SALIENT FINANCIAL FEATURES

OF 2015/16

THE RESULTS FOR THE YEAR ENDED MARCH 2016 WERE ATTAINED WITH

- the starch operations delivering a record performance;

- land conversion and development activities continuing to unlock substantial value and delivering a record operating profit;

- a substantial reduction in sugar production as a result of poor growing conditions (the operations are volume sensitive, with sugar milling and cane growing having a high proportion of fixed costs); and

- positive achievements in the sugar operations in terms of substantial cost reductions in real terms over the past three years and securing and improving local market positions.

|

STARCH OPERATIONS

|

|

|

SUGAR OPERATIONS

|

|

|

LAND CONVERSION AND DEVELOPMENT ACTIVITIES

|

| REVENUE | OPERATING PROFIT |

HEADLINE EARNINGS |

CASH FLOW FROM OPERATIONS |

ANNUAL DIVIDEND |

||||||||

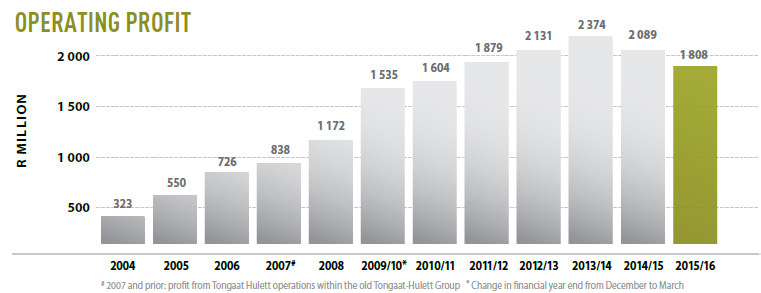

| R16,676 | R1,808 | R783 | R1,262 | 230 Cents | ||||||||

| billion | billion | Million | billion | PER SHARE | ||||||||

| +3,2% | -13,5% | -17,1% | -50,2% | -39,5% | ||||||||

| (2015: R16,155 billion) | (2015: R2,089 billion) | (2015: R945 Million) | (2015: R2,533 billion) | (2015: 380 cENTS per share) |

Cash flow from operations was lower than operating profit, largely as a result of debtors increasing by some R1,3 billion due to the timing of inflows in respect of land conversion activities