open for the 2015/16 season.

- This lower sugar production will result in lower export sales into the region.

Going forward, the priority remains to increase sugarcane supplies through the appropriate balance of a combination of improved cane yields, sugar recoveries and additional hectares under cane. There is an emphasis on vertical growth (in other words, yield improvements) in cane supply, which has a very low cash cost.

- The focus remains on increasing the sugar that is contained in and extracted from the cane stalk, through improved farming practices, suitable fertiliser application, appropriate irrigation of cane, harvesting of cane at the correct age (which is normally every 12-13 months) and better mill performance.

- The business continues to use existing and emerging opportunities for cane development, to prioritise the establishment of indigenous black farmers in collaboration with communities, local governments and other relevant stakeholders, in all areas of operation.

Given the low marginal cost that the business has of producing additional sugar from its existing installed assets, Tongaat Hulett has set as an objective to produce more than 1,8 million tons of sugar per annum.

- A key driver of producing additional tons of sugar from the 2014/15 base is a return to regular growing conditions, which can contribute 37 percent of the increased production. In the South African context, Tongaat Hulett is proactively seeking opportunities to increase the extent of sugarcane land that is irrigated and discussions with the relevant government departments regarding the building of a dam on the Matigulu River in northern KwaZulu-Natal are ongoing. The dam will provide drinking water for surrounding communities and the development of an irrigation scheme which has the potential to provide water for a further 4 500 hectares of sugarcane.

- Yield improvements from the same hectares and better mill performance, specifically around sugar recoveries, will contribute a further 33 percent of the increased sugar production.

- The remaining 30 percent will be driven by additional sugarcane that will either come from land that has already been planted to sugarcane, and is still to be harvested, or land that will still be planted to cane. In instances where more land will be planted to sugarcane, the primary objective is that this investment will be funded by third parties, with a good example of this being the South African sugar operations where additional hectares are being funded through cash received from the Jobs Fund.

| Tons raw sugar | 2014/15 Actual |

2018/19 Target |

Growth will come from | ||

| Regular growing conditions | Yield and sugar recovery improvements | Additional hectares: New cane already planted, net of cane losses and future planting partially grant funded | |||

| South Africa | 541 000 | 847 000 | 42% | 20% | 38% |

| Zimbabwe | 445 000 | 606 000 | 34% | 45% | 21% |

| Mozambique | 271 000 | 307 000 | 11% | 76% | 13% |

| Swaziland (RSE) | 57 000 | 61 000 | 25% | 75% | - |

| Total | 1 314 000 | 1 821 000 | 37% | 33% | 33% |

| 70% | |||||

SUCCESS OF THE SOUTH AFRICAN SUGAR INDUSTRY

The long-term sustainability of the South African sugar industry lies in ensuring that the reward for growing sugarcane is sufficiently attractive to retain current commercial and smallscale farmers and to encourage the expansion of areas that are planted to sugarcane, thereby ensuring that milling assets are fully utilised.

The sugar industry in KwaZulu-Natal currently provides support via direct employment, indirect employment and dependents to some 860 000 people in a province of 10,7 million people.

- The region has one of the largest proportions of rural people with some 54 percent of the population living in rural communities while the national average is 34 percent.

- The industry’s current total revenue of R12,7 billion per annum has significant potential to positively impact the rural population of KwaZulu-Natal through job creation.

- 87 percent of the farmers registered with the South African sugar industry are defined as small-scale farmers who reside in KwaZulu-Natal. These small-scale farmers currently supply just under 1,5 million tons of sugarcane per annum and there is significant potential to grow this to some 6 million tons per annum. In addition, the extent of land under sugarcane currently being farmed by land reform farmers can increase significantly.

Ensuring an improvement in the value of sugarcane requires that a number of strategic interventions are implemented and these “levers” are generally categorised as follows:

- Productive farming and milling - The objective remains that Tongaat Hulett and the farmers that supply sugarcane to its mills will continue to operate as competitively as possible. In an effort to support the activities of the farmers supplying its operations, the business’s Cane and Rural Development Unit (CRDU) is continuing to provide farming and other relevant support to emerging small-scale and land reform farmers, with the objective that in the medium term, these farmers will have the necessary skills to maximise their sugarcane yields. Productivity initiatives for commercial private farmers include the seed cane subsidy, replant assistance scheme and ripening scheme.

- Local market protection - A key requirement of ensuring the long-term sustainability of the industry, and particularly small-scale and land reform farmers, is local market protection. A new application for an increase in the reference price on which the import tariff is based is currently in progress. This application should be viewed within the context of the current local brown sugar price (ex-mill) of 25 US cents per pound competing with the Malawian and Zambian equivalent prices of 41 US cents per pound and 33 US cents per pound respectively.

- Direct support to small-scale and land reform farmers - It has been established that small-scale and land reform farmers are only 8 to 10 percent less competitive than commercial farmers, provided that they are assisted with good quality roots that are planted correctly. The largest cost involved in establishing new sugarcane is the initial root planting exercise. It is therefore essential that government, through its various agencies, supports this initial input to allow for the establishment of new small-scale and land reform farmers. The government’s willingness to do this has been demonstrated through the Jobs Fund grant funding, along with a number of other programs. Tongaat Hulett will continue to develop sources of funding for small-scale and land reform farmer development, including further funding applications from the Jobs Fund. Government support for other elements of community development will continue to be unlocked. This includes infrastructure development, such as dams for potable water and irrigation.

- Ethanol - The sugar industry is working with government on a biofuel framework which would seek to divert most export sugar to the production of ethanol, which would add substantial value to this sugar component of the cane price.

- Electricity generation - The fibre in cane has traditionally been burnt in the sugar mill to produce only sufficient electricity and steam to run the milling complex. The opportunity to convert the energy within the fibre more efficiently, along with the sale of electricity to the natioal grid at an attractive price, immediately introduces a new revenue stream from cane, effectively improving the cane price. The impact that electricity generation can have on the value of the fibre in the sugarcane stalk is significant and has the potential to substantially enhance the agricultural value chain and hence the viability and profitability of farmers. After a lengthy development period, the Request For Bids for electricity under the co-generation IPP Procurement Programme was made available on 4 June 2015. The first phase of this program is aimed at short-term, quick implementation projects. A second phase, tailored for the larger, more complex sugar industry type projects is likely to follow.

A reasonable degree of success in some or all of the above elements will secure the future of the South African industry and allow players to reinvest in the business at an attractive level of return. Improved viability of the sugarcane value chain, particularly the small-scale and land reform farmers, will have a significant impact on the quality of life of people in the region, particularly people living in rural areas.

MOMENTUM IN LAND DEVELOPMENT

The value created per hectare of land sold is increasing with the steadily improving land conversion platform and varies with usage and location. A total of R1,9 billion profit has been earned over the past two years from the sale of 367 developable hectares.

The purpose of the expanded document is to communicate to a wide range of stakeholders the extent to which the portfolio’s scale and location, linked to the company’s activities in growing the agricultural base of rural KwaZulu-Natal and combined with collaborative long-term strategic planning and catalytic investment in urban land use design, infrastructure and market development, create the platform for a transformative impact on the value to be created from the land conversion process.

Successful conversion of land to its best and most effective use near a major city such as Durban or in an area with natural endowments such as the north coast of KwaZulu-Natal is an important opportunity for business and government to collaborate to create and unlock value. It is major enabler of regional competitiveness, investment, economic development and social delivery. Larger areas of the business’ landholdings are benefitting from the ever-increasing collaborative long-term strategic planning and catalytic investments in urban land use design and infrastructure that is ongoing with a wide range of entities at local, provincial and national government level. It is pleasing that 39 percent of the total land portfolio is now well advanced in the latter stages of the processes towards becoming shovel ready, defined as a state where within a short space of time and with a high level of certainty, physical work on both infrastructure and buildings could commence.

The portfolio document provides commentary on seven major demand drivers, namely high-intensity urban mixed use, various housing markets, high-end markets, residential services, the office market, the warehousing, industrial and associated market and unique clusters of opportunity. These are expected to drive substantial demand for land as ever more effective and collaborative focus is brought to bear on positioning the portfolio’s attractiveness to these users and addressing their requirements.

Effective exploitation of the demand drivers, together with the progress being made in bringing more of the portfolio to a shovel ready state, leads to the following possible five-year sales outcomes targeted to come primarily out of 3 801 developable hectares in key focus areas tabulated and described in the land portfolio document:

| DEMAND DRIVER | RANGE OF DEVELOPABLE HECTARES | RANGE OF PROFIT PER DEVELOPABLE HECTARE (Rmillion) |

|||

| from | to | from | to | ||

| High-intensity urban mixed use | 80 | 150 | 22,0 | 35,0 | |

| Housing markets | Mid-market housing | 125 | 175 | 3,5 | 6,0 |

| Affordable housing | 20 | 150 | 2,5 | 3,8 | |

| Government-subsidised housing | 200 | 722 | 2,0 | 2,4 | |

| High-end markets | High-end city hotels and residences | 4 | 16 | 12,0 | 25,0 |

| Coastal Resorts catering to domestic, charter and incentive markets | 10 | 50 | 3,5 | 5,0 | |

| High-end residential developments | 20 | 50 | 6,0 | 9,0 | |

| Residential services | 15 | 66 | 3,8 | 6,0 | |

| Office market | 7 | 50 | 6,0 | 15,4 | |

| Warehousing, logistics, industrial, business park, manufacturing and big box retail | 150 | 350 | 6,0 | 9,5 | |

| Unique clusters of opportunity | 4 | 200 | 4,0 | 7,5 | |

Good progress is being made towards achieving these five-year sales outcomes, with some 635 developable hectares currently at a stage where commercial negotiations and sales processes have commenced or are about to commence. These are provided in the following table. Each tabulated item is described in detail and in a standardised format in the portfolio document, giving details of the land location and extent, current status, as well as, a description of the opportunity, land use and commercial process being pursued.

LAND WHERE COMMERCIAL NEGOTIATIONS HAVE COMMENCED OR ARE ABOUT TO COMMENCE

| AREA | Dev Hectares |

Primary Demand Drivers | |

| DURBAN TO BALLITO | URBAN GROWTH AND CONSOLIDATION - UMHLANGA REGION | 406 | |

| Ridgeside Remaining Precinct 1 and 2 | 42 | High-intensity urban mixed use, high-end residential, hotels, hospitality and other tourism | |

| Umhlanga Ridge Town Centre - Commercial | 1 | High-intensity urban mixed use, prime mid-market to high-end residential, city hotels with residences, premium grade corporate offices | |

| Izinga/Kindlewood | 36 | High-end residential and residential amenities | |

| Umhlanga Ridge Town Centre Western Expansion - Cornubia | 49 | High-intensity urban mixed use, prime mid-market housing, premium and A-grade offices and business process outsourcing facilities, city hotels | |

| Cornubia N2 Business Park | 2 | Warehousing, logistics, industrial, business park, manufacturing, big box retail and offices | |

| Umhlanga Hills (Cornubia) | 43 | Affordable to mid-market, medium to high-density residential, with associated residential services | |

| Marshall Dam Residential (Cornubia) | 12 | Affordable to mid-market, medium to high-density residential | |

| Cornubia Integrated Residential | 14 | Affordable to mid-market, medium to high-density residential, with associated residential services | |

| Cornubia Industrial | 7 | Warehousing, logistics, industrial, business park and manufacturing | |

| Cornubia North Integrated Residential | 200 | Government subsidised, affordable, medium to high-density residential, with associated residential services | |

| COASTAL / LIFESTYLE / LEISURE / HIGH END RESIDENTIAL | 97 | ||

| Zimbali Lakes | 48 | Coastal property, high-end residential, resort and retirement, with possible unique clusters of opportunity | |

| Sibaya Node 1 | 49 | High-end residential, city hotel and residences, resort, high-intensity urban mixed use, with possible unique clusters of opportunity | |

| AIRPORT REGION BUSINESS AND RESIDENTIAL | 122 | ||

| uShukela Drive | 49 | Warehousing, logistics, industrial, business park, manufacturing and warehouse retail, with possible unique clusters of airport-related opportunity | |

| Compensation (East) | 73 | Warehousing, logistics, industrial, business park, manufacturing and warehouse retail, with possible unique clusters of opportunity | |

| REMAINING SITES ON NEARLY COMPLETED DEVELOPMENTS | 10 | ||

| Bridge City | 10 | High-intensity urban mixed use incorporating retail, offices and housing | |

| TOTAL | 635 | ||

SOCIO-ECONOMIC POSITIONING

TONGAAT HULETT’S ONGOING PARTNERSHIPS

WITH RURAL COMMUNITIES, THROUGH ITS

CANE EXPANSION INITIATIVES, RESULTED IN

R835 MILLION BEING PAID TO INDIGENOUS

FARMERS IN MOZAMBIQUE AND ZIMBABWE.

IN SOUTH AFRICA, THE BUSINESS IS CURRENTLY

WORKING IN NUMEROUS TRADITIONAL AUTHORITY

AREAS TO DEVELOP SMALL-SCALE AND LAND

REFORM FARMERS

- In Mozambique, the number of small-scale indigenous farmers has grown from 249 in the 2007/08 season to 2 018 in 2014/15. During this time, sugarcane received from these farmers has grown from 45 528 tons to 414 820 tons. As a consequence of this growth, some R61 million was paid to small-scale farmers in the 2014/15 season.

- Tongaat Hulett is actively involved in 21 Traditional Authority areas in South Africa through various agricultural and socio-economic development initiatives. Standout examples illustrating the development impact of these programmes are the Mbongolwane, Mvuzane, Vuma and Kholweni Traditional Authorities. Over a four-year period, Tongaat Hulett has contributed to the transformation of the agricultural sectors of these communities. By the end of the 2015/16 season, approximately 4 600 hectares of new sugarcane will be developed for eight primary cooperatives, through the innovative Simamisa model. Upon completion, a total investment of R132,6 million in sugarcane development (funded by Tongaat Hulett and the Jobs Fund) would have been made, and will result in the annual employment of 1 000 individuals and approximately 185 000 tons of additional sugarcane production.

- In Zimbabwe, Tongaat Hulett, together with the government and local communities, continues to work on the orderly development of sustainable indigenous private farmers in the south-eastern Lowveld. During 2014/15, R774 million was paid to indigenous private farmers who have been supported and developed through the SUSCO project. Going forward, the business together with government and local communities, is working towards the development of a further 3 390 hectares.

- The starch operation is the third largest purchaser of maize in South Africa, and therefore is well positioned to influence and play a leading role in the transformation of the maize industry, as well as increasing the supply of maize in southern Africa.

DEVELOPING AND IMPLEMENTING A PORTFOLIO OF LAND AND PROPERTY DEVELOPMENT APPROACHES THAT IS ACCELERATING THE ECONOMIC AND SOCIAL DEVELOPMENT OF KWAZULU-NATAL

- Tongaat Hulett’s collaboration with numerous government, business and society groupings in converting agricultural land to optimum urban and tourism uses in KwaZulu-Natal is contributing to intensive and integrated urban development. This leads to increased investment, infrastructure, welllocated and serviced housing and job creation in the key growth corridors north and west of Durban and on the coast north of Ballito.

- Ongoing progress in increasing the supply of zoned and serviced land to accommodate investment demand is enabling Tongaat Hulett to work with a wide range of stakeholders to develop promising market segments, underpinned by a range of demand drivers.

- Tongaat Hulett has identified a number of demand drivers for the accelerated conversion of its portfolio of agricultural land to urban and tourism uses. Such land conversion is a critical aspect of Tongaat Hulett’s strategy of creating viable rural areas in KwaZulu-Natal through cane and rural development, while proactively converting agricultural land to other uses when appropriate to accommodate accelerating urbanisation and economic development.

- Two key demand drivers identified are affordable and government-subsidised housing. Building on the successful collaboration and growing momentum in Cornubia, Tongaat Hulett has identified a further 930 developable hectares, which have the potential to yield over 90 000 housing units. This will contribute significantly towards addressing the current backlog of over 400 000 housing units in eThekwini Municipality required to accommodate low-income households (roughly defined as those having a monthly household income of under R7 500). Government at all levels has identified this as a key priority and is the primary implementing agent for the accelerated delivery of housing to address this market. It is likely that sales in these areas could be large and take place before the land is shovel ready. In addition to this market, there is a substantial backlog and increasing demand for affordable housing to accommodate households with a monthly household income of between R7 500 and R20 000. Servicing this market requires well located land close to job opportunities and public transport and appropriately high densities. Over time, this could require more than 1 000 developable hectares at a take-up rate of up to 60 hectares per annum.

- Tongaat Hulett is proactively seeking to address this market using its unique ability to bring suitable land to the market at scale, combined with appropriate collaboration with a number of role-players, including government (particularly local government), large developers, employers and financial institutions.

2007 BEE TRANSACTION

As part of the company’s Broad-Based Black Economic Empowerment deal in 2007, the Ayavuna and Sangena consortiums (rural communities via the Masithuthukisane and Mphakhathi trusts) and company employees (via the ESOP and MSOP trusts), obtained voting and shareholder rights in Tongaat Hulett (see here for further information).

STRIVING TOWARDS ESTABLISHING AN ORGANISATIONAL SAFETY CULTURE WITH A ‘ZERO HARM’ APPROACH AND VALUES THE HEALTH OF ITS PEOPLE, WHILE LIMITING HARM TO THE ENVIRONMENT

The safety and the welfare of all employees, which amounts to some 34 000 people during the peak milling period, remains a key priority as the business strives towards establishing an organisational culture with a ‘zero harm’ approach. Tongaat Hulett achieved a Lost Time Injury Frequency Rate (LTIFR) of 0,085 per 200 000 hours worked in 2014/15. This was the company’s best safety performance since the formal introduction of SHE management systems. Improvements in this area have been driven by the following key factors:

- Tongaat Hulett has a mature safety management system that provides for a sophisticated risk management programme.

- Proactive and reactive interventions entail comprehensive auditing and incident review processes respectively.

- An organisational SHE culture is built around the concept of promoting care amongst employees who are encouraged to look out for each other. This is supported by a management team that demonstrates visible felt leadership.

- A comprehensive safety training program at all levels of the organisation is in place and safety awareness campaigns are extended to members of the surrounding communities in the spirit of influencing safe behaviour beyond the workplace.

- Contractor management controls were stepped up to ensure that safety standards are aligned and adhered to.

The ongoing progress in the area of safety was further demonstrated by the Xinavane and Triangle operations which exceeded 26 million and 22 million Lost Time Injury (LTI) free hours respectively.

Regrettably, one employee and one contractor employee lost their lives, in two separate incidents. Fortune Mufudze, an employee from Hippo Valley was killed while cleaning a sugar spillage along a conveyor belt and Hopewell Mahlanze, a service provider employee, was fatally injured after falling froma platform at the Amatikulu mill.

Tongaat Hulett has malaria control programmes in place at all of the operations where this is required. During the 2014/15 year, the actions underway in the Mozambique operations contributed to a 23 percent reduction in the number of malaria cases reported.

Tongaat Hulett continued to make progress in the area of its environmental reporting and, currently, 17 out of the business’s 19 operations are certified to the ISO 14001 environmental management system with the remaining two being at an advanced stage of implementation.

SOCIAL SUSTAINABILITY AND INNOVATION

- Social sustainability and innovation are fundamental to the business as Tongaat Hulett seeks demonstrable and practical outcomes to achieve positive social transformation, environmental stewardship and community upliftment.

- Tongaat Hulett continues to embrace good corporate governance by adhering to legal and accepted business practices as embodied in the principles of King III. The company continues to uphold the principles of corporate social responsibility by demonstrating its commitment to philanthropic and empowerment initiatives within the communities in which it operates.

- Tongaat Hulett has a substantial land footprint with some 120 000 hectares of private land under maize supplying the four starch operations. In Mozambique, South Africa, Swaziland and Zimbabwe, more than 190 000 hectares of land supply cane to the business’s eight sugar mills. It is within this context that the company subscribes to principles of sustainable development.

- The business’s participation in various sustainability reporting initiatives, including the Carbon Disclosure Project (CDP), the CDP Water Disclosure Project, the Nedbank BGreen Exchange traded Fund and its inclusion in the JSE’s Social Responsibility Investment (SRI) index for the eleventh consecutive year are testimony to Tongaat Hulett’s approach to sustainable value creation for stakeholders.

SUMMARY OF EXPECTATIONS FROM KEY FOCUS AREAS

FINANCIAL AND OPERATIONS REVIEW FOR THE YEAR ENDED 31 MARCH 2015

| Financial capital | |||

| R16,155 BILLION |

REVENUE +2,8% (2014: R15,716 BILLION) |

||

| R2,089 BILLION |

OPERATING

PROFIT -12,0% (2014: R2,374 BILLION) |

||

| R2,533 BILLION |

CASH FLOW

FROM OPERATIONS +16,6% (2014: R2,173 BILLION) |

||

| R2,533 MILLION |

LAND CONVERSION

PROFIT FROM 108 DEVELOPABLE HECTARES |

||

| 1,314 MILLION TONS |

SUGAR

PRODUCTION 31% GROWTH OVER THE PAST 4 YEARS |

||

| R561 MILLION |

STARCH

OPERATING PROFIT GREW BY 16,4% |

||

| R945 MILLION |

HEADLINE

EARNINGS -14,6% (2014: R1,106 BILLION) |

||

| 380 CENTS PER SHARE |

ANNUAL DIVIDEND +5,6% (2014: 360 CENTS PER SHARE) |

Sales volumes included the sale of sugar from previous season stocks in Zimbabwe. Revenue in Mozambique and Zimbabwe was impacted by a further substantial reduction in prices (4,7 US cents per pound, with a total impact of some R390 million) for exports into the EU. World sugar prices declined further, with global stock levels having increased following favourable weather conditions in many sugar production regions of the world. The overall cane valuation impact in the income statement was a positive R96 million this year (driven mainly by the increased areas under cane and new/ replanting of roots), compared to a negative R153 million last year (when there was a large negative impact of sugar price reductions). Tongaat Hulett’s sugar production for the year totalled 1,314 million tons compared to 1,424 million tons in the prior year.

The South African sugar operations, including the agriculture, milling, refining and various downstream activities, recorded operating profit of R261 million (2014: R340 million). These operations, which previously increased sugar production substantially to 634 000 tons, saw sugar production this season reduce to 541 000 tons due to low rainfall in KwaZulu-Natal. The impact of the dry conditions has been partially mitigated by 11 554 hectares of new cane developments that were harvested for the first time this year. Local sales were below prior years, with various pressures in the market. Cost reduction actions have limited the cost of goods, services, transport, marketing, salaries and wages to an increase of 4 percent this year.

The Zimbabwe sugar operations’ operating profit for the year amounted to R386 million (US$35 million) compared to the R330 million (US$33 million) last year. Local market sales volumes recovered significantly, with improved local market protection (tariffs and import licences) implemented earlier in the year and progress being made with distribution and marketing initiatives. The local market remains suppressed by the macro-economic conditions. Sugar production for the year was 445 000 tons (2014: 488 000 tons) as a consequence of no cane being diverted from the independent ethanol plant at Chisumbanje (39 000 tons sugar equivalent in the prior year) and after experiencing the impact of low dam levels for irrigation at the end of 2013, which only recovered in early 2014. The conversion of US dollar profits into Rands on consolidation was positively impacted by exchange rate movements. The cost of bought-in goods and services, salaries and wages was US$11 million lower than the prior year and US$51 million lower than two years ago, after absorbing input price, salary and wage increases.

The Mozambique sugar operations recorded operating profit of R130 million (2014: R168 million). Sugar production for the year increased to 271 000 tons (2014: 249 000 tons). The local market was significantly impacted by additional imports and this necessitated increased exports by local producers at lower prices, with a negative R77 million profit impact on Tongaat Hulett. The cost of goods and services, salaries and wages was lower than two years ago by an amount of Mt165 million, which was the Rand equivalent of some R58 million, after absorbing price increases and substantial salary and wage increases. Sugar production has grown by 15 percent over the same period.

The Swaziland sugar operations reported operating profit of R29 million (2014: R70 million) as a result of the lower sucrose price as a consequence of a reduction in export prices into the EU. The Swaziland estates produced the raw sugar equivalent of 57 000 tons (2014: 53 000 tons).

Domestic sales volumes grew by 4 percent, with increases in the coffee/creamer, confectionary and paper making sectors. Working together with customers, success has been achieved in increasing sales of products where demand is growing (locally and exporting into the rest of Africa) and recovering local market from imports. Starch and glucose processing margins were in line with the prior year.

Sales came largely from Cornubia (industrial, business and retail) with an average profit of R8,2 million per developable hectare and Izinga/Kindlewood with an average profit of R6,3 million per developable hectare. Profit in Umhlanga Ridge Town Centre exceeded R25 million per developable hectare. The momentum on larger land sales has continued, with a single sale of 19 developable hectares in Izinga and a sale of 27 developable hectares in a new area of Cornubia. The sale of 42 developable hectares of highly valued land in Umhlanga Ridgeside, precincts 1 and 2, which was previously expected to be finalised by the end of March 2015, was not concluded in this financial year. Negotiations with four parties are at various stages, aimed towards reaching an imminent conclusion. The development proposals received for Ridgeside are confirming the value that has previously been attributed to the land.

Total net profit before the deduction of minority interests was R1,047 billion (2014: R1,227 billion) and headline earnings attributable to Tongaat Hulett shareholders amounted to R945 million compared to R1,106 billion last year.

LOOKING AHEAD

Tongaat Hulett has substantially enhanced its strategic positioning over the past few years and expects to continue to do so, focusing on multiple strategic thrusts, all with a positive impact on earnings and cash flow.

MORE FAVOURABLE SUGAR MARKETS IN COMING YEARS

The sustainability of farmers in the sugar industry throughout many parts of the world is under significant pressure at the low current world price and taking into account the substantial input cost increases over the past decade. This, together with possible variable weather conditions, is likely to exert downward pressure on global sugar production levels. Global sugar consumption is predicted to continue to grow at a rate of some 2 percent per annum, with most of this growth coming from low per capita consumption developing countries. There are predictions for sugar demand growth in southern and eastern Africa of some 30 percent over the next six years. The current surplus global stock levels have also been putting pressure on local and regional prices, as well as the EU market, amplified by the EU market reforms. Tongaat Hulett is steadily shifting export sales from the EU to regional deficit markets. Attention is focused on capturing and growing local market sales. In South Africa, the reference price used to calculate import duty levels does not yet fully provide adequate and appropriate protection for this socio-economically important rural industry. In Mozambique, the imminent substantial increase in the reference price should provide such assistance.

FURTHER COST REDUCTIONS

The sustainable cost reductions achieved over the past two years, while having to absorb input price increases, provide a good base for the next steps in the concerted cost reduction process in the sugar operations. Unit costs of sugar production will benefit substantially from growth in volumes and better yields, as milling costs and many of the agricultural costs per hectare are mostly fixed. The marginal cost of additional sugar production from existing hectares under cane is typically 4 to 6 US cents per pound.

GROWING SUGAR PRODUCTION

The crop size in the coming season in South Africa is uncertain and is likely to be at the lowest level for many years, while Zimbabwe and Mozambique are likely to show modest growth in sugar production.

Good progress continues to be made in growing the number of hectares under cane and it is expected that, by 2018/19, an additional 22 800 hectares will be harvested, of which 9 074 hectares have already been planted. Agricultural improvement programs aimed at improving yields and sucrose content are proceeding well. Tongaat Hulett has more than 2,1 million tons of sugar milling capacity. Sugar production is targeted to grow from the 1,314 million tons in 2014/15 to some 1,821 million tons in 2018/19, under normal weather conditions. Of this growth, 37 percent is expected to come from a return to normal weather conditions, 30 percent from additional hectares under cane and 33 percent from yield and sugar extraction improvements.

CREATING VALUE FOR ALL STAKEHOLDERS

Tongaat Hulett continues to focus on value creation for all stakeholders through an all-inclusive approach to growth and development. In KwaZulu-Natal, there are established collaborations with provincial and local authorities in the inextricably linked areas of sugar and cane activities, the development of urban areas (including Cornubia) and maximising the future benefit of renewable energy. The planting of 28 687 hectares in the past four years has created some 7 175 direct jobs in rural areas and the 12 000 hectare project currently underway for cane development and job creation in rural KwaZulu-Natal includes a Jobs Fund grant for R150 million allocated over some three years, with the first R50 million already received. In Zimbabwe, Tongaat Hulett, the government and local communities are working together on socio-economic initiatives in the south-eastern Lowveld region of the country. One of the key focus areas remains the on-going orderly development of sustainable private sugarcane farmers and, at the end of the 2014/15 season, some 857 active indigenous private farmers, farming some 15 880 hectares, employing more than 7 300 people, generated US$70 million in annual revenue. Current initiatives should increase this, by the 2017/18 season, to some 1 023 private farmers supplying more than 1 900 000 tons of cane harvested from 19 270 farmed hectares, with further job creation in rural communities. In Mozambique, 415 000 tons of cane were delivered from 4 370 hectares in the 2014/15 season, supporting 2 018 indigenous private farmers.

GROWING SUGAR PRODUCTION

The starch and glucose operation, which is the only wetmiller in sub-Saharan Africa, is well positioned strategically, focused on growing its sales volume, with an enhanced product mix and customer growth prospects into Africa. This is underpinned by improving use of its available capacity and the efficiency of its operations. Dry weather conditions in the new season have resulted in maize prices trading above international levels and the starch operations current exposure to these higher prices comprises approximately 15 percent of the coming year’s maize requirements.

MOMENTUM IN LAND DEVELOPMENT

The momentum in unlocking value and cash flow from land conversion and development continues, with a portfolio of 8 091 developable hectares in KwaZulu-Natal ultimately earmarked for development. The value achieved per hectare of land sold is increasingly reflecting the steadily improving land conversion platform and varies based on usage and location. A progressively larger area is benefitting from planning activities and infrastructural investment at key points. Tongaat Hulett continues to work together with government, related organisations and key stakeholders in the property industry to capture the synergy of each other’s unique capabilities and to maximise value for all stakeholders. This has a positive impact on economic development, ranging from industrial and commercial to tourism and all levels of residential development and the affordable housing backlog, in the Durban/northern KwaZulu-Natal area and complements the simultaneous rural development taking place around new agricultural cane developments. Over the next five years, sales are expected to come primarily out of 3 801 developable hectares in key focus areas comprising the urban expansion north of Durban in the Umhlanga and Cornubia areas, coastal lifestyle areas of Zimbali and Sibaya, business and residential development around the airport, coastal development north of Ballito in Tinley Manor and in the Ntshongweni area west of Durban.

FINANCIAL PROSPECTS FOR THE YEAR AHEAD

The financial results for the year ahead will be influenced by a number of varying dynamics, the magnitude and impact of which are difficult to predict at this stage. It is likely that the sugar operations will remain under pressure, particularly in South Africa. Land development could have a record year. Starch volumes, mix, cost and exchange rate dynamics are likely to counter maize prices being closer to import parity.

ACKNOWLEDGEMENTS AND CONCLUSION

Tongaat Hulett’s 27 sites in Botswana, Namibia, Mozambique, South Africa, Swaziland, and Zimbabwe have benefitted from the ongoing commitment, loyalty and energy that the company’s more than 34 000 employees give on a daily basis. It is a privilege to lead an organisation that has, over many years, attracted and retained high-caliber people who continue to work towards the achievement of the business’s strategic objectives. The business is committed to equipping and developing the talent in its emerging leaders for the future benefit of the organisation.

The company’s profile as an agricultural and agri-processing business contributes to its significant footprint in the rural communities that surround its operations. Tongaat Hulett is committed to working together with small-scale and commercial private farmers, rural communities and governments to grow its contribution to job creation, rural development and an inclusive economy, thereby creating sustainable value for its stakeholders.

The business values the support that it has received from its shareholders and regularly updates the investment community as it progresses delivery on its business objectives.

Our appreciation is extended to Adriano Maleiane who resigned after six years as a director of the company, following his appointment as the Minister of Economy and Finance in Mozambique. I paid tribute to our previous Chairman, JB Magwaza in the 2014 integrated annual report, in advance of his retirement in July 2014. We once again thank him for his highly appreciated and valued contribution. Tongaat Hulett is in the fortunate position that it has a new Chairman of the quality and calibre of Bahle Sibisi, whose insight on a number of strategic matters is an invaluable contribution to the business. The ongoing support and guidance that we have received from the Board is highly valued.

![]()

Peter Staude

Chief Executive Officer

Amanzimnyama

Tongaat, KwaZulu-Natal

21 May 2015