CHIEF EXECUTIVE'S REVIEW

Tongaat Hulett’s financial results were adversely affected by various dynamics that contributed to the company reporting only its fifth highest operating profit performance in the past 15 years. The business continues to focus on its strategic opportunities and there has been good progress in working towards the achievement of key goals.

In the past year the sugar operations were impacted by the dynamics of imports into the South African market, low international sugar prices and the impact of stronger local currencies on export realisations. Sugar production reflected a partial recovery from the drought conditions of the previous two seasons.

The starch and glucose operation benefitted from more competitive maize costs in the second half of the year and the period saw higher sales volumes arising from the initiative to replace customers’ imported volumes with local production, new business development and growth in export markets.

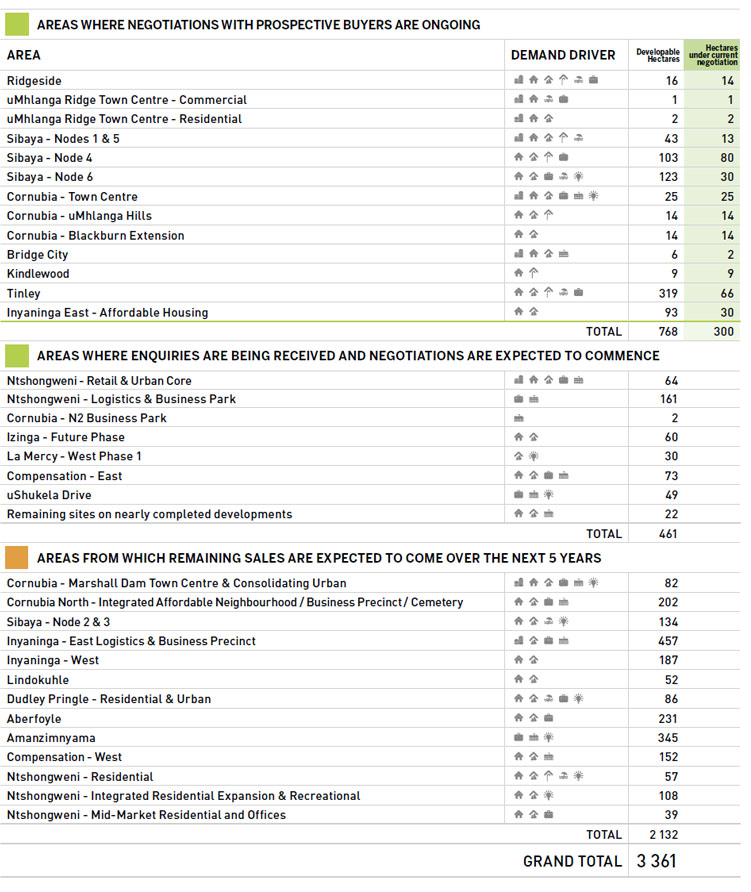

Land conversion and development activities resulted in the business now having some 47 percent (6 percent in 2012) of the land portfolio which has been formally released from agriculture.Environmental approvals were received for specified market-aligned developments on 1 485 developable hectares and 185 developable hectares of shovel-ready land is now available. Expectations are that over the next five years some 600 to 1 100 developable hectares will be sold.

STARCH AND GLUCOSE

IMPROVED MAIZE OUTLOOK AND CONSOLIDATION OF VOLUME GROWTH

The starch and glucose operation is focused on growing its sales volumes and margins by continuing to replace imports with local production, by enhancing its product mix through new business development and by targeting selected export markets. Sales into Sub-Saharan Africa and other regional markets are accelerating from a low base.

Tongaat Hulett’s starch operation currently has about 15 percent of its installed up-stream wet-milling capacity available after servicing existing markets. The operation has a well-developed source of raw materials, a strong South African domestic market presence and access to regional markets. The ongoing focus on operating efficiencies and cost reduction will continue to contribute to profitability.

During the 2017/18 financial year, Tongaat Hulett made good progress in realising the benefits of previous investments undertaken to expand capacity for the coffee creamer sector along with upgrades to key production channels that have improved production capabilities and flexibility. Growth in the domestic market amounted to 5,7 percent and combined with export growth of 21 percent has seen the starch operation achieve a record level of starch and glucose sales of 515 000 tons.

Sales from the import replacement project resulted in some 11 000 tons of imports being replaced with locally manufactured product. In the paper making sector, the work conducted with customers to change the customer raw material mix, combined with the recommissioning of production lines led to a growth in this sector of some 6 500 tons, most of which occurred in the second half of the year. In the coffee creamer sector, demand rebounded as lower price points, supported by the lower maize price, and customer marketing initiatives saw the sector grow by 12 percent.

Looking ahead, investments to expand and optimise the powdered glucose manufacturing facilities are expected to be made during the first quarter of the financial year and will support growth anticipated in powdered glucose sales. Strong growth is expected in the paper making sector, benefiting from the success in the second half of the prior year. Growth in modified starches, with an expanded range of products that support the food industry, is expected to exceed 10 percent.

Overall, local market sales growth is expected to be moderate compared to the prior year, with the impact of muted domestic consumer demand being offset by ongoing benefits from the import replacement project and from new business volumes being in place for the full year. Good progress continues to be made in growing exports to regional African markets, with volume growth of more than 15 percent being achieved during the year. Exports to regional markets now account for more than half of current export volumes and have led to an improved market mix of export sales.

Following the previous year’s record South African maize crop of 16,8 million tons, carry in stocks of some 4 million tons were in place at the beginning of the current season. Despite lower maize prices leading to a decrease in planting area in the current season, reasonable weather conditions experienced during the summer growing season are forecast to yield a crop of 12,8 million tons. Total maize supply is expected to be sufficient and maize prices should remain competitive, close to export parity levels, supporting improved margins.

SUGAR

INCREASING RETURNS BY GROWING SUGAR PRODUCTION FROM AVAILABLE MILLING CAPACITY THROUGH CANE SUPPLY INITIATIVES, REDUCING THE UNIT COST OF PRODUCTION AND DEVELOPING KEY MARKETS AND PRODUCTS

Governments are generally supportive of protecting their domestic sugar markets from imports due to its high rural jobs impact and the economic contribution that the sugar industry makes. For the domestic markets in Zimbabwe and Mozambique, the operations benefitted from the protection measures currently in place and the prospects for substantially improving protection levels of the South African domestic sugar market are good.

Tongaat Hulett continues to maintain a strong market share and brand presence in the domestic markets in the countries where it produces sugar. The sugar industry is a significant contributor to the economy in each of these countries. In South Africa alone, the sugar industry contributes some R14 billion to the economy, directly employs an estimated 85 000 people and supports some one million rural livelihoods.

Import protection in South Africa remains the lowest in the region, with import duties calculated using a US dollar-based reference price of US$566 per ton (25,6 US c/lb). By comparison, the reference price to calculate the import duties in Mozambique is US$806 per ton (36,6 US c/lb) for raw sugar and US$932 per ton (42,3 c/lb) for refined sugar. In Zimbabwe, protection of the local market is through a restricted import permit system and an import duty of US$100 per ton plus 10 percent of the value imported.

In South Africa, over several months, upward revisions to the import duty were not implemented timeously, followed by a period when zero duty was erroneously applied. As a result, some 520 000 tons of imported sugar entered South Africa and eroded local sales volumes by a third. The South African Sugar Association applied for an increase in the US dollar-based reference price, used in the calculation of the duties, to US$856 per ton (38,8 US c/lb). The application was published in the Government Gazette on 11 May 2018. Comments from interested parties closed on 31 May 2018 and a decision is expected during 2018. The Department of Economic Development has supported the application to increase the duty. The industry recently took significant steps towards the creation of a more transformed and sustainable sugar association. These measures included adopting changes to industry structures to accommodate the South African Farmers Development Association (SAFDA), a new grower grouping that provides small-scale and emerging growers with improved representation within the industry. In addition, the industry has committed to provide further support to small-scale growers and expand community sugarcane farming in rural areas. Higher duty protection will assist in rebuilding margins of both growers and millers.

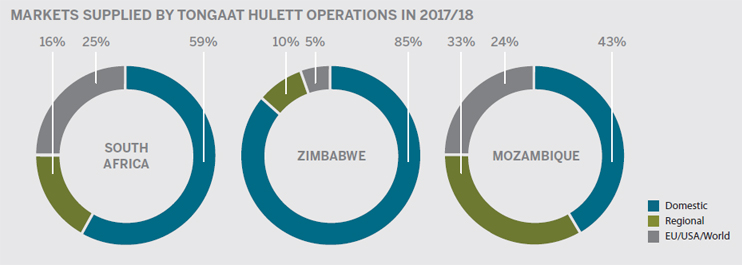

In 2017/18, sales into domestic markets represented 65 percent of Tongaat Hulett’s total sugar production. Domestic market sales in 2018/19 are expected to benefit from an increase in sugar consumption per capita, supported by population and economic growth. In Zimbabwe, sugar consumption of 22kg per capita per annum is lower than historical levels, having been impacted by affordability and availability constraints in rural areas. The prospect of an economic recovery in Zimbabwe after the major transition in leadership, is expected to translate into a further growth in domestic demand, particularly in the industrial sugar market. Sugar consumption in Mozambique is a low 9kg per capita per annum. An increase in consumption in Mozambique to 20kg per capita per annum represents an increase in local market sales of some 275 000 tons.

Sugar consumption per capita in South Africa has remained stable at 33kg per annum and the introduction of the Health Promotion Levy, the tax on sugar-sweetened beverages, is unlikely to reduce consumption significantly. Beverage manufacturers have reformulated certain products to reduce sugar content and reduced sales to these industrial customers is expected to be mitigated by population growth.

Tongaat Hulett remains focused on various initiatives to improve domestic market penetration and product availability, including:

- the ongoing development of its leading Huletts®, Huletts SunSweet®, Blue Crystal® and Marathon® sugar brands;

- improving access to sugar by reviewing pack sizes to match affordability, while maintaining economic recoveries;

- expanding the distribution network to match population demographics and tackling challenges with respect to logistical access into rural areas; and

- streamlining logistics at the mills to respond to peak demands, with an emphasis on packing capacity and dispatch.

CHANGING WORLD TRADE DYNAMICS AND ITS POSITIVE IMPACTS ON REGIONAL SUGAR MOVEMENTS

Global international trading relationships are experiencing an unprecedented level of change and uncertainty, not seen since the end of World War II, where nationalism is tending to replace the globalisation that the World Trade Organisation (WTO) sought to entrench. The global trading regime envisaged in the General Agreement on Tariffs and Trade (GATT) and WTO is struggling to make progress on key fronts that have been stalled now for more than 20 years, particularly in the area of trade liberalisation in key agricultural commodities. The suppressed world market price for sugar continues to reflect the impact of the multiple trading regimes and government interventions that persist within the sugar sector.

The EU continues to pay more than €400 million per year to sustain 3 to 4 million tons of white sugar production annually that would otherwise not arise. Longstanding international trade arrangements in multiple global regions are being renegotiated, reviewed or called into question. The intended goal of a global multilateral trade system is increasingly being supplanted by bilateral and plurilateral trade arrangements, presenting both opportunities and threats.

Africa has for long had multiple, overlapping regional trade blocs, with some progress towards unifying SADC, Common Market for Eastern and Southern Africa (COMESA) and East African Community (EAC) into a tri-partite free trade area. Limited access to higher value markets in first world countries for agricultural goods has hampered rural development in the region, and in some cases local agricultural production is overwhelmed by imported products. Increasingly Africa’s countries are looking to expand trade amongst themselves to replace imported agricultural goods with African agricultural goods. Recent developments around imports of world market sugar in Kenya and Tanzania confirmed this growing trend of the move towards regionalisation of trade.

The African Continental Free Trade Area was launched by Africa’s heads of states in Kigali, Rwanda on 21 March 2018 and represents the first step on a long journey with the ultimate goal for unconstrained trade in goods across the African continent. The demise of high values for sugar in the EU is leading to a clamour by Southern and East African sugar producing countries with large export surpluses that were formerly delivered to the EU to call into question the current SADC and other sugar trade arrangements. South African Customs Union (SACU) being the single biggest sugar demand market in Sub-Saharan Africa is looking to gain better and preferred access to regional deficit markets.

The changing landscape in global and regional trade relations and dynamics holds both opportunity and risk for Tongaat Hulett and its stakeholders. Tongaat Hulett has been engaging for some time on a bilateral basis in the region to be recognised as a key developmental partner in agriculture and agri-processing, with significant progress already made to this end in Angola. Entrenching the Huletts® brand in the region by exporting branded sugar, Tongaat Hulett will be focusing resources to engage in this strategic opportunity. The objective is to shape the conversation and outcomes, and in so doing, will look to leverage both its extensive experience in agriculture and its current exports to the region’s deficit markets to achieve a better outcome for agriculture in the destination markets and for its exports.

BUILDING ON THE RECENTLY ESTABLISHED PLATFORM IN MOZAMBIQUE TO SUBSTANTIALLY INCREASE PERFORMANCE AND PROFITABILITY OF THE OPERATION

The investment in a 90 000-ton sugar refinery at the Xinavane operation will deliver a step change improvement to the sales mix in Mozambique, as sugar, previously sold into world price related markets, will now be redirected to the local market. Presently, demand for refined sugar in Mozambique exceeds the limited existing production capacity with the shortfall being imported into the country. In addition to replacing imported sugar, the refinery will satisfy the country’s growing industrial demand, particularly in light of the recent and planned expansion of capacity by industrial users of sugar. Tongaat Hulett’s capital investment of R550 million in the refinery builds on the investments the company has made over a period of 20 years, which in money of today amounts to some R5,5 billion for the Xinavane operation. The current replacement value of Xinavane is now some R10 billion and the operation is recognised as the premier sugar manufacturing asset in Mozambique. The business is well placed to leverage off this established asset base supported by growth in the domestic sugar consumption in a country with a population of some 28,8 million people and one of the lowest per capita consumption levels in the world.

The refinery at Xinavane is well located in relation to Maputo’s concentration of industrial customers. The refinery is on target for commissioning in September 2018 and the project is within budget. The 2018/19 financial year will benefit from three months of refined sugar production, with the full year benefit being realised from 2019/20.

FLEXIBILITY TO ADJUST EXPORT DESTINATIONS AND MARKET POSITIONS TO ACHIEVE BEST POSSIBLE PRICES IN RESPONSE TO GLOBAL SUGAR TRADE AND MARKET DYNAMICS

The positive socio-economic impact of sugarcane and sugar beet in a rural context, is well documented and understood. It is accentuated by the high positive rural job impact of sustainable agricultural activity, with attendant benefits of ameliorating the consequences of unplanned urbanisation, meaning that the businesses priority remains to first supply increasing demand in its countries of operation before considering other markets. The current market mix for exports continues to move to a greater emphasis on regional deficit markets where premiums of between R500 and R1 000 per ton are currently being achieved as compared to exporting to markets where prices reflect the value of world futures markets.

Tongaat Hulett’s sugar production is projected to increase by between 280 000 tons and 430 000 tons by the 2019/20 season. The company’s exposure to the world market outside the African regional market is expected to decline over the period from around 18 percent to 10 percent of total sales volumes partially driven by sugar imported into South Africa and Mozambique being substituted by locally produced sugar, the former driven by expected changes in the level of import protection in SACU, and the latter by the completion of the refinery at Xinavane in Mozambique.

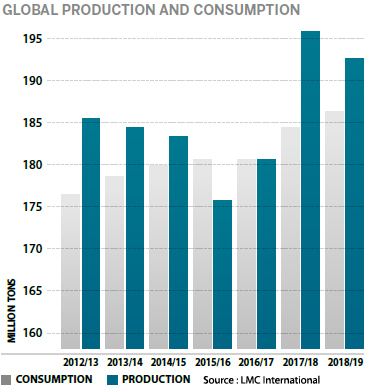

Globally, annual demand for sugar continues to rise. Current growth is around 1,5 percent per annum, equal to some 2,6 million tons of additional demand per year, with growth in both Africa and Asia continuing to exceed population growth. Growth in global consumption is primarily driven by increasing demand in developing countries, which historically have a low per capita consumption rate because of limited availability, affordability and distribution capability.

The price of raw sugar in the world market came under pressure in the 12 months to March 2017 because of the prospects of a global production surplus in the 2017/18 year (October - September). The price has continued to show weakness. In the 12 months to March 2018 prompt prices traded in a range of some 12,2 US c/lb to 16,8 US c/lb. Of late, prompt prices have been trading in the range of 10,8 US c/lb to 13 US c/lb.

In the coming year, the price of raw sugar is currently expected to trade in a broad range of 8 US c/lb to 17 US c/lb, impacted by supply prospects over the coming 12 months in the major sugar producing countries. The reaction of farmers to the lower prices is impacted by multiple factors including the value of alternative crops, the extent of subsidies in the value chain and the reinvestment in sugarcane roots. Weather will continue to exert an important influence on agricultural outcomes.

The sugar/ethanol mix in Brazil is expected to continue to impact increasingly on world sugar prices. The Brazilian government has recently announced initiatives to increase the production of ethanol from sugarcane.

At current pricing levels the probability of supply growth through sizeable investments in sugarcane growing and milling assets being triggered is remote.

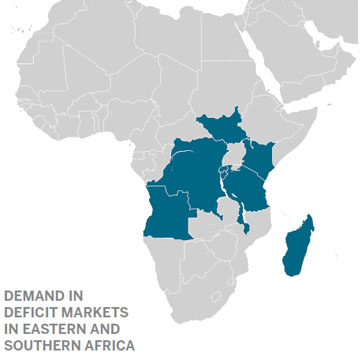

GROWING A REGIONAL PRESENCE THROUGH COOPERATION AND DEVELOPMENTAL PARTNER REPUTATION

Tongaat Hulett is increasing its presence in a number of countries in the region where sugar deficits exist. The sugar deficit in these countries currently totals some 1,6 million tons, with a large portion supplied from outside the continent. Sugar consumption per capita in these countries averages 10 kg per annum (Brazil: 53 kg, South Africa: 33 kg) which, combined with higher population and economic growth rates, is conducive to a growing demand. This total deficit is anticipated to exceed 2 million tons by 2020. Regional trade preferences and agreements are gathering momentum. In the region, Tongaat Hulett already realises a premium over world market prices, supported by high-quality products and services, and where possible, by leveraging its sugar brands. The Huletts® Refined and Huletts SunSweet® sugar brands are already available in targeted markets, such as Kenya.

The Sub-Saharan Africa region has a particular position in the sugar market today as it holds the greatest potential for sugar consumption growth of any global region, with below-average per capita consumption and above average population growth. It has abundant resource for the expansion of agricultural production, in general, and sugar production in particular. It also has potential for diversification into biofuels, electricity generation and cooking fuels. There have been government initiatives, including support from international bodies and the EU, that have resulted in development growth for national sugar industries in a few countries. The industry in Southern Africa holds some of the best production-cost credentials in the sugar world.

| Projected Growth in REGIONAL demand for imported sugar (tons ‘000) |

|||

| Country | 2016/17 | 2019/20 | Increase |

| Angola | 361 | 415 | 54 |

| Burundi | 23 | 30 | 7 |

| DR Congo | 368 | 424 | 56 |

| Kenya | 373 | 516 | 143 |

| Madagascar | 98 | 130 | 32 |

| Rwanda | 50 | 72 | 22 |

| South Sudan | 117 | 131 | 14 |

| Tanzania | 228 | 323 | 95 |

| Total | 1 618 | 2 041 | 423 |

Tongaat Hulett has more than 30 years’ experience trading sugar to the region’s deficit markets, having delivered in excess of 180 000 tons in the 2017/18 year. Sales improved on the back of increased production in South Africa and Mozambique, offset by the lower production in Zimbabwe. The Mafambisse and Xinavane sugar mills and the Huletts refinery in Durban are close to ports, providing efficient access to regional markets. Zimbabwe and Mozambique are well positioned for supplying regional deficit markets. Zimbabwe benefits from being a member of the COMESA trade bloc, and both countries are members of the SADC trade bloc. Good progress continues to be made in accessing regional markets with sugar from Zimbabwe and Mozambique.

Most deficit markets of Southern and Eastern Africa aspire to eventually establish their own sugar industries. The development of such industries takes many years. Options to enter the value chain by establishing local packing, selling and distribution capabilities, similar to Tongaat Hulett’s operations in Botswana and Namibia, are being developed.

Well-positioned to take advantage of EU supply and demand dynamics, post-Brexit UK possibilities, US quotas and the growing markets for speciality sugars

Given the duty-free access of Tongaat Hulett’s Mozambican, South African and Zimbabwean operations, the opportunities to benefit from increased sugar pricing during lower domestic EU sugar production periods remains, particularly in view of the business' ability to rapidly adapt its sugar supplies to various markets.

Prices in the EU have declined rapidly over the past 12 months and are currently in a surplus period, more reflective of the world market price for sugar. In the US, prices continue to reflect the benefits of the support and protection provided by the government, delivering a premium of between R2 750 and R3 300 per ton compared to world market prices.

Tongaat Hulett has commenced delivering high-value, special brown sugar to EU buyers from its two Mozambican sugar mills. These products are expected to grow to a meaningful proportion of Tongaat Hulett’s deliveries of sugar to the EU in future. Opportunities continue to be sought to benefit from the duty-free quota recently allocated to South Africa.

Possibilities latent in the UK sugar market in a post-Brexit environment are emerging. Tongaat Hulett continues to influence the debate and outcomes in this regard to be able at least to continue with existing preferences, particularly for higher-margin, value-added sugars.

Details of the markets that Tongaat Hulett operations have supplied in the past year are presented below.

Proactive sugarcane development and water supply initiatives to grow sugar production and utilise available milling capacity of 2 million tons per annum

The focus remains on realising the cash flow potential of these operations through commercial initiatives, continued cost reduction interventions and exploring opportunities to expand downstream activities.

Sugar production in 2017/18 was 1,171 million tons, an increase of 115 000 tons from the 1,056 million tons produced in 2016/17. A strong post-drought recovery in production was achieved in South Africa, but production in Zimbabwe dropped due to low yields as low dam levels constrained water availability for irrigation during peak growing periods. Good rains in key catchments in Mozambique and Zimbabwe in the 2017/18 summer have filled the dams that supply irrigation to Tongaat Hulett’s operations, such that they now contain enough water for between 15 and 30 months of irrigation. The recently commissioned Tugwi-Mukosi dam has provided a major improvement in water security in Zimbabwe. An accelerated replant programme, after limited replanting occurred in the previous season due to the drought, has further contributed to improved yield prospects in all agricultural operations. Given regular growing conditions, continued progress with the agricultural improvement programmes and completion of the planting partnerships already under way, the existing sugarcane footprint has the potential to produce some 1,6 million tons of sugar. The total sugar production estimate for 2018/19 is between 1,310 million tons and 1,450 million tons.

Tongaat Hulett, in collaboration with multiple stakeholders, continues to expand the sugarcane supply to meet the capacity of its sugar mills, contributing significantly to the socio-economic dynamics of the communities in which it operates. Across all its sugar operations, approximately 34 000 hectares of new cane land, within reasonable distance to company sugar mills, has been planted over the past six years, mainly in communal areas. The replacement value of Tongaat Hulett’s unutilised sugar milling capacity in 2017/18 exceeds R20 billion.

| Tons raw sugar |

Historical peak production |

2013/14 Actual |

2015/16 Actual |

2016/17 Actual |

2017/18 Actual |

2018/19 Estimate |

2019/20 Early estimate* |

Capacity |

| South Africa | 977 000 (2000/01) |

634 000 | 323 000 | 353 000 | 513 000 | 560 000 -

630 0000 |

610 000 -

675 000 |

1 000 000 |

| Mozambique | 271 000 (2014/15) |

249 000 | 232 000 | 198 000 | 218 000 | 264 000 -

280 0000 |

290 000 -

310 000 |

340 000 |

| Zimbabwe | 578 000 (2002/03) |

488 000 | 412 000 | 454 000 | 392 000 | 433 000 -

483 0000 |

500 000 -

560 000 |

640 000 |

| Swazilandˆ | 59 000 (2011/12) |

53 000 | 56 000 | 51 000 | 48 000 | 53 000 -

57 000 |

54 000 -

58 000 |

60 000 |

| Total | 1 885 000 | 1 424 000 | 1 023 000 | 1 056 000 | 1 171 000 | 1 310 000 -

1 450 000 |

1 454 000 -

1 603 000 |

2 000 000 |

| * | Progress with replant programme, given average rainfall in the summer of 2018/19 and targeted progress with the agricultural improvement plans. |

| ˆ | Raw Sugar Equivalent |

Growth in sugar production from the existing sugarcane footprint, through better yields and sugar content, has a low marginal cost as milling costs are 85 percent fixed. Tongaat Hulett’s average marginal cost of the additional sugar production to achieve the 1,4 million tons projected for 2018/19 is US$101 per ton (4,6 US c/lb), when produced from its own sugarcane. For third-party sugarcane, marginal costs are higher and move in tandem with revenue, as growers are paid a share of this revenue. Of the projected growth in sugarcane supply across Tongaat Hulett’s operations in the next two years, 47 percent is expected to come from the company’s own sugarcane.

Sugar production will benefit significantly from improved water availability

In Zimbabwe, the new 1,8 million megalitre Tugwi-Mukosi dam is currently 78 percent full, the 1,7 million megalitre Mutirikwi dam system is 54 percent full, and the two smaller supplying systems are 92 and 100 percent full. At current levels, these dams will ensure that the majority of the Zimbabwean sugarcane supply has sufficient water available to irrigate sugarcane for the next two years, irrespective of whether further rainfall is received during this period. The improved water availability ensured that full irrigation of the crop has commenced, which will result in substantially improved sugarcane yields over the next two seasons. In addition, the operation accelerated its sugarcane root replant programme, planting 5 448 hectares of Tongaat Hulett farmed sugarcane in 2017, while private growers planted 1 226 hectares, a total of 14,8 percent of the area under sugarcane. The improvement in sugarcane yields, accelerated sugarcane root replant and better crop positioning will result in sugar production rising to between 500 000 and 560 000 tons in 2019/20, which represents utilisation of 78 to 88 percent of the Zimbabwe operations installed sugar milling capacity.

In Mozambique, significant inflows into the Corumana dam near Xinavane meant that full irrigation resumed. The Corumana dam is currently 54 percent full and this provides water coverage through to August 2019, irrespective of whether further rainfall is received during this period, while the Muda dam near Mafambisse is 100 percent full, providing water coverage for two years. Water security at the Xinavane operation will be significantly improved by the building of the 760 000 megalitre Moamba Major dam, which commenced in October 2015, and the alterations to the Corumana dam currently in progress, which will result in the dam capacity being increased by 380 000 megalitres by the end of 2019. Sugarcane yields are projected to substantially increase over the next two seasons, as the operations benefit from the improved water availability combined with the impact of the ongoing intensive agricultural improvement programmes. Sugar production from the Mozambican operations is expected to rise to between 290 000 and 310 000 tons in 2019/20, reflecting the combined impact of improved water availability, higher sugarcane yields, accelerated sugarcane root replant and improved crop positioning, which represents between 85 and 91 percent utilisation of the Mozambican operation's installed milling capacity.

In South Africa, the sugar production for the 2017/18 season of 513 000 tons benefited significantly from the improved rainfall received during the key sugarcane growing months of November 2016 to March 2017. Over the past six years, Tongaat Hulett’s South African sugar operations facilitated the planting of 28 500 new hectares to sugarcane as the operation partnered with various government agencies, including The Jobs Fund, to use existing and emerging opportunities for sugarcane development. These opportunities prioritise the establishment of indigenous black farmers in collaboration with rural communities, local governments and other relevant stakeholders, in all the company’s areas of operation. Given ongoing average rainfall, particularly during the key sugarcane growing summer months of 2018/19, sugar production in the 2019/20 season is projected to grow to between 610 000 tons and 675 000 tons as the operations benefit from the growth in hectares harvested and improved sugarcane yields.

Multi-faceted agricultural improvement programmes have already yielded considerable benefits and are ongoing

Substantial progress continues to be made with the intensive agricultural improvement programmes that have, as their primary focus, higher sugarcane yields, improving sugar content and sugar extraction. Tongaat Hulett continues to research, develop and adopt the latest technological advances across all its agricultural estates, utilising a peer review system that facilitates benchmarking and information sharing between operations. Areas of focus include the following:

- Controlled traffic farming systems (CTFS): Utilising GPS technology and changing row configurations to minimise the year-on-year crop and soil damage inflicted during harvest and ratoon management operations.

- Planting period optimisation: CTFS facilitates precision tillage operations which allow for less costly and more effective replants and importantly also allows for more of the annual replant programmes to be conducted in the months February to May each year (for irrigated estates). Planting during this period and harvesting the crop at the beginning of the following harvest season allows for plant crop yields to be optimised with subsequent ratoons harvested at an age of greater than twelve months (more mature cane with greater annualised sucrose yields per hectare) while rateable supply of cane to the mills is maintained.

- Drainage: Adoption of breakthrough infield surface and subsurface drainage technologies are being encouraged while estates, particularly in Mozambique, continue to make progress in the effectiveness of their macro drainage systems in line with detailed master drainage plans.

- Irrigation: A self-assessment tool was developed in-house to assist estates to benchmark themselves against global best practice to prioritise and plan for more efficient and flexible irrigation systems, matched optimally to the prevailing soil characteristics. More than 100 irrigation managers and operators were trained during the financial year on how to conduct systems performance evaluations as part of this process. A holistic approach to irrigation upgrades is being adopted to ensure that the sustainability of future farming systems is central to the decision-making process. Estates continued to make progress in metering irrigation pump station installations.

- Intra-field management: Progress has been made in the development of operational standards to enable operations to optimise the timing, sequence and quantity of agricultural inputs on an intra-field level i.e. precision agriculture.

Emphasis is being placed on realising synergies within farming systems, recognising the multiplicative effect each additional best practice standard achieved, or exceeded, has on overall crop performance. In so doing, crop resilience is bolstered, as part of which cash crops are being considered as rotational crops to boost soil health and future sugarcane crop performance. Tongaat Hulett is active in encouraging its grower communities to apply similar approaches in pursuit of sustainable yield improvement.

Reducing the cost of the sugar production value chain, from cane growing to the delivery of sugar to the customer

All sugar operations continue to prioritise the reduction of the cost base, building on the successes of previous years. The total cost reduction in 2017/18, compared to 2012/13, is R1,43 billion. Cost reduction initiatives are focused on bought-in goods, services, logistics, marketing and manpower costs across all the business areas. Examples of cost saving initiatives include:

- The investment in additional strategic sourcing capability to maximise the combined purchasing power of Tongaat Hulett’s operations. Further savings are anticipated in the year ahead as new contracts are negotiated and cash flows will benefit from new ways of optimising working capital.

- The implementation of the intensive agricultural improvement programmes is contributing to savings on electricity and fertiliser cost as the benefits of improved irrigation and precision farming are realised.

- Tongaat Hulett has developed, patented and proven, via a demonstration plant, a new sugar refining technology, called GREEN refining. When fully implemented, the technology will reduce the energy requirements of a refinery by approximately half. The first phase of this technology has been implemented at the refinery in Durban, at a cost of some R90 million. Commissioning will be completed in the second quarter of 2018/19, and the benefits in respect of the refinery’s operating costs will be realised during the second half of the year.

With the SAPTM platform operational throughout the business, Tongaat Hulett is well-positioned to identify further cost saving opportunities through enhanced cost visibility, new business insights and increased benchmarking of operations.

Unlocking opportunities in livestock nutrition and farming, ethanol production and electricity generation

Opportunities in livestock nutrition and farming, ethanol production and electricity generation can add to the value extracted from sugarcane and diversify revenue streams for the sugar operations. These have the potential to provide an opportunity for further rural development and job creation which is important for the future expansion of the sugar industry.

Molasses, the liquid co-product arising from the production of raw crystal sugar at the sugar mills, is a valuable component of the sugar value chain. Tongaat Hulett adopts a regional approach to the use of molasses, taking into account the logistics costs of moving product within the region, to ensure it is used optimally. Currently, most of Tongaat Hulett’s molasses is used in the animal feeds operation in South Africa and for ethanol production in Zimbabwe.

The combination of Tongaat Hulett’s Voermol operation and the co-products produced by the starch and glucose operation, results in Tongaat Hulett having a significant footprint in the livestock nutrition industry, with a current turnover of R1,6 billion. The business continues to explore opportunities to expand this footprint in the region, particularly at its Mozambican and Zimbabwean operations:

- Mozambique is emerging as a producer of beef to replace imports, and market penetration has begun by supplying Voermol products through the Xinavane operation. A Livestock Improvement Centre demonstration facility to showcase Voermol products and stimulate demand is being considered.

- In Zimbabwe, plans are in place to grow the company’s cattle herd from the current 6 000 head to 30 000 head in the next four years, using intensive farming, irrigated pastures, feedlots and improved genetics. A phased rehabilitation and modernisation of the mothballed 42 000 ton per annum animal feeds plant at Triangle mill is planned.

Tongaat Hulett has been producing fuel-grade ethanol in Zimbabwe for blending in the local market for many years, as well as producing smaller volumes of industrial alcohol. During the 2017/18 season, the distillery produced 21,7 million litres in total, with 27,5 million litres planned for 2018/19. In 2017, the statutory blending ratio was increased from 15 percent to 20 percent, with a further increase to 25 percent likely. Plans are being developed to debottleneck the Triangle distillery to increase production capacity from 40 to 70 million litres, in line with the growth in the market.

Future ethanol production in South Africa looks particularly promising. A task team, involving government and representatives of the sugar industry, is investigating the feasibility of a fuel ethanol programme as one of a range of measures intended to enhance the sustainability of the industry. A decision by sugar companies to invest in the production of fuel ethanol is dependent on regulatory certainty around the price support mechanism for sugar-based ethanol.

Electricity remains an important co-product of sugar production. All sugar mills generate their own electrical power needs, using sugarcane fibre as a fuel, and some generate additional power for irrigation and supply into the grid. With capital investment, much more electricity can be produced from the same fibre energy through high pressure boilers and improved sugar mill efficiency.

Opportunities are being explored for increased generation in Zimbabwe and Mozambique, including the possibility of a third-party-owned power island for the Mafambisse operation. In South Africa, large-scale renewable electricity from sugarcane continues to be reviewed. The wheeling of power from sugar mills in Northern KZN to starch mills in Gauteng has received final regulatory approval and will be in operation from June 2018. Tongaat Hulett and the South African sugar industry are continuing to engage with government at various levels to realise the possibility of electricity generation from cane fibre.

LAND CONVERSION AND DEVELOPMENT

CONTINUING TO CREATE VALUE FOR STAKEHOLDERS THROUGH AN INCLUSIVE APPROACH TO LAND DEVELOPMENT ACTIVITIES

Tongaat Hulett has well-established land development resources, track record and processes, underpinned by a portfolio comprising 7 612 developable hectares of prime land in KwaZulu-Natal, near Durban and Ballito, which over a number of decades, will be converted out of sugarcane into urban land usage.

Expectations are that over the next five years some 600 to 1 100 developable hectares will be sold during this land conversion process. The land conversion and development process is based upon comprehensive collaboration with public sector, communities and other businesses, that takes place across the entire land use cycle, from agricultural usage and rural advancement through to intensive urban development. These partnerships continue to increase in scope and socio-economic impact, with private sector investment of R7,8 billion currently underway on land previously sold, supporting 55 000 construction jobs, with 5 800 permanent jobs to be sustained as projects are completed.

Tongaat Hulett’s development activities are supporting a comprehensive, embedded social programme; are yielding increasing numbers of opportunities for well-located, affordable neighbourhoods; and are enabling transformation of ownership and participation in the real estate value chain.

A wide range of stakeholders benefit substantially from Tongaat Hulett’s land conversion processes. Society at large is deriving increasing benefit as Tongaat Hulett continues to improve its processes to attract fixed investment to the region, achieve urban spatial integration and integrated residential neighbourhoods, and create an ever-growing range of opportunities and mechanisms to stimulate transformation in property ownership and the real estate value chain. The land conversion process creates a platform for increased public sector income generation through rates and taxes, and maximises the returns from infrastructure investment, both financially and in terms of Enterprise Development (ED), job creation and local economic development. Tongaat Hulett’s shareholders are benefiting from the increased value in the land portfolio which now reflects the impact of the activities and proactive planning undertaken by the business. Simultaneously, Tongaat Hulett’s investments in new agricultural development are enhancing rural livelihoods

Significant progress made in key focus areas, including increasing the extent of available “shovel-ready” land

Further significant milestones have been achieved during this period in strengthening the foundations for increased value creation through land conversion activities into the future and acceleration in the short term. This progress is particularly important in the current environment of heated debate around land value for stakeholders, land tenure and spatial, economic and land reform.

A central measure and milestone of the progress made is the achievement of steps toward shovel-ready status, which enables Tongaat Hulett to unlock the developmental potential, social and economic value of the land under urban land use. This process has many elements and significant progress has been made on all of them; specific milestones are:

- Formal approval is required from the National Ministry of Agriculture, Forestry and Fisheries for release of land from agriculture under Act 70 of 1970. With the support of local and provincial authorities, Tongaat Hulett has applied for and been granted such approval over 3 566 developable hectares (47 percent of the portfolio), up from 537 hectares at the end of 2012. Such land is now being intensively accelerated into environmental and zoning approval processes.

- Environmental approvals for specified, market-aligned development have been granted over 1 485 developable hectares (20 percent of the portfolio), providing clarity on timing and suitability for ultimate use.

- Available shovel-ready land currently totals 185 developable hectares, exceeding the 171 hectares sold over the past two years.

the investment that has gone into the planning and infrastructure that underpin future land sales, with their associated multiplier effects, INCREASED to R979 million

The period under review has seen the completion of a number of significant infrastructural projects by Tongaat Hulett, together with other regional infrastructure initiatives by the public sector, that together represent significant progress in creating a platform for the city to be able to attract and satisfy demand for a range of urban land uses.

Of the R979 million invested, R489 million has gone into Cornubia, an area where intensive urban growth is expected to occur and where over 25 000 homes will ultimately be located in integrated, well-located, affordable neighbourhoods. In this last year Tongaat Hulett land sales have unlocked 2 500 of these opportunities, to be developed by the private sector, to add the 2 000 completed to date by the government. Cornubia is a landmark human settlement project for the country and represents visible evidence of the massive potential impact of collaborative delivery in urban development.

Cornubia North, representing the future expansion of the development northwards toward Sibaya at eMdloti and the King Shaka International Airport, has received approval for release from agriculture, and the concept for development is being refined for planning applications to be made in due course to move this landholding towards shovel-ready status.

The recent environmental approval for Tinley Manor represents an important new opportunity for Tongaat Hulett. Sales negotiations have commenced over 66 hectares, including 20 hectares for an internationally-branded coastal resort, the first of its kind in South Africa. Planning processes currently underway are expected to open new development areas around King Shaka International Airport. The first zoning approvals were granted at Ntshongweni west of Durban in April 2018.

Land development activities involve considerable cash inflows and outflows that occur over an extended period and may not coincide within a financial year. Strong cash inflows are anticipated, mainly in the second half of the next financial year. Several infrastructure projects in the region are completed or nearing completion, cash outflows will be below those of the previous two years.

Demand Drivers and Market Solutions

The pace of sales is dictated by progress in moving land to a shovel-ready status; availability of metropolitan and regional scale infrastructure; demand arising from the various Demand Drivers and selection and successful conclusion of sales transactions most appropriate for each specific set of circumstances.

Analysis of individual Demand Drivers continues to amplify that, in many cases, Durban is lagging its potential to attract or address business and residential demand that would drive real estate investment and hence land take-up. Ongoing progress in creating more shovel-ready land in the region, across different geographical localities and serving a range of markets, is expected to start to enable underlying demand requirements to be better satisfied and to create the opportunity for Tongaat Hulett and the region to become more proactive in attracting investment and creating new markets.

The past three years have seen an ongoing focus on understanding the potential of and dynamics driving or retarding some 12 different Demand Drivers for land for a variety of urban uses. As this has progressed, the mechanisms to create specific real estate solutions that address these market dynamics have gained traction. This has led to increasing sales in targeted demand sectors such as retirement, primary, secondary and tertiary education and affordable residential neighbourhoods, that supplement existing markets such as mid-market and high-end residential, and high-intensity mixed-use, which Tongaat Hulett has addressed successfully over an extended period.

Significant negotiations are currently underway over some 300 developable hectares spread over a wide range of Demand Drivers and locations, including Ridgeside, Sibaya, Cornubia, Bridge City, uMhlanga Ridge Town Centre, Kindlewood, Inyaninga and Tinley Manor.

The table above gives details of current negotiations, other areas where enquiries are being received and the areas from which sales anticipated over the next five years are expected to come.

The table that follows provides an assessment of the range of sales anticipated over the next five years based on an assessment of demand across the various Demand Drivers, evolving market solutions to address the dynamics of these various market sectors, progress in moving land to shovel-ready status, availability of metropolitan and regional scale infrastructure and selection of the transaction approach most appropriate to each set of circumstances.

The eighth edition of the document describing the approach to creating value for stakeholders through an inclusive approach to land development activities is circulated in hard copy, accompanying this report and is available here. The document provides further detail of the elements summarised in this report as well as the developmental process itself, the embedded social programmes, the infrastructure environment, the targeted Demand Drivers and details of each of the individual locations and their own unique opportunities.

ANTICIPATED RANGE OF SALES OVER FIVE YEARS

CONSTRUCTIVE INTERFACE ARISING FROM RELATIONSHIPS WITH SHAREHOLDERS

Tongaat Hulett values the constructive interfaces arising from its responsibility towards its shareholder base. The business is committed to engaging with the investment community and its shareholders on the performance and prospects of the company in an open and transparent manner, ensuring that relevant information is readily available. In doing so, the company’s objective remains that the investment community knowing that Tongaat Hulett takes congisance of their input on key topics and that the business’s strategy going forward is, in general, well understood. The company is proud of being acknowledged by the Investment Analyst Society (IAS) as the leader in corporate reporting in the Consumer Products sectorfor the 12th consecutive year.

TONGAAT HULETT'S INTERACTIONS WITH GOVERNMENTS AND SOCIETY

The environment within which the company operates is increasingly impacted by multiple developmental challenges. Tongaat Hulett’s philosophy as a partner of government and society is for the company to contribute towards improving the prospects of a better life for many by making a substantial, positive impact on various socio-economic challenges, including job creation and security, transformation, attracting fixed investments, urban spatial integration, food security, youth development, infrastructure establishment and inclusive rural development. This strategic view has been described as “Value creation for all stakeholders through an all-inclusive approach to growth and development”.

The business has long-standing, constructive relationships with rural communities and governments. The following are some examples of recent achievements:

- In Mozambique, where deep rural communities have limited access to healthcare and other basic facilities, Tongaat Hulett has played a significant role in improving the quality and extent of healthcare that is available to the communities that surround its Xinavane and Mafambisse operations. From the perspective of economic development of these rural economies, the number of small-scale indigenous farmers has grown from 249 in the 2007/08 season to 3 269 in 2017/18. During this time, sugarcane received from these farmers has grown from 45 528 tons to 404 625 tons.

- In Zimbabwe, Tongaat Hulett plays a significant role in the provision of primary healthcare. In the 2017/18 year, some 240 763 people received primary healthcare support through the two hospitals that the operations manage in the eastern Lowveld. The business continues to work with the government and local communities on the orderly development of sustainable indigenous private farmers in the south-eastern Lowveld. The extent of sugarcane supplied by indigenous farmers has grown from 532 000 tons in the 2011/12 season to just over 1,075 million tons in 2017/18. During this time, the cumulative number of jobs created by these farmers has increased from 4 750 to 8 000 people, and this has substantially contributed to the economic development of the region.

- In South Africa, transformation, housing, job creation and rural economic development continue to be some of the primary developmental challenges. Tongaat Hulett is actively involved in numerous traditional authority areas in rural KwaZulu-Natal through various agricultural and SED initiatives. A prime example of the activities that the company is involved in, is its recently concluded partnership with The Jobs Fund which created 3 019 new jobs in less than four years, against an initial commitment to create 2 874 jobs through the life of the project. The project assisted in the creation of 27 cooperatives, with more than 3 000 members, and encompassed areas overseen by 15 different traditional councils and some 10 972 hectares of rain fed sugarcane were planted since commencement on 1 August 2014.

- The starch operation is the third largest purchaser of maize in South Africa. It is therefore well positioned to influence and play a leading role in the transformation of the maize industry, as well as increasing the supply of maize in Southern Africa.

- The land conversion and property development activities, by its very nature, provides an ideal environment to create new jobs, develop skills, facilitate enterprise and supplier development and transformation over the full real estate value chain. This applies to both construction activity (construction jobs) during infrastructure delivery and building construction as well as to operational activities (permanent jobs) which commence once buildings are completed and occupied. In addition to the employment impacts, the development activities facilitate significant new investment into the region which then leverages ongoing economic multipliers. The Total Real Estate Investment Value is an indication of the collective market value of land and buildings on occupation within each of the Demand Drivers and is estimated in current-day terms. From a municipal perspective, development activities lead directly to substantial incremental rates and user charges that significantly boost the municipal fiscus. The transactions concluded in this reporting period will lead to R9,2 billion in new investment; R100 million annual municipal rates; 55 000 construction jobs and 3 200 permanent jobs as the developments take place.

2007 BEE Transaction in South Africa

As part of the company’s Broad-Based Black Economic Empowerment deal in 2007, the Ayavuna and Sangena consortiums, rural communities via the Masithuthukisane and Mphakhathi trusts and company employees via the ESOP and MSOP Trusts, obtained voting and shareholder rights in Tongaat Hulett (see here for further information).

Tongaat Hulett subscribes to the principle of "ZERO HARM" embedded in an interdependent culture among stakeholders

Tongaat Hulett is making progress towards creating an interdependent culture to achieve “ZERO HARM” to people and the environment. The company is maintaining focus on improving the safety and health for employees, contractors and all people visiting business operations whilst at the same time extending the safety campaign to include communities surrounding company operations. Over the past years, the company’s safety performance improved substantially, leveraging on established safety, health and environmental management systems and various safety improvement initiatives. In the past three years, Tongaat Hulett introduced structured high-fatality risk control interventions and periodic executive stand back safety reviews that are being monitored regularly at Board level. This top executive driven intervention has led to the sustained safety improvements realised thus far.

The company’s safety performance in terms of serious injuries that result in loss of time improved in 2017/18 compared to the previous year. A Lost Time Injury Frequency Rate (LTIFR) of 0,083 per 200 000 hours worked was achieved in 2017/18, reflecting an improvement from the 0,093 achieved in 2016/17. One of the highlights of the year was that Tongaat Hulett Sugar’s Botswana operation and Tongaat Hulett Starch’s Bellville operation completed 7,5 years and 2,75 years, respectively, without recording a Lost Time Injury.

The safety initiative targeted at managing high-fatality risks is being pursued and reviewed periodically at both senior executive and Board levels. Key elements of this risk based safety approach involve the following:

- Common fatality risk topics - key topics of motorised equipment, moving machinery, unsafe behaviour and contractor management are common across all operations and are being taken through repeated internal risk assessment processes aimed at replacing less effective risk controls with engineering solutions and/or hard barriers to minimise an overreliance on human behaviour control. Subsequent to internal processes, the same topics are subjected to third-party risk assessment reviews done by independent subject matter experts to test the robustness and effectiveness of risk controls.

- Country/operational specific topics, e.g. work at heights, hazardous chemicals and energy release are being taken through a similar process which is monitored and reviewed at business unit level.

- Top executives stand-back reviews of business operations experiencing business, operational, and/or geo-social challenges negatively impacting on the safety of employees, contractors or people from the community are continuing whenever a need is identified. In the past year, at least four stand-back reviews were done at Zimbabwe, Mozambique and South Africa sugar operations involving top executives from various business units.

Regrettably, a single work-related fatality was suffered in the year, at Tongaat Hulett Triangle in Zimbabwe. The deceased, Mr. Brighton Huku succumbed to injuries following an accidental release of steam during a planned plant shutdown. This single fatality recorded in the year represented a reduction in the number of work-related fatalities recorded in the past three years (2016/17: 3 and 2015/16: 5).

Considering that Tongaat Hulett employs more than 40 000 people during peak milling season at 27 locations in six countries in Southern Africa, health issues being experienced across the SADC region where the business operates are varied. Tongaat Hulett is achieving satisfactory progress in implementing the South Africa National Standards (SANS) 16001 on wellness management systems to ensure best practices are adopted and measured for compliance. The key health highlight for the company in the year was celebrated when Tongaat Hulett Hippo Valley Estates was selected by an esteemed external health panel as the Winner of the Business Action on Health Award for Workplace and Workforce Engagement.

SHE and food safety performances are benchmarked against global best practices to promote continuous improvement and stakeholder satisfaction. Operations subscribe to various internationally recognised management systems and/or specifications that include NOSA, OHSAS 18001, ISO 14001, ISO 9001, FSSC 22000 and ISO 22000. All operations retained certification to either NOSA 5 Star systems or OHSAS 18001 covering occupational health and safety. All 19 main operations, are now certified to the ISO 14001 environmental management system. All starch operations, the refinery, and pack stations for Xinavane, Triangle and Namibia operations retained certification to FSSC 22000 or ISO 22000 on food safety management systems.

SOCIAL SUSTAINABILITY

Tongaat Hulett’s approach to social sustainability includes a holistic process in its management of key topics including SED and corporate social responsibility.

- Social sustainability and innovation are fundamental to the business as Tongaat Hulett seeks demonstrable and practical outcomes in terms of positive social transformation, environmental stewardship and community upliftment.

- The evolution of Tongaat Hulett, in continuing to be regarded as a responsible corporate citizen has also seen the business continue to embrace good corporate governance by adhering to legal and accepted business practices as embodied in King IV™. The company continues to uphold the principles of corporate social responsibility by demonstrating to society its commitment to philanthropic and empowerment initiatives within the communities in which it operates.

- Tongaat Hulett has a substantial land footprint in the countries in which it operates. It is within this context that the company subscribes to principles of sustainable development.

The business’s participation in various sustainability reporting initiatives, including the CDP, the CDP Water Disclosure Project, the Nedbank Green Fund and its listing on the FTSE/JSE Responsible Investment Index for the fourteenth consecutive year are testimony to Tongaat Hulett’s approach to sustainability and stakeholder value creation. Tongaat Hulett was honoured to be recognised as a global leader in sustainable water management, being awarded a position on the CDP Water A-list.

FINANCIAL REVIEW

Tongaat Hulett’s operating profit for the year ended 31 March 2018 totalled R1,958 billion (2017: R2,333 billion). The sugar operations were adversely affected by the dynamics of imports into the South African market, low international sugar prices and the impact of stronger local currencies on export realisations. Sugar production reflected a partial recovery from the drought conditions of the previous two seasons.

Operating profit from the starch and glucose operation improved in the second half of the year, benefitting from more competitive maize costs. Land conversion and development activities led to a number of sales in new markets and operating profit which was in line with the previous year.

The various sugar operations recorded operating profit of R837 million (2017: R1,271 billion). Total sugar production increased to 1,171 million tons (2017: 1,056 million tons). The price of raw sugar in the world market remained under pressure during the year.

The Zimbabwe sugar operations generated operating profit of R563 million (2017: R504 million). Local market sales continued to grow, assisted by the refinery optimisation project that increased the availability of refined sugar for the industrial market. The ethanol operation performed well with improved margins. Low dam levels during peak growing periods limited irrigation, which affected cane yields, resulting in reduced sugar production of 392 000 tons (2017: 454 000 tons). Higher standing cane valuations reflect the improvement in the sugarcane crop to be harvested, which benefitted from increased water availability, supported by the recently commissioned Tugwi-Mukosi dam (currently 78 percent full) and accelerated sugarcane root replanting, as limited replanting had occurred during the drought. The past year saw a major transition in the leadership of the government, creating more positive local and international sentiment.

The South African sugar operations, including downstream activities, recorded operating profit of R86 million (2017: R390 million). Improved rainfall in the coastal areas of KwaZulu-Natal saw production increase to 513 000 tons (2017: 353 000 tons). The recovery in production was negated by high volumes of imported sugar into the local market when, over several months, upward revisions to the import duty were not implemented timeously. This was followed by a period during which zero duty was erroneously applied. Imports into the South African market increased to 520 000 tons in the 12 months to December 2017, dropping the industry’s sales into the local market to some 1,18 million tons compared to 1,64 million tons in the previous year. The impact was prolonged by the storage of large quantities of sugar that were imported during the period. The displaced locally-produced sugar was exported in the latter part of the year and was impacted by a low world price and a stronger Rand. The South African sugar industry has taken measures to regain its local market share by ensuring local prices are more responsive to international markets; by applying for an increase in the US dollar-based reference price used in the calculation of the duties, as published in the Government Gazette on 11 May 2018; and through increased involvement in the process to implement duty revisions timeously. Voermol, the animal feeds operation, performed well.

The Mozambique sugar operations recorded operating profit of R159 million (2017: R308 million). Sugar production increased to 218 000 tons (2017: 198 000 tons) and good progress was made with export sales into deficit regional markets. The strengthening of the Metical against the US dollar put pressure on local prices and it contributed, together with low international prices, to reduced export realisations. Lower revenue and inflation-driven increases in Metical-based costs reduced margins. The construction of the 90 000-ton sugar refinery at the Xinavane sugar mill is progressing well, with commissioning targeted for September 2018. The refined sugar production will replace imported white sugar, satisfy the country’s growing industrial demand and realise a meaningful price premium in export markets.

The starch and glucose operation recorded operating profit of R572 million (2017: R510 million). Higher sales volumes arose from the initiative to replace customers’ imported volumes with local production, new business development and growth in export markets. Margins benefitted from lower maize prices, that traded closer to export parity levels after the record crop of 16,8 million tons and were negatively impacted by a stronger Rand. Improved plant capacity utilisation and an ongoing focus on operational efficiencies contributed further to improved profitability.

Land conversion and development activities delivered operating profit of R661 million (2017: R641 million) from the sale of 96 developable hectares (2017: 75 developable hectares). Interest in the newly opened prime location at Tinley Manor on the coastline north of Ballito realised a sale of 28 hectares, while 35 hectares were sold in uMhlanga Hills and Marshall Dam in Cornubia for integrated well-located affordable neighbourhoods. Further sales were concluded for a retirement offering, a new tertiary education campus, offices, urban amenities and high-intensity mixed-use precincts. Profit per developable hectare is influenced by the degree of enhancement through urban planning, land use integration and the density, location and intensity of infrastructure investment, and was in line with anticipated ranges communicated previously. Further investments were made during the year into planning and infrastructure that underpins future sales, mainly in areas where sales negotiations are underway or enquiries are being received.

Tongaat Hulett’s operating cash flow (after working capital) was R2,275 billion (2017: R3,176 billion). Improved operating cash flows generated by the starch and glucose operation provided some mitigation for the cash impact of lower profits from the sugar operations. In the land conversion and development activities, cash outflows exceeded cash inflows by R68 million (2017: R900 million net inflow). Capital expenditure totalled R2,168 billion (2017: R1,209 billion) with the commencement of the refinery project in Mozambique and the considerable investment in sugarcane root replanting after the drought. Finance costs of R878 million (2017: R810 million) were commensurate with the borrowings levels. Overall, the year reflected a net cash outflow after dividends of R1,324 billion (2017: R544 million inflow). Tongaat Hulett’s net debt at 31 March 2018 was R6,463 billion, compared to R4,780 billion at 31 March 2017. Tongaat Hulett has access to unutilised, committed facilities of R2,87 billion and continues to meet the covenants associated with its long-term unsecured South African debt facilities. Short-term borrowing facilities are mainly subject to 365-day notice and unlikely to become due in the next year.

Taking the above into account, headline earnings for the year decreased by 37 percent to R617 million (2017: R982 million).

A final dividend of 60 cents per share (2017: 200 cents per share) has been declared bringing the annual dividend to 160 cents per share (2017: 300 cents per share).

Tongaat Hulett is a proactive and resilient organisation working in collaboration with all its stakeholders in a focused, constructive, mutual value-adding and developmental manner. It is well-positioned to benefit, and be a key development partner, as agriculture and agri-processing in Sub-Saharan Africa develops from a low base. It has operations in six countries in Southern Africa, significant sugarcane and maize processing facilities, a unique land conversion platform, a growing animal feeds position, opportunities to further grow ethanol production and electricity generation, and possibilities in cassava processing.

Overall, Tongaat Hulett’s earnings for the 2018/19 year will be impacted by a wide-range of dynamics. The organisation is focused on driving improved performance within its areas of influence and using its experience to navigate influences outside its control. Earnings and cash flows are expected to exceed those of the 2017/18 year.

ACKNOWLEDGEMENTS AND CONCLUSION

I am privileged to have led an organisation that together with multiple stakeholders has played and continues to play a significant role in the development of the region. Tongaat Hulett’s excellent bench strength at top leadership level has often been endorsed by many stakeholders and bodes well for the CEO succession that is imminent.

Tongaat Hulett’s profile as an agri-processing business provides the company with a substantial opportunity to play a leading role in the development of the rural communities that surround its operations. Through its land conversion and development activities, the business has made a valuable contribution to the growth and advancement in the region that surrounds its land footprint. Tongaat Hulett values the relationships that it has established and remains committed to working together with small-scale and commercial private farmers, rural communities and governments to grow its contribution to job creation, rural development and an inclusive economy, thereby creating sustainable value for its stakeholders.

Through its employee base of some 40 300 people during its peak milling period, the company continues to benefit from the commitment, loyalty and drive towards the achievement of the business’s strategic objectives. The ongoing development of talent and emerging leaders, remains a priority that will contribute to the future success of the organisation that is currently based on

27 sites in Botswana, Namibia, Mozambique, South Africa, Swaziland, and Zimbabwe.

Tongaat Hulett values the constructive interfaces arising from its responsibility towards its shareholder base. The company is committed to regularly updating the investment community as it progresses the delivery of its strategic and business objectives. The support and inputs that Tongaat Hulett has received from its shareholders are greatly appreciated.

Tongaat Hulett is fortunate to have a competent Board that provides ethical leadership. The guidance and strategic direction that Tongaat Hulett receives from the Board and the Chairman are highly valued.

![]()

Peter Staude

Chief Executive Officer

Amanzimnyama

Tongaat, KwaZulu-Natal

24 May 2018