CHIEF EXECUTIVE'S REVIEW

Tongaat Hulett continues to focus its actions on its strategic opportunities that will lead to further increased profitability and cash generation. There has been significant progress in achieving goals in key focus areas and further significant outcomes are targeted for the year ahead.

The past year has seen the sugar operations maintain the momentum established in cost reduction, make good progress in the protection against imports, benefit from increased sugar pricing and the return to improved weather and growing conditions. The starch operation was adversely affected by higher maize costs and lower co-product revenues while the land conversion and development activities sold fewer hectares than the previous year. The implementation of multiple actions related to the sugar operations’ intensive agricultural improvement plans is ongoing and, together with improved weather and growing conditions, will substantially improve sugar production over the next two years.

SUGAR: INCREASING RETURNS FROM THE ASSET BASE

RECOVERING CANE YIELDS, GROWING SUGAR PRODUCTION, UTILISING EXISTING CAPACITY WITH LOW INCREMENTAL COSTS

Weather and growing conditions over the past three years led to a low sugar production of 1,056 million tons in 2016/17. These conditions have masked the benefits from the intensive agricultural improvement programmes that Tongaat Hulett made in the four countries where it farms 88159 hectares under cane. Good rains in key catchments in Mozambique and Zimbabwe in the 2016/17 summer have filled the dams supplying irrigation to Tongaat Hulett’s operations, such that they now contain enough water for two full years of irrigation. Given average rainfall in South Africa in the summer of 2017/18, ongoing progress with the agricultural improvement programmes and replanting of fallow land, this should lead to sugar production of some 1,5 million tons in 2018/19.

Weather and growing conditions over the past three years led to a low sugar production of 1,056 million tons in 2016/17. These conditions have masked the benefits from the intensive agricultural improvement programmes that Tongaat Hulett made in the four countries where it farms 88159 hectares under cane. Good rains in key catchments in Mozambique and Zimbabwe in the 2016/17 summer have filled the dams supplying irrigation to Tongaat Hulett’s operations, such that they now contain enough water for two full years of irrigation. Given average rainfall in South Africa in the summer of 2017/18, ongoing progress with the agricultural improvement programmes and replanting of fallow land, this should lead to sugar production of some 1,5 million tons in 2018/19.

Increased sugar production will be achieved using existing unutilised sugar milling capacity, the replacement value of which, in 2016/17, stood at approximately R20 billion. Production growth from existing cane land, through better yields and sugar content, has a low marginal cost as milling costs are 85 percent fixed. Tongaat Hulett’s marginal costs of the additional sugar production to achieve the 1,5 million tons projected for 2018/19, drawing cane from both its own estates and third-party growers, in each of its key sugar-producing countries, are detailed in the table below. The average marginal cost of this increased production is US$100 per ton (4,5 US c/lb) if produced from Tongaat Hulett’s own cane. For third-party cane, marginal cost moves in tandem with revenue, as growers are paid a share of this revenue. The table illustrates this for world raw price scenarios of 14 c/lb and 17 c/lb.

| Tons raw sugar | Historical peak production | 2013/14 Actual | 2015/16 Actual | 2016/17 Actual | 2017/18 Estimate | 2018/19 Early estimate | Capacity |

| South Africa | 977 000 (2000/01) |

634 000 | 323 000 | 353 000 | 500 000 - 564 0000 | 630 000 - 680 000 | > 1 000 000 |

| Mozambique | 271 000 (2014/15) |

249 000 | 232 000 | 198 000 | 205 000 - 221 0000 | 265 000 - 280 000 | > 340 000 |

| Zimbabwe | 578 000 (2002/03) |

488 000 | 412 000 | 454 000 | 421 000 - 440 0000 | 535 000 - 570 000 | > 640 000 |

| Swazilandˆ | 59 000 (2011/12) |

53 000 | 56 000 | 51 000 | 50 000 - 53 000 | 55 000 - 58 000 | > 60 000 |

| Total | 1 885 000 | 1 424 000 | 1 023 000 | 1 056 000 | 1 176 000 - 1 278 000 | 1 485 000 - 1 588 000 | > 2 000 000 |

Tongaat Hulett achieves premiums over the world price in its EU and regional markets.

| Marginal cost of additional sugar production (US$ per ton) |

2018/19 Growth from Tongaat Hulett |

Tongaat Hulett cane | Third-party cane | ||||

| World price @ 14c/lb | World price @ 17c/lb | ||||||

| South Africa | 26% | $123 | 5,6 c/lb | $238 | 10,8 c/lb | $281 | 12,8 c/lb |

| Mozambique | 62% | $102 | 4,6 c/lb | $230 | 10,5 c/lb | $273 | 12,4 c/lb |

| Zimbabwe | 64% | $76 | 3,5 c/lb | $236 | 10,7 c/lb | $287 | 13,0 c/lb |

| Average | 40% | $100 | 4,5 c/lb | $235 | 10,7 c/lb | $280 | 12,7 c/lb |

Strong volume growth in attractively priced domestic markets in the countries where Tongaat Hulett produces sugar

In 2016/17, Tongaat Hulett sold 76 percent of its sugar into the domestic markets in the countries where it produces sugar. In growing production, through to 2018/19, growth of sales into domestic markets of some 150 000 tons is targeted, benefiting from population growth, product availability and economic growth and development. This growth includes the commencement of sales into the Mozambican refined sugar market in the latter part of the period, following the commissioning of a refinery at Xinavane. There has been significant success in Mozambique and Zimbabwe, and some progress in South Africa, in establishing favourable local market pricing and protection against imports. The governments in these countries are increasingly supportive of their sugar industries’ contribution to job creation and the social economy of rural areas (recognising, in domestic pricing policy, that sugar is not a staple food, but has one of the highest rates of job creation in agriculture).

- Mozambique is currently a deficit market despite having local raw sugar production that exceeds local market requirements because of a shortage of refined sugar production, some 90 percent of refined sugar requirements having been imported in 2016/17. Tongaat Hulett’s Xinavane operation, as the largest and most efficient sugar production operation in the country, with good proximity to Maputo’s concentration of industrial customers, is well placed to expand downstream into refining. Project preparations to build a refinery with a capacity of 90 000 tons, for some R500 million, are well underway. It will begin commercial production in the second half of 2018/19.

- The reference price used to calculate import duty in Mozambique is US$806 per ton (36,6 US c/lb) for brown sugar and US$932 per ton (42,3 US c/lb) for white sugar. Sales over the past year in Mozambique grew by 21 percent despite multiple increases in domestic sugar prices, arising from the devaluation of the Metical against the US Dollar, and despite a tight economic environment in the second half of the year.

- Current sugar consumption in Mozambique is a very low 9 kg/capita/annum following the past year’s 21 percent increase in domestic consumption. In some rural areas consumption is as low as 4 kg/capita/annum. An increase to 20 kg/capita/annum represents an increase in the local market of some 275000 tons. The company will build on its success in continuing to increase domestic sugar sales in Mozambique through:

- continuing to expand the distribution network to match population demographics and tackling challenges with respect to logistical access;

- streamlining logistics at the mills to respond to the peak demands, with an emphasis on packing capacity and dispatch; and

- reviewing of pack sizes to match affordability while maintaining economic recoveries.

- In Zimbabwe, sales in the domestic market grew by 4 percent compared to the prior year despite a 5 percent US Dollar increase at the beginning of the year and difficult macro-economic conditions. Protection of local market pricing and local producers is via an import permit system and an import duty of 10 percent plus US$100 per ton.

- Zimbabwean sugar consumption of 21 kg/capita/annum is lower than where it has been historically, impacted by the non-availability of sugar impeding consumption growth in rural Zimbabwe. Growth in sales is targeted by improving access to sugar, in particular ensuring availability of small sugar pack sizes in rural communities.

- Effective sales into the South African domestic market will increase with Tongaat Hulett’s ramp-up in production, as the company’s local market share will increase with its share of domestic production.

- In South Africa, the Dollar Based Reference Price (DBRP) for sugar is currently US$566 (25,7 US c/lb) per ton. The sugar industry is in an engagement process with government to increase the DBRP, citing the fact that South Africa has the lowest domestic price in the region by a significant margin, and that, at the current level, imports become a threat when the Rand is strong against the US Dollar.

- South Africa’s sugar consumption is 33 kg/capita/annum and has been around that level for some time as consumption has historically tracked population growth. While this is higher than the African average, it is moderate compared with the United States sugars consumption of some 60 kg/capita/annum, and the average for the Americas of 43 kg/capita/annum. Should the proposed tax on sugar-sweetened beverages in South Africa go ahead, its likely impact on domestic market volumes (volume will be moved to the export market) is estimated to be less than 5 percent; a level that would be overtaken by population growth within three years. In its engagement with the industry on the tax, government has also invited the proposal of “mitigation” measures, and the following are under discussion, having received the support of organised labour:

- an increase in the DBRP;

- a programme of export incentives; and

- a national programme to produce fuel ethanol from sugar.

- Across all countries of operation, measures continue to be implemented to strengthen non-tariff barriers as well as actively monitoring imports and adherence to import protection measures, thereby maintaining domestic market prices that support development of sustainable cane-growing communities.

- Tongaat Hulett continues to develop its premium Huletts®, Huletts SunSweet®, Blue Crystal® and Marathon® sugar brands in the domestic and regional markets to drive the value earned from the premium-priced domestic markets. Huletts® has been classified as one of the leading Icon Brands in the ASK AFRIKA survey over the past five years and continues to be the top sugar brand.

Tongaat Hulett has the flexibility to rapidly adjust export destinations and market positions to achieve best possible prices, given global sugar market dynamics

The businesses priority remains to first supply increasing demand in its countries of operation before considering other markets. The current market mix continues to be adapted to achieve an optimal balance between the EU and the regional deficit markets. Tongaat Hulett’s sugar production is projected to increase by some 470 000 tons by the 2018/19 season. The company’s exposure to the world market outside the African regional market is expected to remain constant over the period, at around 18 percent of total sales volumes.

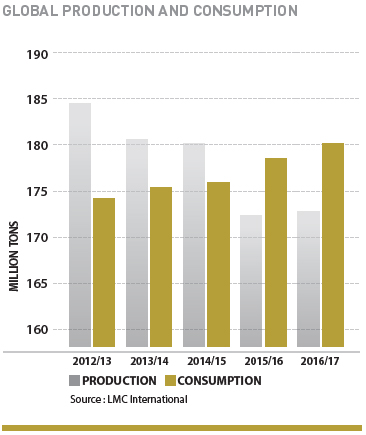

- Global annual demand for sugar rises consistently, with 1994 being the last year in which per capita consumption fell year-on-year. Current growth is around 1,3 percent per annum, equal to some 2,3 million tons of additional demand each year, with growth in both Africa and Asia continuing to exceed population growth. Growth in global consumption is primarily driven by increasing demand in developing countries, which historically have a low per capita consumption rate because of limited availability, affordability and distribution capability.

- The price of raw sugar in the world market, having traded in a wide range of some 14,0 to 23,8 US c/lb in the 12 months to March 2017 (13,2 to 16,7 US c/lb in the prior year), has come under pressure over the past six months.

- Increases in sugar prices can happen rapidly based upon emerging farmer behaviour and weather patterns. There remain key variables that could materially impact on the latest forecasts of global production to September 2018. The price of raw sugar is currently expected, in the coming year, to trade in a broad range of 14 to 18 US c/lb. Expectations are that decisions concerning the sugar/ethanol mix in Brazil will increasingly impact on world sugar prices.

- The probability of supply growth through sizeable investments in sugarcane growing and milling assets being triggered, at current pricing levels, is remote.

Tongaat Hulett is growing its regional presence through the opportunities presented in regional deficit markets

- Tongaat Hulett has more than 30 years experience trading sugar to the region’s deficit markets, having delivered at a peak of some 180 000 tons per year.

- Sales by Tongaat Hulett in the past year into the regional markets were impacted by lower sugar production levels in the South African sugar industry, where quantities available for export were constrained by the lower levels of production.

- The Mafambisse and Xinavane sugar mills and the Huletts® refinery in Durban are close to ports, providing efficient access to regional markets.

- Zimbabwe and Mozambique are well positioned for supplying regional deficit markets. Zimbabwe benefits from being a member of the COMESA trade bloc, and both countries are members of the SADC trade bloc. Good progress was made in accessing regional markets with sugar from Zimbabwe and Mozambique.

- Existing alliances and resources are being expanded and deepened to better penetrate the markets more rapidly with increased volumes.

- Most deficit markets of southern and eastern Africa aspire to establish their own sugar industries - the development of such industries takes many years. Options to move down the value chain by establishing local packing, selling and distribution capabilities, similar to Tongaat Hulett’s operations in Botswana and Namibia, are being developed.

- The company’s premium brands, already present in African markets, will be leveraged to further develop market penetration.

- Demand for imported sugar in the countries where Tongaat Hulett has a competitive advantage, amounts to some 2,3 million tons of sugar per annum, which has been supplied by the region's producers and by India, Thailand, Saudi Arabia, Dubai and Brazil.

- Annual import demand in the deficit markets of the region over the period from 2016/17 to 2018/19 is forecast to grow from 2,3 million tons to some 2,7 million tons, an increase of some 372 000 tons over the period.

- Annual per capita sugar consumption is substantially lower (5 kg - 18 kg) than in the Southern African Customs Union.

- Sugar prices trade at a premium to world market prices and move mainly in tandem with changes in those prices. Premiums vary from market to market, and have traded in a broad range of 2 US c/lb - 4 US c/lb over the past year.

| Projected Growth in demand for imported sugar (tons ‘000) |

|||

| Country | 2016/17 | 2018/19 | Increase |

| Angola | 361 | 400 | 39 |

| Burundi | 23 | 27 | 4 |

| DR Congo | 368 | 402 | 34 |

| Eritrea | 115 | 128 | 13 |

| Ethiopia | 253 | 293 | 40 |

| Kenya | 373 | 468 | 95 |

| Madagascar | 98 | 119 | 21 |

| Rwanda | 50 | 64 | 14 |

| Somalia | 354 | 395 | 41 |

| South Sudan | 117 | 127 | 10 |

| Tanzania | 228 | 289 | 61 |

| Total | 2 340 | 2 712 | 372 |

Tongaat Hulett is well positioned to take advantage of EU supply and demand dynamics, post-Brexit UK possibilities, US quotas and the growing markets for its special brown sugars

Going forward, EU prices are forecast to become more directly linked to the world market price for sugar, trading at a differential to that price based upon the internal EU supply and demand dynamics. Premiums could evolve to levels more attractive than those achievable in the regional African deficit markets.

- There is an emerging consensus that imports of 1 to 1,5 million tons of sugar per year will be required as from October 2017 to meet EU internal demand, particularly in areas where beet production is absent or uncompetitive, and for higher value, special brown sugars that are not produced within the EU.

- Significant duties on imported sugar are being retained, as are the duty-free access rights for many countries, including Mozambique and Zimbabwe.

- Tongaat Hulett has commenced delivering high-value, special brown sugar to EU buyers from its two Mozambican sugar mills. These products are expected to grow to a meaningful proportion of Tongaat Hulett’s deliveries of sugar to the EU in future. Opportunities continue to be sought to benefit from the duty-free quota recently allocated to South Africa.

- Possibilities latent in the UK sugar market in a post-Brexit environment are emerging. Tongaat Hulett is positioning itself to influence the debate and outcomes in this regard to be able at least to continue with existing preferences, particularly for higher-margin, value-added sugars.

- In the US market, Tongaat Hulett continues to benefit from the premium prices available in that market via the tariff-rate quotas allocated to the countries in which it operates. There is also an opportunity to begin to supply special brown sugar from its two Mozambican sugar mills.

Improved water availability significantly benefiting sugar production over the next two years

- In Zimbabwe, the new 1,8 million megalitre Tokwe-Mukorsi dam commenced impounding water in December 2016, and the dam is currently 72 percent full. This, together with the traditional water supply, primarily received from the 1,7 million megalitre Mutirikwi dam system (currently 52 percent full), will ensure that the Zimbabwean operations have sufficient water available to irrigate cane for at least the next two years, irrespective of whether further rainfall is received during this period.

- The improved water availability ensured that full irrigation of the crop commenced in March 2017 and, going forward, will substantially improve sugarcane yields over the next two seasons. In addition, the operation will accelerate its root replant programme from the standard 10 percent to 15 percent replant of hectares under cane, during the 2017/18 season.

- The improvement in sugarcane yields, accelerated root replant and better crop positioning will result in sugar production rising to some 570 000 tons in 2018/19, which represents utilisation of 90 percent of the Zimbabwe operations installed sugar milling capacity.

- In Mozambique, significant inflows into the Corumana dam near Xinavane meant that full irrigation resumed in March 2017. The Corumana dam is currently 67 percent full and this provides sufficient water coverage for the next two years. Water security at the Xinavane operation will be significantly improved by the building of the 760 000 megalitre Moamba Major dams, which commenced in October 2015, and the alterations to the Corumana dam currently in progress, which will result in the dam capacity being increased by 380 000 megalitres in 2019.

- Sugarcane yields are projected to substantially increase over the next two seasons, as the operations benefit from the improved water availability combined with the impact of the ongoing intensive agricultural improvement programmes.

- Sugar production from the Mozambican operations is scheduled to rise to some 280 000 tons in 2018/19, reflecting the combined impact of improved water availability, higher sugarcane yields, accelerated root replant and improved crop positioning, which represents over 80 percent utilisation of the Mozambican operations installed milling capacity.

- In South Africa, the sugar production estimate for the 2017/18 season, of between 500 000 tons and 564 000 tons, benefited significantly from the improved rainfall received during the key sugarcane growing months of November 2016 to March 2017.

- Over the past five years, Tongaat Hulett’s South African sugar operations have planted an additional 24 560 hectares to cane as the operation partnered with various government agencies, including The Jobs Fund, to use existing and emerging opportunities for cane development. These opportunities prioritise the establishment of indigenous black farmers in collaboration with rural communities, local governments and other relevant stakeholders, in all the company’s areas of operation.

- Given ongoing average rainfall, particularly during the key sugarcane growing summer months of 2017/18, sugar production in the 2018/19 season is projected to grow to between 630 000 tons and 680 000 tons as the operations benefit from the growth in hectares harvested and improved sugarcane yields.

Intensive agricultural improvement programmes have already yielded considerable benefits and are ongoing

Weather and growing conditions over the past two years have masked the substantial progress made with the intensive agricultural improvement programmes. Significant progress continues to be made on these programmes that have, as their primary focus, higher cane yields, improving sugar content and sugar extraction. Key themes include the following:

- Multiple initiatives to improve the quality and quantity of the cane have been implemented, and include soil health, root management and crop nutrition, optimising soil moisture management, adjustments to match fertiliser application to soil and crop requirements, cover cropping/green manure (alternative crop to break mono-cropping cycle) and additional measures to control weeds, pests and diseases.

- Improving water efficiencies, including the implementation of more efficient irrigation methods and upgrades to drainage systems, particularly in Mozambique. This process has also included actions to improve the availability of equipment, predominantly for items related to the irrigation of cane.

- The availability and reliability of electricity for irrigation in Mozambique and Zimbabwe has improved, with a reduction in load-shedding by the utilities and the success of a secure power agreement in Zimbabwe. Problems with the mills’ own power generation equipment at Xinavane, Triangle and Hippo Valley, and with the utility’s transformer at Mafambisse, were all addressed during 2016.

- Extensive training programmes have been implemented over several years to ensure that employees in the agricultural operations are equipped to diligently execute best farming practices. These programmes have been augmented with changes in management structures, including the appointment of additional field managers.

- Dissemination of best practices across operations.

- A common reporting framework, and the implementation of a peer review system that enables benchmarking and improved management of operational efficiencies.

Reducing the cost of the sugar production value chain, from cane growing to the delivery of sugar to the customer

Substantial reductions in the cost base have been achieved over the past four years.

- The decrease in costs achieved over the previous four years, equivalent to some R1,45 billion in real terms, provides good momentum for ongoing cost reduction in the sugar operations. The insights gained and the systems and disciplines put in place over previous years position the operations ideally to manage costs as sugar production increases. Unit costs of sugar production will benefit substantially from future volume increases, given the high proportion of fixed costs inherent in sugar milling and cane growing activities.

- Generally, 85 to 90 percent of sugar milling and overhead costs are fixed. On average, the sugar milling and overhead costs account for 30 percent of the total cost of sugar production.

- Agricultural costs related to sugarcane faming are largely fixed or directly linked to the extent of hectares being farmed.

- Harvesting, loading and transport costs vary depending on the distance to the sugar mill, and generally mills are supplied by sugarcane that is farmed within a 100-kilometre radius. On average, these associated costs account for 20 percent of the total cost of sugar production.

- The implementation of the intensive agricultural improvement programmes is contributing to savings on electricity and fertiliser cost as the benefits of improved irrigation and precision farming are realised.

- Tongaat Hulett has developed, patented and proven, via a demonstration plant, a new sugar refining technology, called GREEN refining. When fully implemented, the technology will reduce the energy requirements of a refinery by approximately half. The first phase of this technology is currently being implemented at the refinery in Durban, at a cost of some R90 million. The technology will be commissioned in the last quarter of 2017/18, and the benefits in respect of the refinery’s operating costs will accrue during the next financial period.

Increasing value out of molasses and the fibre in sugarcane - animal feeds, ethanol and electricity

- Molasses, which is the liquid co-product arising from the production of raw crystal sugar at the sugar mills, is a valuable component of the sugar value chain. Tongaat Hulett is in the process of moving from a local approach in the use of molasses to a regional approach, in which the molasses arising from the various mills is utilised in the optimal way, taking account of the logistics costs involved in moving the product within the region. Currently, most of Tongaat Hulett’s molasses is being used in South African animal feeds and Zimbabwean ethanol production.

- Tongaat Hulett has been producing fuel-grade ethanol in Zimbabwe for blending in the local market for the last few years. During the 2016/17 season it produced 21 million litres of which 5 million litres was supplied to industrial users, while the remaining 16 million litres was used for fuel blending. In South Africa, a decision by any of the sugar companies to invest in the production of fuel ethanol is dependent on regulatory certainty around the price support mechanism for sugar-based ethanol and finalisation of all the details around the regulatory framework.

- In South Africa, progress on the renewable energy and cogeneration independent power producer procurement programme nationally has been slow in the last 24 months, complicated by a current oversupply of generation capacity, and Eskom’s consequent reluctance to deliver on its obligations in respect of the programme. A cogeneration programme for major sugarcane-based projects has not yet been issued by IPP and the Department of Energy. Tongaat Hulett and the South African sugar industry are continuing to engage with government at various levels to move the possibilities for electricity from cane fibre forward. It is not expected that any bidding will be possible in 2017.

- Work is in progress to put in place the necessary arrangements to wheel electrical power from the Felixton sugar mill to the Germiston starch factory.

- Both ethanol and electricity provide significant promise for rural development and job creation, and hence are important for the future development of the industry.

- The combined impact of Tongaat Hulett’s Voermol operation and the co-product volumes produced by the starch operation, results in Tongaat Hulett having a significant footprint in the animal feeds industry. The business continues to explore opportunities to expand this footprint in the region, particularly at its Mozambican and Zimbabwean operations.

STARCH AND GLUCOSE - MORE COMPETITIVE MAIZE AND BETTER VOLUME PROSPECTS

The starch and glucose operation is well positioned strategically and is focused on growing its sales volumes, as it consolidates gains from the replacement of imports in the coffee and coffee creamer sector along with other sectors. It continues to enhance its product mix and to develop opportunities which have been identified and targeted for growth through exports. In the coming year, the benefit of the more competitive maize price, following the announcement of the 15,6 million-ton maize crop, will be particularly evident in the second half of the year, while the first half of the year will continue to see the impact of reduced co-product prices.

Tongaat Hulett’s starch operation currently has about 15 percent of its installed upstream wet-milling capacity available after servicing existing markets. The operation has a well-developed source of raw materials, a strong South African domestic market presence and access to regional markets.

Following the drought of last year and a small maize crop of 7,8 million tons, higher prices led to a 35 percent increase in planting area. This, combined with ideal weather conditions, resulted in an estimated crop of 15,6 million tons, the largest crop in the country’s history. This has seen maize prices fall from import parity levels to levels below export parity with absolute prices falling from levels of over R3 200 per ton to the current levels of below R1 900 per ton. Two areas of the starch operation are linked to the maize price, being maize as a raw material and second being the impact that it has on the revenues that Tongaat Hulett derive from some of its co-products, particularly Gluten 20, a feed product, which is sold to the animal feed industry.

In the first half of the 2017/18 year, with over 80 percent of customer contracts concluded at higher maize prices and co-product volumes being sold relative to the current maize prices, margins are expected to continue to be under pressure. The lower maize prices are encouraging for the second half of the current year, and will provide support to margins as new contracts are concluded. Over 75 percent of the maize requirements for the second half of the year will be priced at the current maize price.

During the 2016/17 financial year, Tongaat Hulett began to realise the benefits of its R135 million investment made in the coffee and coffee creamer sector in the 2015/16 financial year, with all imports of glucose, previously made by Tongaat Hulett and its customers, in the prior year being replaced with local production. In the case of Tongaat Hulett, this resulted in 6347 tons of prior year imported product being replaced with locally produced glucose. In addition to these volumes, 9363 tons of product, previously imported by traders and distributors for the powdered glucose and confectionary sectors, was replaced by local production. The difficult trading conditions experienced during the year have masked these gains with lower consumer demand and lower agricultural production, which impacted the paper converting and canning sectors, leading to some volume loss.

In looking ahead to the 2017/18 year, contracts amounting to 12 228 tons of new business have been concluded, and supply under these contracts has commenced. Further changes in customer raw material mix and the recommissioning of production lines by certain customers are expected to lead to further volume gains in the second half of the year. Work is continuing with customers to develop new regional and offshore export markets and to develop the modified starch market. The benefits from these initiatives, combined with the lower maize prices, will be particularly evident during the second half of the year.

VALUE CREATION FROM LAND CONVERSION AND DEVELOPMENT

Tongaat Hulett has a well-established development platform underpinned by a unique land portfolio in the fastest growing areas of KwaZulu-Natal. The mutually reinforcing and inextricable link to sugarcane farming activities and rural socio-economic development is maintained and over the past five years 24 560 hectares of new cane land have been planted, mainly in communal areas. A total of 3 582 developable hectares have been released from agriculture (Act 70 of 1970) out of the 7 709 developable hectares in the portfolio. Currently, 1 314 developable hectares have environmental impact assessment (EIA) approvals, of which 962 hectares were approved in the period, with a further 1 100 developable hectares well advanced in EIA processes. Taken together, these dynamics point to an expected acceleration of land conversion activity over the next two years.

The land conversion activities are capable of producing significant value to many stakeholders. Good progress is being made in the important value drivers. These include growing demand in selected usage areas; increasing the supply of shovel-ready land through planning processes and unlocking infrastructure. Furthermore, it entails the transferring of land to others through sales that include structuring selected transactions that are appropriate to unlock targeted Demand Drivers and deliver specific progress in transformation of ownership and participation in the real estate value chain. These all take place against a backdrop of nurturing continually improving relationships with key stakeholders.

- The ongoing use and conversion of land by Tongaat Hulett has a major impact on the various communities that make up the citizenry of the city and region, and offers business opportunities for a wide range of businesses. The achievement of optimal value creation through land use and conversion is dependent on sound, open relationships with, and support from, these communities, from all spheres of government and from businesses on whom the process depends for its success. This reality demands, on the one hand, sound, professional and appropriate mutual communication and ongoing stakeholder interface. On the other, it demands a firm commitment to, and demonstrable leadership in, the transformation of the rural, urban and real estate landscape throughout the land use and conversion process.

- Large-scale land conversion for urban development purposes requires collaboration between multiple stakeholders that generates co-ordinated actions toward infrastructural policy and strategy, planning and co-ordination, funding, procurement, implementation, operation and maintenance. Progress continues to be made in advancing the multiple processes that enable this co-ordination, thus ensuring that infrastructure ceases to be a constraint in the face of demand for real estate investment in the Durban and KwaZulu-Natal coastal regions.

- Possessing a strategic position on international shipping routes, a growing population of 3,7 million people and a diversified and sophisticated economy, Durban is expanding, driving demand for property across a wide range of usage categories. This includes high-intensity urban mixed use, residential neighbourhoods across a range of affordability levels, a growing retirement market, urban amenities for the growing metro, tourism markets, offices, warehousing, logistics, manufacturing, retail and various niched and unique clusters of opportunities.

- Land conversion and development activities recorded operating profit of R641 million from the sale of 75 developable hectares. This is lower than the currently expected pace, on average, of between 121 and 262 developable hectares annually over the next five years.

The sixth edition of the portfolio document for land conversion in KwaZulu-Natal, which provides further detail of the process and progress of value creation through the land conversion and development activities, is circulated in hard copy accompanying this report and is available here.

The conversion of land from agriculture to other uses to address demand requires formal release from agriculture, currently in terms of the subdivision of Agricultural Land Act, 70 of 1970. A new bill, the Planning and Development of Agricultural Land Framework Bill, is being considered to replace Act 70 of 1970. Release from agriculture involves both the provincial and national Departments of Agriculture and takes place within the parameters of the prevailing provincial and municipal strategic and spatial plans. Tongaat Hulett’s steady, planned conversion process over time, in line with both provincial and local government's strategic and spatial plans, underpinned by its leading role in developing agriculture in KwaZulu-Natal and optimum agricultural use throughout the process, provides the foundation for sustainable urban growth and development and, thereby, for the requisite policy support. Currently, some 3 582 developable hectares of land within the portfolio have formal release from agriculture, of which 624 hectares at Cornubia North were approved in this period.

A wide range of stakeholders benefit substantially from Tongaat Hulett’s land conversion processes. Society at large is deriving increasing benefit as Tongaat Hulett continues to improve its processes to attract fixed investment to the region, achieve urban spatial integration and integrated residential neighbourhoods, and create an ever-growing range of opportunities and mechanisms to stimulate transformation in property ownership and the real estate value chain. The land conversion process creates a platform for increased public sector income generation through rates and taxes, and maximises the returns from infrastructure investment, both financially and in terms of enterprise development, job creation and local economic development. Tongaat Hulett’s shareholders are benefiting from the reduced risk and increased value in the land portfolio. Simultaneously, Tongaat Hulett’s investments in new agricultural development are enhancing rural livelihoods.

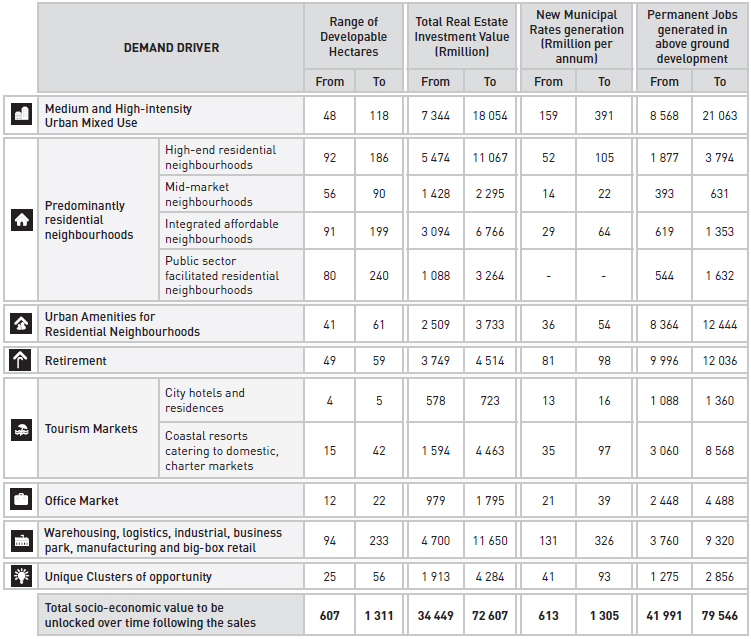

Underlying Demand and Expectations for Land Conversion Sales

The pace of sales is dictated by progress in moving land to a shovel-ready status; availability of metropolitan and regional scale infrastructure; demand arising from the various Demand Drivers and selection and successful conclusion of the sales transaction approach most appropriate for each specific set of circumstances. Current and planned progress on these key drivers, under current business conditions, leads to an anticipated range of sales over the next five years of between 607 and 1 311 developable hectares. These sales are expected to be achieved primarily from within 3 312 developable hectares in areas and landholdings tabulated and described in the land portfolio document.

Across all sectors, Tongaat Hulett’s land conversion activities have, to date, been concentrated mainly in one geographical location, namely the northward development of the city of Durban in the greater uMhlanga area. Progress in bringing more land into a state of shovel-readiness will bring a further three geographical locations, with distinct sub-markets, into play over the next two years, namely the region centered on the new King Shaka International Airport, the area of Ballito and its surrounds on the north coast and the expansion corridor to the west of Durban in the greater Hillcrest area.

Tongaat Hulett’s land conversion process reduces risk for property developers in a unique way by avoiding the need to execute multiple land purchases from diverse parties, carrying out all the planning and approval processes to ensure land is fit for the intended use, dealing with the provision of metropolitan and regional scale infrastructure and showing evidence of a track record of development and sustainable ongoing management at a sub-metropolitan scale sustained over a period of decades.

KwaZulu-Natal is home to 10 million people. It has a diverse economy, with particular strengths in agriculture, manufacturing, trade and tourism, while being relatively underweight in finance, real estate and the government services sectors. Increasing linkage with the growing Gauteng region is likely to encourage growth across all sectors.

Durban municipality is the main economic driver of KwaZulu-Natal, with a port handling over 60 percent of total container traffic to and from South Africa, a municipality with an investment grade credit rating, a new international airport with installed capacity to handle over 7,5 million passengers and 100 000 tons of freight and growth capacity to 65 million passengers and 2 million tons of freight. The GO!Durban integrated rapid public transport network currently being rolled out across the city will radically enhance Durban’s competitiveness and attractiveness as it commences operations during the next year.

Analysis of individual Demand Drivers continues to amplify that, in many cases, Durban is lagging its potential to attract or address business and residential demand that would drive real estate investment and hence land take-up. Ongoing progress in creating more shovel-ready land in the region, across different geographical localities and serving a range of markets, is expected to start to enable underlying demand requirements to be satisfied better and to create the opportunity for Tongaat Hulett and the region to become more proactive in attracting investment and creating new markets.

Driven by urbanisation, growing population and increasing numbers of middle-class households, residential neighbourhoods and their associated amenities are expected to comprise between 60 and 70 percent of the total land demand. Demand for high-end residential around uMhlanga is robust as the area grows in stature as a prime location on the national scale for homes and investment properties. Within the greater uMhlanga area, there is a significant under-supply of freehold sites in a secure environment, which Tongaat Hulett is seeking to address through planning processes.

The country’s economy reflects a growing first-time-buyer market and, potentially, an emerging downsizing and renting trend. The current rental take-up rate for mid-market residential product in uMhlanga Ridge averages 80 units per month and it is projected that the market will continue to take up to 1 000 units per annum. The strategy in this market sector is also to bring more opportunities to the market to meet the substantial demand.

Integrated, affordable residential remains a priority of government, while nationally, as well as within Tongaat Hulett’s land portfolio, delivery lags demand substantially. Tongaat Hulett’s primary response is to address supply side blockages. In this period, sales have taken place that have introduced the first integrated, affordable residential at scale in the region, bringing in national developers, who were hitherto completely absent, despite recognising that a balanced national portfolio must have Durban in the mix. The further interest from national and international developers is a key element of increasing supply into this price-sensitive market.

Retirement is a residential niche market where the north and west of Durban have been under-supplied, despite offering a very attractive location for the use. Recognising this, Tongaat Hulett has focused on this niche, including launching a digital marketing campaign. Since its inception in September 2016, the RetireKZN campaign has been achieving an average of 258 new registrations from interested end-users per month, indicating a deep pool of end-user demand and driving developer interest.

The ongoing residential development leads to demand for, and is in turn enhanced by the availability of, residential amenities such as schools, hospitals and the like. This period saw the sale of a site for the first new private school in the region for over a decade, while the first public school is commencing in Cornubia. There is significant interest in further schools in a number of locations. Tongaat Hulett’s land portfolio offers a number of strategic opportunities where high-intensity mixed use precincts are either already being implemented or are being planned and made ready for development. These include uMhlanga Ridge Town Centre, Bridge City, Ridgeside, Sibaya, Ntshongweni and the uMhlanga Ridge Western Expansion into Cornubia Town Centre. The development of this type of high-intensity mixed use precinct is being increasingly welcomed and supported by all levels of government. High-intensity mixed-use nodes have yielded some of the highest-value real estate in South Africa over the past decade, such as the Cape Town Waterfront and Melrose Arch, while uMhlanga Ridge is the largest such initiative in the country over the past fifteen years.

The ongoing residential development leads to demand for, and is in turn enhanced by the availability of, residential amenities such as schools, hospitals and the like. This period saw the sale of a site for the first new private school in the region for over a decade, while the first public school is commencing in Cornubia. There is significant interest in further schools in a number of locations. Tongaat Hulett’s land portfolio offers a number of strategic opportunities where high-intensity mixed use precincts are either already being implemented or are being planned and made ready for development. These include uMhlanga Ridge Town Centre, Bridge City, Ridgeside, Sibaya, Ntshongweni and the uMhlanga Ridge Western Expansion into Cornubia Town Centre. The development of this type of high-intensity mixed use precinct is being increasingly welcomed and supported by all levels of government. High-intensity mixed-use nodes have yielded some of the highest-value real estate in South Africa over the past decade, such as the Cape Town Waterfront and Melrose Arch, while uMhlanga Ridge is the largest such initiative in the country over the past fifteen years.

Outstanding weather and a variety of attractions account for KwaZulu-Natal’s popular appeal as a prime leisure and tourist destination, accounting for at least 30 percent of all domestic trips taken annually and 10 percent of annual international tourist arrivals into South Africa. The 70 kilometre stretch of coastline from uMhlanga to the Thukela River constitutes a central opportunity to pursue tourism development. The sustained hotel performance in uMhlanga has continued to fuel interest in the area from both South African and international hotel brands. There is currently no truly integrated beach resort in KwaZulu-Natal or South Africa. The KwaZulu-Natal coastline has been acknowledged by global tour and resort operators as South Africa’s foremost opportunity to compete with other global beach resort destinations, provided critical mass can be achieved. Tinley North is being framed around a formal expression of interest from a global resort operator to act as a catalyst for more instances of this type of development on the north coast.

KwaZulu-Natal is becoming more attractive for Business Processing Outsourcing (BPO) uses owing to its competitiveness with domestic and international players in this sector. eThekwini offers a cost competitive BPO value proposition due to lower office rental cost, telecommunication and labour costs, which are approximately 30 percent lower than Cape Town and Johannesburg.

KwaZulu-Natal is becoming more attractive for Business Processing Outsourcing (BPO) uses owing to its competitiveness with domestic and international players in this sector. eThekwini offers a cost competitive BPO value proposition due to lower office rental cost, telecommunication and labour costs, which are approximately 30 percent lower than Cape Town and Johannesburg.

The three percent vacancy rate in industrial space in the north of Durban is demonstrative of the need for additional industrial accommodation along the northern corridor, with growth hampered by the lack of appropriately located and serviced industrial land in the region. The long-term potential of this sector in the region is largely linked to the port activities and the primary logistics corridors of the N2 and N3. Efficient linkages to the ports and major domestic and neighbouring markets will become key drivers of value creation in this sector.

Recent developments in tertiary education in South Africa have spurred the growth of private tertiary education providers. Interest has been experienced from a number of tertiary institutions and educational service providers across a range of concepts from large campuses through to executive education and Technical and Vocational Education and Training (TVET) facilities catering for diverse technical skills linked to local industries.

Socio-economic value unlocked following Land conversion sales

Tongaat Hulett's land conversion process creates significant value over time for a wide array of stakeholders, based on pace of sales. The high-level assessment of these outcomes is based on research and empirical evidence-based forecasting, which is conservatively estimated and shown for each of the Demand Drivers in the table here. These socio-economic outcomes are typically unlocked over several years following sales.

The Total Real Estate Investment Value is an indication of the collective market value of all land and buildings on completion of construction activities for each Demand Driver and is estimated in current-day terms. Municipal rates income is generated across the real estate value chain throughout the development cycle. The table below shows an estimation of the rates income generated by the various Demand Driver uses once the buildings have been completed. Development activity, by its very nature, provides an ideal environment to create jobs, transfer skills and facilitate enterprise and supplier development as it stretches over the full real estate value chain. This applies to both construction activity (construction jobs), which occurs both at the infrastructure installation phase and the top-structure construction phase, and operational activity (permanent jobs), which commences once the buildings are completed and occupied.

RANGE OF SOCIO-ECONOMIC OUTCOMES THAT WILL BE UNLOCKED OVER TIME

TONGAAT HULETT'S SOCIO-ECONOMIC POSITIONING AND CONSTRUCTIVE INTERACTIONS WITH GovernmentS AND SOCIETY

TONGAAT HULETT'S SOCIO-ECONOMIC POSITIONING AND CONSTRUCTIVE INTERACTIONS WITH GovernmentS AND SOCIETY

Tongaat Hulett operates in a societal environment that is impacted by multiple developmental challenges. The company’s underlying philosophy is that, in partnership with society and government, it can contribute towards improving the prospects of a better life for many by making a substantial, positive impact on many socio-economic challenges, including job creation and security, transformation, attracting fixed investments, urban spatial integration, food security, youth development, infrastructure establishment and inclusive rural development. Given this context, the business has articulated its strategic goal of building a relationship with society that is based on shared value and prosperity. This strategic goal has been described as “Value creation for all stakeholders through an all-inclusive approach to growth and development”.

The business has long-standing, constructive relationships with rural communities, governments and other key stakeholders. The following are some examples of recent achievements:

- In Mozambique, where deep rural communities have limited access to healthcare and other basic facilities, Tongaat Hulett has played a significant role in improving the quality and extent of healthcare that is available to the communities that surround its Xinavane and Mafambisse operations. From the perspective of economic development of these rural economies, the number of small-scale indigenous farmers has grown from 249 in the 2007/08 season to 2 389 in 2016/17. During this time, sugarcane received from these farmers has grown from 45 528 tons to 340 234 tons.

- In Zimbabwe, Tongaat Hulett plays a significant role in the provision of primary healthcare. In the 2016/17 year, some 232 000 people received primary healthcare support through the two hospitals that the operations manage in the eastern Lowveld. The business continues to work with the government and local communities on the orderly development of sustainable indigenous private farmers in the south-eastern Lowveld. The extent of sugarcane supplied by indigenous farmers has grown from 532 000 tons in the 2011/12 season to just over 1,1 million tons in 2016/17. During this time, the cumulative number of jobs created by these farmers has increased from 4 750 to 8 000 people, and this has substantially contributed to the economic development of the region.

- In South Africa, transformation, housing, job creation and rural economic development continue to be some of the primary developmental challenges. Tongaat Hulett is actively involved in numerous traditional authority areas in rural KwaZulu-Natal through various agricultural and socio-economic development initiatives. A prime example of the activities that the company is involved in, is its partnership with The Jobs Fund, which to date, has resulted in the planting of 6 781 hectares of sugarcane, the creation of 1 802 new permanent jobs, 1 124 beneficiaries being trained and the establishment of 27 agricultural cooperatives across 15 traditional councils.

- The starch operation is the third largest purchaser of maize in South Africa. It is therefore well positioned to influence and play a leading role in the transformation of the maize industry, as well as increasing the supply of maize in southern Africa.

- The key objectives of Tongaat Hulett’s land conversion are to create wide stakeholder value by fostering investment and economic activity through unlocking targeted Demand Drivers and to deliver specific progress in transformation of ownership and participation in the real estate value chain. This includes the achievement of transformation and empowerment objectives spanning the property development and investment value chain.

2007 BEE Transaction in South Africa

As part of the company’s Broad-Based Black Economic Empowerment deal in 2007, the Ayavuna and Sangena consortiums, rural communities via the Masithuthukisane and Mphakhathi trusts and company employees via the ESOP and MSOP Trusts, obtained voting and shareholder rights in Tongaat Hulett (see here for further information).

Tongaat Hulett subscribes to the principle of "ZERO HARM"

Tongaat Hulett subscribes to the principle of "ZERO HARM". The "ZERO HARM" philosophy is embedded in the company’s business framework as a core value. The company’s safety performance improved substantially during the past decade, having been built up on established safety management systems and various safety improvement initiatives. Tongaat Hulett has been consciously introducing targeted high-fatality risk control interventions that are being reviewed regularly. This executive intervention approach has been attributed to a sustained safety improvement realised so far.

The safety and the welfare of all employees, which amounts to some 38 200 people during the peak milling period, remain a key priority as the business strives towards establishing an organisational culture with a "ZERO HARM" approach. The company’s safety performance in terms of serious injuries that result in loss of time slightly declined in 2016/17 compared to the previous year. A Lost Time Injury Frequency Rate (LTIFR) of 0,0930 per 200 000 hours worked was achieved in 2016/17, reflecting a negative trend for the first time in more than five years, following a prior consistent performance of 0,073 achieved in 2015/16. This decline was partly caused by an increase of five lost time injuries and a significant reduction of employee hours worked amounting to 10 million hours when compared to those recorded in 2015/16. One of the highlights of the year was the hours worked without an LTI achieved by the Xinavane agricultural operations, during which they exceeded 37 million LTI-free hours.

The safety programme is continuously reviewed and a new approach to further manage high-fatality risks was adopted. Key elements of this emerging safety approach involve the following:

- Top-down approach - key topics of motorised equipment, moving machinery, unsafe behaviour and contractor management are common across all operations and are being monitored at senior executive and Board levels.

- Country/operational specific topics, e.g. work at heights, hazardous chemicals and energy release are being monitored and reviewed at business unit level.

- Proactive/reactive top executives stand-back reviews of business operations experiencing poor production/ financial/safety trends are being reviewed.

- New risk matrix has been adopted and is being consistently applied in reassessment of high-fatality risk topics.

Regrettably, a total of three work-related fatalities were suffered during the 2016/17 year. Ms Ntomboxolo Tshomela, who was employed by Tongaat Hulett land conversion contractor, Emerald Landscapes, was fatally injured after being hit and run over by a third-party vehicle on a public road. In Zimbabwe, Mr Desire Chikwanda, an electrician at Hippo Valley, fell from an 11-metre-high crane gantry structure where he was repairing lights. Mr Godfrey Mthethwa, a security guard employed by Rainbow Security, based at Tongaat Hulett’s Sibaya construction site, was fatally injured after being attacked by unknown assailants at his work station.

Mental health issues, and stress and non-communicable diseases worldwide are contributing to the burden of disease among employees. While acute infectious diseases (e.g. malaria) still rank as the leading cause of ill health, non-communicable diseases are increasingly featuring in the causes of ill health among employees. Tongaat Hulett is working towards implementing the South Africa National Standards (SANS) 16001 on wellness management systems to ensure best practices are adopted and measured for compliance.

SHE and food safety performances are benchmarked against global best practices to promote continuous improvement and stakeholder satisfaction. Operations subscribe to various internationally recognised management systems and/or specifications that include NOSA, OHSAS 18001, ISO 14001, ISO 9001, FSSC 22000 and ISO 22000. All operations retained certification to either NOSA 5 Star systems or OHSAS 18001 covering occupational health and safety. All 19 main operations, are now certified to the ISO 14001 environmental management system. All starch operations, the refinery, and pack stations for Xinavane, Triangle and Namibia operations retained certification to FSSC 22000 or ISO 2200 on food safety management systems.

Social Sustainability and Innovation

Tongaat Hulett’s evolution in the priority area of social sustainability demonstrates innovation in a number of areas. This includes a holistic approach to socio-economic development and corporate social responsibility.

- Social sustainability and innovation are fundamental to the business as Tongaat Hulett seeks demonstrable and practical outcomes in terms of positive social transformation, environmental stewardship and community upliftment.

- The evolution of Tongaat Hulett, in continuing to be regarded as a responsible corporate citizen has also seen the business continue to embrace good corporate governance by adhering to legal and accepted business practices as embodied in the principles of the King III. The company continues to uphold the principles of corporate social responsibility by demonstrating to society its commitment to philanthropic and empowerment initiatives within the communities in which it operates.

- Tongaat Hulett has a substantial land footprint in the countries in which it operates. It is within this context that the company subscribes to principles of sustainable development.

- The business’s participation in various sustainability reporting initiatives, including the CDP, the CDP Water Disclosure Project, the Nedbank Green Fund and its listing on the FTSE/JSE Responsible Investment Index for the thirteenth consecutive year are testimony to Tongaat Hulett’s approach to sustainability and stakeholder value creation.

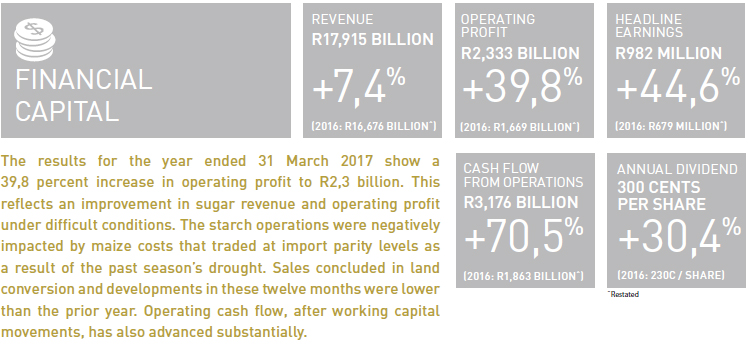

FINANCIAL REVIEW

The various sugar operations generated operating profit of R1,271 billion (2016: loss of R15 million). This is reflective of more effective import protection dynamics, improved local market prices and higher prices realised for exports, especially into regional African markets and the EU. Sugar production totaled 1 056 000 tons (2016: 1 023 000 tons), with volumes impacted by low cane yields due to the drought experienced in KwaZulu-Natal and poor growing conditions with low rainfall and restricted irrigation levels in Mozambique and Zimbabwe as a result of low dam levels. The momentum established to reduce costs has been maintained across all operations.

The South African sugar operations, including various downstream activities, produced operating profit of R390 million (2016: loss of R85 million). Sugar production started to recover, amounting to 353 000 tons (2016: 323 000 tons), costs were well contained and Tongaat Hulett increased its share of total industry production to 22 percent (2016: 19,5 percent), leading to an increased proportion of local market sales. The local market saw significantly better pricing and sales mix dynamics. The higher value of standing cane is reflective of the yield recovering in the next crop following the good summer rainfall in the past six months. Voermol animal feeds has contributed well, with increased margins.

The Mozambique sugar operating profit improved to R308 million (2016: R25 million). Sugar production was 198 000 tons (2016: 232 000 tons). Domestic market sales of locally produced sugar increased by 21 percent, for the whole industry, as a result of better protection against imports and improved sugar distribution and availability in more remote areas. Local market price increases and higher export prices positively impacted revenue and cane valuations. The Metical weakened substantially against the Rand and the US dollar, benefitting the operations with sizeable Metical based costs and revenue linked to the US dollar.

The Zimbabwe sugar operating profit increased to R504 million (2016: R9 million). Sugar production increased by 10 percent to 454 000 tons (2016: 412 000 tons). Local market sales volumes and mix improved due to there being lower imports into the market. Exports increased on the back of higher production and prices realised into the EU and regional markets were some 20 percent above the previous year. As part of an ongoing process, involving Government and farmers, to review the division of proceeds, an upward adjustment to the milling portion was made in the past year, with the commensurate recovery for sugar milling.

The starch and glucose operation recorded an operating profit of R510 million (2016: R658 million). Margins were negatively impacted in the second half of the year by maize costs which were at import parity levels following the drought of the past season and by lower co-product revenues. An improved sales mix was achieved during the period due to the successful replacement of imported volumes with local production and ongoing market development for modified starches and powdered glucose. This was offset by lower volumes as the prevailing economic climate led to lower consumer demand.

Land conversion and development activities recorded operating profit of R641 million (2016: R1,115 billion). The major contributors were Sibaya (high-end residential, retirement and school - 57 developable hectares sold), the industrial area of Cornubia (6 hectares), high-intensity mixed use areas of uMhlanga Ridgeside (2 hectares) and uMhlanga Ridge Town Centre (1 hectare), integrated affordable residential at Bridge City (3 hectares and further high end residential at Izinga (4 hectares) and Kindlewood (2 hectares), totaling 75 developable hectares compared to 121 developable hectares sold in the prior year. Revenue, costs and profit recorded per developable hectare vary, reflective of the degree of enhancement through urban planning, land use integration and density, location and the intensity of infrastructure investment and are in line with the value ranges communicated previously. During the year, the remaining interests in the Zimbali properties were disposed of to IFA for a cash component and in exchange for their joint venture share of the Westbrook/Zimbali South Banks land, resulting in some R24 million being recognised in operating profit.

The stronger Rand exchange rate at the year-end against the US dollar in respect of Zimbabwe and the Metical in respect of Mozambique has led to a reduction in the foreign currency translation reserve on consolidation into Rands of these operations’ balance sheets, which is reflected in the statement of changes in equity and other comprehensive income.

Operating cash flow (after working capital movements) was R3,176 billion which is a R1,3 billion increase over the R1,863 billion of last year. Sugar cash flows improved as a result of higher revenue and operating profits, as well as lower root planting costs and capital expenditure during the past drought. The land conversion and development activities generated stronger operating cash flow, with significant proceeds being received and after development expenditure related payments being made. In total, after taking into account capex and root planting costs which totaled R1,2 billion (2016: R1,9 billion), there was a net cash inflow (after dividend payments) of

R544 million, compared to a net cash outflow of R1,278 billion last year. Tongaat Hulett’s net debt at 31 March 2017 was

R4,780 billion, compared to R5,101 billion at March 2016. Finance costs of R810 million (2016: R680 million) were commensurate with the borrowing levels during the period and the higher interest rates.

Operating cash flow (after working capital movements) was R3,176 billion which is a R1,3 billion increase over the R1,863 billion of last year. Sugar cash flows improved as a result of higher revenue and operating profits, as well as lower root planting costs and capital expenditure during the past drought. The land conversion and development activities generated stronger operating cash flow, with significant proceeds being received and after development expenditure related payments being made. In total, after taking into account capex and root planting costs which totaled R1,2 billion (2016: R1,9 billion), there was a net cash inflow (after dividend payments) of

R544 million, compared to a net cash outflow of R1,278 billion last year. Tongaat Hulett’s net debt at 31 March 2017 was

R4,780 billion, compared to R5,101 billion at March 2016. Finance costs of R810 million (2016: R680 million) were commensurate with the borrowing levels during the period and the higher interest rates.

Taking all of the aforementioned into account, headline earnings for the year increased by 44,6 percent to R982 million (2016: R679 million).

A final dividend of 200 cents per share (2016: 60 cents per share) has been declared bringing the annual dividend to 300 cents per share (2016: 230 cents per share).

LOOKING AHEAD

Tongaat Hulett will continue to enhance its strategic positioning, focusing on multiple strategic thrusts, with a positive impact on earnings and cash flow.

Increasing Returns from the Sugar Asset Base Recovering Cane Yields, Growing Sugar Production, Utilising Existing Capacity, with Low Incremental Costs

Weather and growing conditions over the past two years have masked the substantial progress that is being made with intensive agricultural improvement programmes, increased hectares under cane, irrigation efficiency and power reliability. The estimated impact is some 500 000 tons of annual sugar production. The existing sugarcane footprint, with regular growing conditions, the agricultural improvement programmes and the completion of the few new planting partnership initiatives underway should produce some 1 650 000 tons of sugar. Tongaat Hulett’s objective is to continue with these actions until it fully utilises its installed milling capacity of more than 2 000 000 tons per annum. The recent completion in Zimbabwe of the Tokwe-Mukorsi dam and, in Mozambique (Xinavane), the raising of the Corumana dam wall and the construction of the new Moamba dam on the Incomati river, will diversify the water catchment area and provide increased stability in future water supply.

An early season estimate for total sugar production in 2017/18 is between 1 176 000 tons and 1 278 000 tons, compared to 1 056 000 tons in 2016/17. The good rainfall of the 2016/17 summer in the coastal areas of KwaZulu-Natal is positive for the 2017/18 crop yield and more hectares are to be harvested. The 2017/18 crop in Zimbabwe and Mozambique will be impacted to some extent by the reduced irrigation and limited replanting that was necessary during 2016. The current dam levels following the good rains at the end of 2016 into 2017 will provide full irrigation during 2017/18 leading to a significant crop recovery by 2018/19. Total sugar production is expected to recover over 2 years, to between some 1 485 000 and 1 588 000 tons in 2018/19. Tongaat Hulett’s marginal cost of additional sugar production is currently some US$100 per ton from own cane (40 percent) and US$280 per ton from third-party cane (60 percent). Realisations, ex-mill, based on current regional and EU market dynamics are approximately

US$390 per ton.

An early season estimate for total sugar production in 2017/18 is between 1 176 000 tons and 1 278 000 tons, compared to 1 056 000 tons in 2016/17. The good rainfall of the 2016/17 summer in the coastal areas of KwaZulu-Natal is positive for the 2017/18 crop yield and more hectares are to be harvested. The 2017/18 crop in Zimbabwe and Mozambique will be impacted to some extent by the reduced irrigation and limited replanting that was necessary during 2016. The current dam levels following the good rains at the end of 2016 into 2017 will provide full irrigation during 2017/18 leading to a significant crop recovery by 2018/19. Total sugar production is expected to recover over 2 years, to between some 1 485 000 and 1 588 000 tons in 2018/19. Tongaat Hulett’s marginal cost of additional sugar production is currently some US$100 per ton from own cane (40 percent) and US$280 per ton from third-party cane (60 percent). Realisations, ex-mill, based on current regional and EU market dynamics are approximately

US$390 per ton.

The decrease in costs achieved over the past four years (equivalent to some R1,45 billion in real terms) provides good momentum for the ongoing cost reduction process. The objective is to further reduce the cost of sugar production, from cane growing to the delivery of sugar to the customer. The nature of sugar milling and cane growing is such that there is a high proportion of fixed costs and a low variable or incremental portion. Unit costs of sugar production will reduce further with the benefit of future volume increases. The ongoing cost reduction process is focused on bought-in goods, services, transport, marketing, salaries and wages.

The domestic markets in countries where Tongaat Hulett produces sugar remain a key focus area. There has been some progress in South Africa and significant success in Zimbabwe and Mozambique with the required protection from imports, with Government support, given the high rural job impact of these industries and being in line with international norms. In South Africa, discussions are underway between the South African Sugar Association and the relevant SA government departments, to increase the level of the reference price used for the import tariff determination. The current import tariff level is the lowest in the region and with the volatility of the Rand against the US dollar, a risk exists of increased imports from overseas sources into the SACU market. In Zimbabwe and Mozambique, sugar refining matters are being addressed, which should lead to the replacement of imported industrial white sugar. Growth is expected in consumption per capita, off a low base, particularly in Mozambique and partly in Zimbabwe, supported by distribution, industrialisation and marketing initiatives. Tongaat Hulett has the leading sugar brands in South Africa, Zimbabwe, Botswana and Namibia. The proposed sugar sweetened beverage tax in South Africa and its socio impact is being assessed and debated. It is likely to have a limited effect on total local sugar demand and the financial impact would inter alia depend on the level of the prevailing world sugar price.

Tongaat Hulett has key market positions and experience in both the region (southern and eastern Africa) and the EU for the sale of its additional sugar. It is developing and expanding its positions in regional deficit markets, where a premium is earned over world market prices as well as broadening its footprint in key value-add markets in the EU where it enjoys preferential access.

The price of raw sugar in the world market, having traded in a wide range of some 14,0 to 23,8 US cents per pound in the 12 months to March 2017 (13,2 to 16,7 US cents per pound in the prior year), has come under pressure over the past six months from emerging forecasts for a global supply surplus in the 12 months to September 2018. Of late, it is trading in the region of 16,5 US cents per pound. The price of raw sugar is currently expected in the coming year to trade in a broad range of 14 to 18 US cents per pound, impacted by supply prospects over the coming 15 months in the major sugar producing countries. The sugar/ethanol mix in Brazil is expected to increasingly impact on world sugar prices. In the medium term, there continue to be concerns of the ability of global supply to match demand at prevailing price levels. Global sugar consumption is predicted to continue to grow at a rate of some 1,5 percent per annum, with most of this growth coming from low per capita consumption developing countries.

Starch and Glucose - More Competitive Maize and Better Volume Prospects

The starch and glucose operation is well positioned strategically and is focused on growing its sales volume, as it consolidates its gains from replacement of imports in the coffee and coffee creamer and other sectors, continued enhancement of its product mix and developing opportunities which have been identified and targeted for growth through exports. Working together with customers, further opportunities are being targeted for growth through customer exports. Market development to increase the production of value added modified starches is progressing. This is all underpinned by improving the use of the available capacity and the efficiency of operations.

Following the drought of the past year, high maize prices led to a significant increase in maize plantings and combined with good summer rainfall conditions are expected to yield a crop of 14,5 million tons (2016/17: 7,5 million tons). New season maize prices have moved close to export parity levels and will benefit operating margins in the second half of the new financial year. Co-product revenues are expected to remain under significant pressure in the first half of the year. A recovery in sales volumes is anticipated during the coming year as customers’ import contracts expire and are replaced with local production. Further volume growth is expected to be supported by some recovery in consumer demand and increased export sales as the benefits of lower maize prices materialise.

Value Creation from Land Conversion and Development

Tongaat Hulett is focused on creating stakeholder value through converting prime land near Durban and Ballito to enable investors, developers and end-users to access bankable, shovel-ready real estate investment projects that yield the best possible urban use. Over the past three years 304 developable hectares, from the portfolio of some 7 709 developable hectares, have been converted to such projects. Simultaneously, Tongaat Hulett drives rural development in the cane catchment area of its sugar mills and over the past five years 24 560 hectares of new cane land have been planted, mainly in communal areas. The value creating capability of the land conversion activities continues to increase, with good progress in the important value drivers. These include nurturing sound relationships with key stakeholders; growing demand in selected usage areas; increasing the supply of shovel-ready land through planning processes and unlocking infrastructure; and transferring land to others through sales that include structuring selected transactions that are appropriate to unlock targeted demand drivers and that deliver specific progress in transformation of ownership and participation in the real estate value chain. Further Act 70 of 1970 approvals were received in the period, taking the total to some 3 582 developable hectares. These approvals are being consolidated through further planning. A total of 962 developable hectares achieved EIA approval in the period, bringing the total of land with EIA approvals in the portfolio to 1 314 developable hectares, with a further 1 100 developable hectares being well advanced in EIA processes.

Negotiations on some 233 developable hectares are currently underway, representing profit potential of around R1,58 billion. These reflect diverse current demand, covering affordable residential, mid-to-upper market residential, retirement, offices, warehousing and logistics, resort/hotel, a range of urban amenities, and educational uses. The nature of the transactions being negotiated is selected to suit the demand sector, optimise value created and achieve transformation objectives and accelerated investment into the region. Geographically, these negotiations include uMhlanga Ridge Town Centre (Commercial and Residential), Ridgeside Precincts 1 and 2, Sibaya Nodes 1, 5 and 4, Kindlewood, Bridge City, various Precincts in Cornubia (Cornubia Town Centre, Marshall Dam Residential, uMhlanga Hills and Blackburn Extension) and Tinley Manor. In addition, increasing enquiries are being received at Ntshongweni, west of Durban, and in the airport region. A detailed update on the portfolio and the process and progress of creating value through land conversion in KwaZulu-Natal is available here.

2017/18

Tongaat Hulett’s profit for the 2017/18 year will continue to be influenced by a number of substantial and varying dynamics, both positive and negative. Overall, there is a positive outlook for the full year with earnings growth expected to continue and the cash flow momentum expected to be maintained.