CHIEF EXECUTIVE'S REVIEW 2008

Peter Staude

Chief Executive Officer

Tongaat Hulett grew profit from operations in 2008 by 35 percent to R1,132 billion with headline earnings improving to R583 million (2007: R61 million) as it continues to capitalise on its competitive position as an agri-processing business which includes integrated components of land management, property development and agriculture.

The benefits of increased focus and related actions in the business gained momentum during the year. In Mozambique excellent progress was made on the sugar expansion that will benefit from the improved market access for Least Developed Countries (LDC) to the European Union (EU). In the starch operations, the advances made over a number of years ensured that the operation was able to benefit from the improved local maize and international starch and glucose markets. The continued expansion of eThekwini and the need to provide the necessary infrastructure to support community developments resulted in the successful conclusion of land sales in the eThekwini growth corridor, in a market environment where conditions deteriorated in the prime residential, resorts and commercial sectors. In the South African sugar operations improved domestic sales volumes, a higher world price and a weaker exchange rate combined with increased contributions from downstream value added activities resulted in an improvement in operating earnings.

The Zimbabwean operations had to contend with the extreme effects of hyperinflation, exchange rate movements, foreign currency shortages, price controls and a loss of skills. These circumstances lead to the collapse of Zimbabwean macroeconomic fundamentals with the manufacturing sector alone estimated to be operating at less than 20 percent of its capacity. In these uncertain and volatile times, the first signs of change within Zimbabwe are beginning to materialise. The impasse between opposition parties is beginning to recede with the formation of a Government of National Unity and the Governor of the Reserve Bank of Zimbabwe has announced significant monetary reforms that seek to facilitate the upliftment and restoration of various key economic sectors. These reforms are positive for Tongaat Hulett’s operations in Zimbabwe and are anticipated to be backed by the necessary regulatory changes that will result in a relaxation of government intervention in the Zimbabwean economy.

Tongaat Hulett continues to be recognised for its achievements in the area of transformation and during 2008 it was ranked fourth out of all listed companies in South Africa and as the top food and beverage company in the annual Financial Mail empowerment survey. During the second BEE accreditation process, Tongaat Hulett achieved a score of 70,38 percent (2007: 75,16 percent) and was awarded Level Four Contributor status in terms of the broad based South African BEE scorecard, which entitles its customers to recognise in their own scorecards their full procurement spend with the company.

The safety and the welfare of all employees remains a key priority as we strive to create a workplace free of injuries. Regrettably, the seven fatalities that occurred during the year served as a cruel reminder of the risk profiles that exist across the operations. The emphasis in safety programmes has undergone a step change with a shift in focus to identifying high risk activities at each operation and the implementation of associated actions that include an evaluation of the effectiveness of existing control measures, risk assessment training for all management and supervisory staff, accreditation, selection and management of contractors, accident and incident investigations, and workforce training and involvement. In 2008, progress was made in reducing safety risks as reflected in the continued reduction in Lost Time Injuries to 57 (2007: 71) and the reduction in the Lost Time Injury Frequency Rate to 0,11 (2007: 0,14). The provision of primary health care services continues to receive a high focus with particular emphasis on the health risks posed by HIV and AIDS, malaria and cholera to its staff and the communities in the regions in which it operates.

TONGAAT HULETT’S COMPETITIVE POSITION IN A CHANGING WORLD OF AGRICULTURE

Review of the Global Environment within the Context of Prevailing Economic Conditions

Agricultural markets continue to be supported by the strong underlying growth in food demand being driven by income growth and changing dietary patterns in developing countries as population numbers increase. This is coupled with an increase in the number of people in the world that are estimated to be undernourished to 960 million and will place additional pressure on the need to expand global food production. Low and stable prices for agricultural commodities that existed during the past two decades discouraged the necessary increases in production, resulted in less research into improving agricultural productivity and a decrease in global stocks. These factors, coupled with the recent development of renewable energy, albeit at decreased rates in the short term, continuing market reforms and adverse weather conditions have resulted in the prices of agricultural commodities remaining above their longer term average despite recent reductions as a result of current global market conditions.

As the pressure on the world’s scarce fresh water resources increases, Sub-Saharan Africa, excluding South Africa, with less than 10 percent of its existing available water resources being utilised, is in a position to make more efficient use of this resource in order to increase agricultural production.

The interrelationships between crops, such as soya and other edible oils, maize, cassava, wheat and sugar cane are increasing as farmers and agri-processors are confronted by choices as to which crops to farm and process, based on their relative profitability and initial input cost requirements given the restricted access to credit supply in the current markets. Tongaat Hulett, with its portfolio of agri-processing assets, is well positioned in this world of increasing demand for agricultural products.

World sugar prices, after initially increasing to levels of 14,5 US cents per pound in early 2008, declined to levels as low as 10 US cents per pound despite a reduction in sugar production in India. Early in 2009, sugar prices recovered to 13 US cents per pound. Factors that continue to affect prices include improving margins of low cost sugar cane producers in the developing world due to exchange rate movements, lower international oil prices, the reforms in the EU sugar sector and the expectation that India will move from a sugar surplus to the need to import sugar to supplement local production.

The international maize price has experienced a period of high volatility and after rising to record levels during the first part of 2008 has fallen rapidly to current levels as the impact of the global financial market crisis continues. The weakness of the South African Rand along with other emerging market currencies has limited the decrease in the South African maize price, resulting in a price which allows farmers to cover input costs whilst local prices remain competitive in world terms. This is expected to support improved margins in the production of starch-based products.

TThe global proportion of the world population living in urban areas was estimated at 50 percent in 2005 with projections by the United Nations indicating a rise to 60 percent by 2030. This trend is equally prevalent in South Africa where the provision of housing, specifically for those with limited incomes is seen as a national priority. Recent reports have estimated the national housing backlog at 2,2 million units with approximately 200 000 of those in eThekwini.

The growth in demand for agricultural products, coupled with an increase in competition for alternative land usage due to increasing urbanisation and tourism growth, is resulting in an increase in the significance of agricultural land in many countries. In such an environment, Tongaat Hulett with its strong mix of agri-processing and prime land assets in Southern Africa has the opportunity to create substantial value over time in all phases of land usage, from acquisition, agriculture and agri-processing to the transition to development.

Expanding Sugar Production to Benefit from Improved Access to Attractive Markets

The 2009 financial year will mark a significant change in the scale of Tongaat Hulett’s Mozambique sugar operations with the commissioning of the expanded Xinavane sugar mill with an installed capacity to crush 1,7 million tons of cane and produce 208 000 tons of sugar per annum by 2010. The 2009 cane harvest will be drawn from the expansion in the area under cane rising from 8 163 hectares in 2008 to 12 877 hectares in 2009. At Mafambisse the 2 100 hectare expansion at Lamego South will boost sugar production to levels above 100 000 tons by 2010.

The pace at which reforms in the EU sugar industry have been adopted continued to increase in 2008. Sugar production in the EU is projected to fall to 13 million tons in 2009/10 from prior levels in excess of 20 million tons prior to the key 1 October 2009 deadline which allows LDC and African, Caribbean and Pacific (ACP) countries duty and quota free access to the EU. This decrease in production, coupled with constraints in the expansion of sugar cane production in EU and certain LDC and ACP countries, is creating opportunities for those LDC and ACP countries with the available production capacity. Tongaat Hulett has concluded agreements with marketing partners in the EU for 90 000 tons of its EU market access tonnages at levels above the institutional reference price and continues to engage with other prospective buyers.

Land Management, Agricultural Land Conversion and Development

The significance of Tongaat Hulett’s landholdings within the SADC region, particularly the prime locations within the city limits of eThekwini and the coastal areas south of the Tugela River, require an effective land management and property development approach.

The development pressures on the eThekwini region are increasing, driven by an expanding urban population, the R10 billion investments in the expansion of the port and the new airport and trade port and the topography of the region which is limiting the region’s development choices. Tongaat Hulett’s landholdings include land suitable for the city’s expansion. Its landholdings consist of 6 006 hectares in the prime developable coastal areas north of Durban, a further 2 050 hectares to the west of the city and 6 086 hectares located in the eThekwini growth corridor north of the city.

These 14 142 hectares of landholdings form part of the 48 621 hectares that provide cane to the sugar cane mills. With sugar cane production having declined from the levels reached in 2000, a number of initiatives are underway to improve the supply of cane to the mills. These initiatives seek to improve yields, assist with the productive resolution of land claims in areas of cane supply and increase the area under cane. During 2008 Tongaat Hulett was successful in increasing the area under cane by 8 103 hectares.

Renewable Energy in the Agricultural Value Chain

It is estimated that energy generation accounts for up to 60 percent of global CO 2 emissions and the reduction of its impact on the environment remains a policy imperative for many national governments as they seek to reduce CO2 emissions and limit their effect on climate change. The significant investment in ethanol facilities in South and North America and in the EU in biodiesel facilities, coupled with legislation, such as the Energy Policy Act of 2005 and the Energy Independence and Security Act of 2007 in the United States along with similar legislation in the EU, are expected to keep the demand for biofuels high in the medium to longer term in order to reduce dependence on fossil fuel.

In Brazil ethanol from sugar production is able to compete with crude oil as a source of fuel at a world price above US$40 to US$45 per barrel and results in between 70 and 90 percent less CO2 emissions than fuels produced from crude oil. Although significant debate and research continues surrounding the use of food crops as sources of renewable energy, ethanol from sugar cane with its status as the most cost effective and environmentally efficient feedstock is estimated in research conducted by the World Economic Forum to triple its global production capacity by 2030. Sugar cane grows well in many Southern hemisphere countries and has the potential to substantially increase production without impacting on food security.

In Brazil and Columbia, two of the fastest growing sugar industries in the world, clearly defined government strategies have provided a clear framework and support that have resulted in the establishment and viability of a significant sugar cane industry where the integrated renewable energy component has been a key part of its success.

In South Africa, the power supply situation in 2008 stabilised, as the global economic downturn saw reduced electricity demand as a number of large expansion projects were either cancelled or put on hold. Electricity generation also improved as Eskom increased its coal stockholdings and conducted an extensive maintenance programme at its generating units. This is likely, in the short term, to allow Eskom to address the supply shortfall via its Energy Conservation Scheme comprising voluntary reductions by consumers, the proposed Power Conservation Programme that includes mandatory regulations to reduce demand and ongoing focus on maintaining coal stock levels and generating plant maintenance programmes. The introduction of new participants in the power generation sector remains constrained with possible entrants unable to compete at current electricity prices that rely on long-term input agreements at prices well below current global averages and an installed capital base that does not reflect the replacement cost of these power stations.

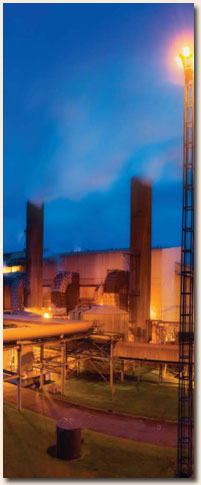

Renewable energy in the Southern African sugar industry remains a key element for the growth and long-term viability of millers and growers as it should create opportunities for increased realisations from bagasse and molasses. Tongaat Hulett’s sugar mills in Southern Africa, operating at full capacity, would have the potential to generate approximately 660MW of electricity using current technologies if they were to utilise all the bagasse and two thirds of the tops and trash from the cane supplied to the mills. This would have the environmental benefit of saving 2 million tons of coal annually and reducing CO emissions by 4,25 million tons in season.

Tongaat Hulett has made progress in completing the necessary environmental impact assessment approvals and detailed design and engineering for the expansion of its cogeneration capacity at its Felixton operation and will be in a position to proceed with the project when more competitive market conditions prevail in the electricity generation industry.

FINANCIAL RESULTS FOR 2008

Revenue increased by 11 percent to R7,1 billion in 2008 and profit from operations grew by 35 percent to R1,132 billion. Headline earnings improved to R583 million (2007: R61 million which were affected by corporate structuring transactions).

Profit from the starch and glucose operations grew to R240 million (2007: R105 million), as margins recovered in improved market conditions. Local maize prices traded closer to world prices from April 2008. Prices in international starch and glucose markets improved as demand for agricultural commodities increased with changing dietary habits. Co-product prices increased due to greater international demand for edible oils and proteins.

Profit from the various sugar operations grew to R606 million (2007: R360 million) with the Zimbabwean operations being accounted for on a dividend received basis. Total sugar production in 2008 was 1,106 million tons (2007: 1,119 million tons). The factors affecting production levels are explained in the Review of Operations and include a reduction in the Zimbabwean sugar crop in 2008.

The Mozambique operations’ contribution to profit increased to R250 million (2007: R88 million). At Mafambisse, following the completion of the agriculture expansion, Tongaat Hulett’s shareholding increased from 75 percent to 85 percent. At both Mafambisse and Xinavane, as the plant-up areas of the agriculture expansion reached completion, shareholder loans have been converted to equity and the benefit of currency gains realised.

The South African agriculture, sugar milling and refining operations contributed R73 million to profit (2007: R46 million). The small 2007 and 2008 crops resulted in lower raw sugar export volumes and upward pressure on costs per ton. There were higher export and domestic sales realisations. In May 2008 the fire at the raw storage facility at the sugar refinery destroyed raw sugar storage buildings, conveyor equipment and 5 000 tons of raw sugar. Production resumed after a 21 day period. Comprehensive insurance is in place and R39 million has been recognised to date as a loss of profits insurance claim and R49 million has been included in capital profits as an insurance net gain in respect of the building and equipment destroyed in the fire.

The downstream sugar value added activities contributed R204 million to profit (2007: R138 million). The South African refined exports, domestic marketing, sales and distribution activities delivered another good performance, as did the Botswana and Namibian sugar packing and distribution operations. Voermol, the downstream animal feeds operation increased profits due to improved margins.

Dividends of R35 million (2007: R53 million) were received from Triangle Sugar in Zimbabwe.

The Swaziland operations contribution to operating profit increased by 26 percent to R44 million.

Operating profit from agricultural land conversion and developments amounted to R263 million (2007: R428 million) with a further R22 million in capital profits (2007: R48 million) being realised. Market conditions for property development in the prime residential, resorts and commercial sectors were depressed during the year, while the demand for land for affordable housing and industrial property in the Durban area remained positive. The shortage of established industrial logistics, support and service locations, continues to delay development north of Durban. During the year 181 developable hectares (368 gross hectares) were sold, comprising 21 hectares in prime locations, mainly Umhlanga Ridgeside and Umhlanga Ridge Town Centre, and 160 hectares for affordable housing in the Cornubia area.

The centrally accounted and consolidation items include an R86 million gain on the recognition of an unconditional entitlement, in 2008, to an employer surplus account in respect of the 2001 surplus apportionment in the Tongaat Hulett pension fund.

Cash inflow from operations increased to R965 million for 2008 (2007: R502 million), including a release of cash from working capital. Tongaat Hulett’s net debt has increased to R2,356 billion from R991 million at the end of 2007, with significant capital expenditure, mainly on the Mozambique expansion and investment in sugar cane growing crops. Net finance costs increased to R280 million, with the higher interest rates and the increased borrowings in the business.

The effective tax rate for the year ended 31 December 2008 was 23,8 percent. This is lower than the statutory tax rate of 28,0 percent, primarily as a result of the effect of the lower tax rates in Mozambique and Botswana, non-taxable foreign income, and the impact of the reduction in the South African corporate tax rate on the carrying value of deferred tax. This was, to some extent, offset by the secondary tax on companies charge.

The 2007 financial results included the main effects of the completed corporate structuring transactions – the listing and unbundling of Hulamin, a share buy-back and the 25 percent BEE equity participation transactions. The 2008 results include the ongoing amortisation of the employee BEE equity transactions’ IFRS 2 charge to the income statement and the consolidation of the BEE special purpose vehicles, as required by International Financial Reporting Standards (IFRS). The balance sheet reflects the consolidation of the debt in the BEE equity participation entities, which is independent of the Tongaat Hulett net debt and is to be effectively equity settled.

The Board has declared a final dividend of 150 cents per share. This brings the total annual dividend to 310 cents per share, which is the same as the prior year.

REVIEW OF TONGAAT HULETT’S OPERATIONS

Tongaat Hulett has the advantage of owning a compelling mix of agri-processing assets in Southern Africa with access to attractive markets. Its expansion path favours large scale agriculture and agri-processing operations in selected countries, given the importance of understanding and establishing social, political and community support in Africa and the associated land and water management requirements. Through its South African sugar and starch and glucose operations, it produces almost half of the refined carbohydrates manufactured in South Africa. In starch, one of nature’s most versatile raw materials, and in sugar, arguably nature’s most efficient source of carbohydrate, Tongaat Hulett has the platform for a variety of downstream products. Product development within the organisation follows an integrated approach between the sugar and starch operations and has seen the successful commercialisation in 2008 of high purity fructose from sugar with a number of significant opportunities under investigation. Its four significant operations in Mozambique and Zimbabwe are located in agricultural areas that represent some of the lowest cost sugar production regions in the world.

STARCH AND GLUCOSE

Maize Procurement

As worldwide demand for food increases and an increasing proportion of food crops are diverted to renewable energy, global food commodity stocks, such as maize, are declining. The low stock levels, combined with a limited ability to increase the area of land available to agriculture, have lead to increases in the international price of maize to levels at which the South African agricultural industry is competitive. This encouraged increased planting in South Africa which, coupled with good weather, resulted in an excellent crop of 12 million tons which was harvested in mid 2008. The increased crop resulted in South African maize prices, despite the higher local price, trading at levels close to the price of maize in international markets and supported Tongaat Hulett Starch’s competitiveness from April 2008. The outlook for the 2008/09 crop remains positive with planting intentions of 2,56 million hectares being slightly below those for 2007/08. Early weather conditions have been favourable and as a result expectations are for a crop similar in size to the prior season.

International prices, after peaking at a price of US$295 per ton in July 2008, have declined to levels around US$150 per ton because of the impact of the world economic situation and falling oil prices. At these levels, prices remain above the long term average Chicago Board of Trade (CBOT) price of US$95. Local producers have been cushioned from this decline by a weaker exchange rate and local prices continue to trade at levels US$5 to US$10 above the CBOT price.

Tongaat Hulett secures its physical supply of non-genetically modified maize through direct contracting with farmers and contracting for delivery with selected grain traders. The physical supply for the remainder of the 2007/08 maize season and the bulk of the physical supply for the 2008/09 season has been contracted.

The pricing of the maize continues to be delinked from the physical supply utilising two established methods, namely toll manufacturing arrangements with selected customers where the final product price reflects the maize input costs, and the back-to-back contracting approach in which the maize is priced at the time the final product price is agreed with a customer. These approaches effectively eliminate the risk of profit volatility that could arise from valuation adjustments on maize. The back-to-back method does not eliminate the profit volatility which arises due to the relative prices of South African maize compared to the world prices.

A third pricing mechanism, which secures the local price of maize at a level relative to the international price has been developed and applied for the first time in 2008. This mechanism, referred to as a “gap hedge” allows Tongaat Hulett to take advantage of periods when the South African maize price is at a level (gap) that is competitive with the international price of maize. This is achieved by contracting for a fixed quantity of maize at a local price that will maintain a constant premium or discount in US dollars to the CBOT price.

Utilising a combination of the above three methods has resulted in the maize price on approximately 70 percent of the 2009 local maize requirements being hedged at levels close to the international price of maize at December 2008.

Local Market

Domestic volumes in the starch operation grew by 1 percent in 2008. Growth of 12 percent in the confectionery sector and 5,5 percent in the coffee creamers sector was offset by volumes in the papermaking sector reducing by 9,6 percent and in the alcoholic beverage sector by 2,5 percent. In a number of other major sectors, such as corrugated packaging, volumes were in line with the prior year.

The trend towards increased prices for starch and glucose in international markets continued well into 2008 and this resulted in improved pricing in the South African market. The starch operation derives approximately 84 percent of its local sales volumes from industry sectors related to consumer foods and products. It is anticipated that demand in these market sectors will offset volume losses experienced in the industrial sectors of the market.

New product development for the local and export markets continued in 2008 with the commissioning late in the year of a second pre-gelatinsation plant at the Meyerton mill. The new plant will supply waxy modified starches to local and export markets. Ongoing research trials and market development continued for Zeba®, a starch based hydropolymer product used as a soil amendment agent that is able to retain and release water and nutrients. The results of the trials continue to reflect the benefits of the product in improving crop yields and quality.

Export Markets

Exports in 2007 had been constrained by the high relative price of maize in South Africa, compared to the world price. The closure of this gap for most of 2008 allowed the starch operation the opportunity to compete more aggressively in export markets resulting in volumes increasing by 40,6 percent over 2007.

In particular, the operations set up to trade in the Australian market started to enjoy success, winning a major contract for supply of modified starch into the mining industry in Australia.

Cost Management, Efficiencies and Capacity Utilisation

Various initiatives to reduce costs and improve efficiencies continued in 2008. These included a significant focus on boiler performance, with encouraging improvements in coal usage at Kliprivier, ongoing focus on delivery performance resulting in significant improvements in customer service on starch products and a number of projects focused on improving electricity usage. Wet mill capacity utilisation increased from 75 percent in 2007 to 77 percent in 2008.

Initiatives to reduce storage and handling costs continued during the period with the establishment of a 20 000 ton bunker silo facility at the Kliprivier mill. The utilisation of silo bags at various locations continued and was effective in reducing the overall costs of storage.

Trends in International Starch and Glucose Markets

The early part of 2008 saw continued upward pressure on starch and glucose prices on the back of higher agricultural commodity prices resulting in an improvement in margins for starch and glucose producers. Decreases in prices in the latter part of the year on the back of falling raw material prices have been offset by lower maize input costs and freight rates resulting in margins remaining constant. Globally, the quality of product from China, a major exporter, remains a concern following the melamine crisis during 2008.

SUGAR CANE PROCESSING

Sugar cane processing operations in Southern Africa have previously been confronted by global and regional market conditions that resulted in declining returns and inhibited reinvestment in the industry. In a global environment that has seen agricultural market reforms, increasing demand for food and the integration of renewable energy and agriculture, these changes, particularly given the correct regional legislative frameworks and support, will significantly enhance agriculture and agri-processing in the region. As sugar cane is increasingly viewed as feedstock material that can be processed to produce a variety of products and co-products, a number of additional business opportunities for its processing or beneficiation are likely to be created.

SOUTH AFRICAN SUGAR OPERATIONS

SA Sugar Crop, Agriculture, Cane Supply and Milling Capacity Utilisation Initiatives

The sugar mills situated on the North Coast of KwaZulu-Natal continue to experience a shortage of cane supply. Grower viability, the uncertainty created over land ownership and adverse weather conditions in recent years have all contributed to reduced cane supply. The increase of 8 103 hectares in the area under cane in 2008 to 148 621 hectares was offset by a continuation in the adverse growing conditions experienced since 2006 and limited the increase in sugar production to 644 000 tons (2007: 604 000 tons).

Sugar cane production per hectare of cane has declined from levels of 64 tons per hectare achieved in 2000 by 26 percent because of the factors outlined above. In order to match existing capacity at its South African cane milling operations, land management and cane supply initiatives to increase the area of land under cane and improve yields have been identified for implementation.

The dominant features of achieving greater yields per hectare lie in sugar cane receiving the appropriate amount of rainfall at suitable times of the year, together with improved farming practices. Processes designed to encourage and enable growers to apply the correct farming practices are currently underway with the aim of improving yields to above 64 tons per hectare in a good rainfall year. These processes are supported by the expansion of Tongaat Hulett’s cane extension services and the associated transport initiatives to support the establishment of cane on third party land that is fallow or being utilised for alternate crops. Initiatives to increase cane supply by acquiring land that is currently not supplying the mills, supports property development and adds value to its existing landholdings continue to be pursued.

As part of the overall land management process, Tongaat Hulett is assisting in the land claims processes within its cane catchment area in a positive and constructive manner that ensures cane supply to its mills is sustained. The post settlement model entails working with the claimant communities in order to assist them with business management and the development of successful farming practices, both during the transitional period prior to the settling of the claim and once the claimant community has taken ownership of the land.

Tongaat Hulett is able to demonstrate proof of ownership on its landholdings pre-dating 1913. Some 5 495 hectares of Tongaat Hulett owned land, of which 1 050 hectares is prime development land, is under gazetted land claims. Tongaat Hulett has reached agreement on the disposal of 3 230 hectares of bushveld land with the Regional Land Claims commission and continues to monitor and assist in the settlement of land claims on land supplying its mills in the most appropriate manner to improve future cane supplies.

Operational Performance – Milling and Refining

Tongaat Hulett’s sugar technology leadership was confirmed during the year with milling performance continuing to exceed industry benchmarks measured in terms of critical sugar recovery. Improvements in efficiencies and capacity at the refinery continued, despite a fire destroying the raw sugar warehouse and causing the refinery to shut for 21 days. Refined production for the year was 549 000 tons (2007: 574 000 tons) and would have exceeded 2007 levels were it not for the fire. Continued focus on operational efficiencies resulted in improvements in a number of areas and will see the refinery achieve production in excess of 600 000 tons. These improvements have resulted in a decrease in the cash cost of operating the refinery to US$36 against the current refined white sugar premium of US$80 per ton.

Domestic Market

Tongaat Hulett continues to optimise the value of the Huletts® brand as the leading sugar brand in South Africa. The brand remains the cornerstone of Tongaat Hulett Sugar’s market positioning and offers a total sweetener solution including a range of high intensity sweeteners. During 2008 the successful commissioning of a liquid fructose plant at the refinery has added liquid fructose to this range. Market demand for liquid fructose has exceeded expectations and work is continuing on efforts to debottleneck the pilot plant whilst the feasibility of a larger scale production facility is investigated.

Local market sugar sales of 466 000 tons increased by 1 percent over prior year sales of 460 000 tons with stockholdings at 31 December 2008 increasing to 173 000 tons (2007: 144 000 tons). Sugar prices in South Africa remain the lowest in the region with the current price of 23,6 US cents per pound being 10 percent below the next highest price in the region.

The application that was made through the South African Sugar Association (SASA), with the support of the DTI, to ITAC for an increase in the import tariff reference price from US$330 to US$400 per ton has received two objections. SASA is currently responding to the objections. A successful outcome on this application will enhance protection in the local market against duty paid imports in times of low world prices.

International Markets

Following the small 2007 and 2008 crops, export volumes from South Africa were 210 000 tons (2007: 245 000 tons) and were sold at an effective world sugar price of 12,1 US cents per pound (2007: 11,8 US cents per pound) at an average exchange rate of R8,05/US$ (2007: R7,12/US$). Stock on hand at the end of December 2008 was 89 000 tons (2007: 62 000 tons).

Voermol

Having pioneered the production of bagasse and molasses-based animal feeds under the Voermol® brand, this operation continues to be a leader with its range of energy and supplementary feeds, amongst others, as the cornerstone of its offerings to the livestock farming community. This operation is integral to the strategy of optimising value from molasses and bagasse from the sugar mills and showed an increased contribution to earnings in 2008.

MOZAMBIQUE SUGAR OPERATIONS

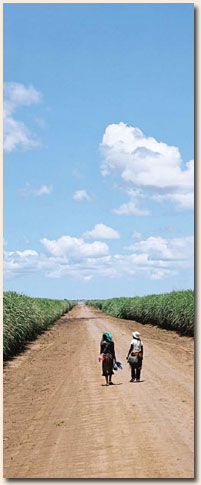

Tongaat Hulett’s sugar operations in Mozambique consist of the Xinavane and Mafambisse sugar mills and surrounding estates. The 2009 year marks a watershed in the development of these operations with the commissioning in late April 2009 of the expanded Xinavane sugar mill and the harvesting of the expanded sugar estates at Xinavane and Mafambisse that will result in sugar production in 2009 being more than double that achieved in 2008.

Mozambique Sugar Crop, Agriculture and Milling Capacity Expansions

During 2008 the complexities and interruptions associated with the expansion projects in the Mozambique operations and the diversion of 64 000 tons of cane, representing approximately 8 000 tons of sugar, to seed cane in the agricultural expansion of Xinavane resulted in sugar production of 108 000 tons being in line with prior year production.

As part of the Xinavane mill expansion, good progress on the 6 500 hectare agricultural expansion of the sugar cane estates was made during 2008 with sugar cane being planted on 5 470 hectares. The 2009 area under cane supplying the Xinavane mill of 12 877 hectares, which includes 2 028 hectares of outgrower cane, will be expanded during the course of the next two years to 15 858 hectares comprising 11 879 hectares from company owned estates and 3 979 hectares from outgrower estates. It is anticipated that all except 2 percent of this total area would have been planted by the end of 2009. At Lamego South the 2 100 hectare expansion was completed during 2008, to further utilise the spare capacity of the Mafambisse sugar mill. Production at Mafambisse was 45 000 tons (2007: 41 000) and at Xinavane 63 000 tons (2007: 67000 tons).

The expansion of the Xinavane sugar mill continues to make good progress. A number of key pieces of equipment are on the critical path with initial crushing scheduled for May 2009.

These expansions in Mozambique will result in production of 300 000 tons of sugar by 2010.

Renewable Energy

In Mozambique, the duty free access into the EU for LDC and ACP countries is of particular relevance. The primary focus of ethanol production in these operations would be for sale to the EU in terms of Mozambique’s preferential market access. Tongaat Hulett is pursuing opportunities for producing biofuel at Cofomosa (Moamba) in Mozambique as part of the expansion plans at Xinavane.

SWAZILAND SUGAR CANE OPERATION

The Tambankulu sugar cane estate in Swaziland has consistently achieved excellent sucrose yields due to the good soils and growing conditions in the region. These conditions resulted in the production of a raw sugar equivalent of approximately 56 000 tons during 2008 (2007: 58 000 tons) which although below the record levels achieved in 2007, remains well above comparable estates in the region. The operations also benefited from higher realisations within the Swaziland sugar industry.

ZIMBABWE SUGAR OPERATIONS

Tongaat Hulett’s strategy, in respect of its wholly-owned Triangle Sugar and its 50,35 percent held Hippo Valley Estates, under the extremely difficult circumstances during the period under review, was to manage these operations as far as possible to ensure that the infrastructure and skills base was maintained. In addition there is an increasing emphasis on re-establishing outgrower production to former levels.

In the 2008 season, sugar production was 298 000 tons compared to the 349 000 tons produced in 2007. The business has had to contend, inter alia, with the extreme effects of hyperinflation, exchange rate movements, foreign currency shortages and price controls in Zimbabwe. In addition to the impacts of the low cane throughput, principally from outgrower cane land, the crushing season has been affected by production stoppages caused by the non-availability of spares and a shortage of boiler fuel. Refined sugar and alcohol production levels were significantly impacted by poor energy balances in the two sugar mills. Alcohol has been produced at the sugar operations in Zimbabwe since 1980, with Zimbabwe as an ACP country enjoying similar preferential market access to attractive European markets, as do Tongaat Hulett’s Mozambique operations. Local market sales for 2008 remained at selling prices significantly below world and regional levels.

Rehabilitation of Existing Capacities

Zimbabwe’s land reform programme was undertaken with various shortcomings including a lack of provision for equipment, working capital, finance and training for the newly settled farmers to grow and harvest the established sugar cane crop. This has led to yield reductions of 72 percent on outgrower farms, with the crops perishing on 38 percent of these farms. In addition, shortages of agro-chemicals, spares and foreign currency have detrimentally affected both the company’s as well as outgrower estates.

Despite efforts in 2008 to commence with the rehabilitation of outgrower estates, the deteriorating macroeconomic environment that prevailed restricted meaningful progress in this regard.

It is estimated that under improving macroeconomic conditions the rehabilitation of the outgrower sector of approximately 15 000 hectares will take place over a period of three to four years. The most significant source of funding for this rehabilitation will be accessing the EU Adaption Aid Funding. In the case of Zimbabwe, Euro 45 million has been allocated, most of which will be channeled through the Canelands Trust that has been set up by the company, with oversight provided by the EU and the Government of Zimbabwe. The first tranche of Euro 2,7 million has been made available to establish the project’s administrative capability with the balance of the funding conditional upon, amongst other issues, security of land tenure and the removal of domestic market price controls on sugar. The capital cost to restore milling capacity to 600 000 tons sugar per annum is estimated to be less than R100 million.

The Triangle and Hippo Valley operations provide extension services and support programmes to all qualifying outgrowers of sugar cane through technical training, sourcing of key inputs and finance, and access to surplus farming assets at Mkwasine.

LAND MANAGEMENT AND DEVELOPMENTS

Value Creation from Agricultural Land Conversion

Worldwide population growth, urbanisation, expanding middle classes, food scarcity and environmental concerns are increasing the competition for and underlying scarcity and value of agricultural and urban land. The phases of property markets and the timing thereof are difficult to predict, being strongly influenced by local factors and global events. Over a number of years, Tongaat Hulett has developed the ability to optimise the value of and earnings from its landholdings, while minimising risk, through its profile of:

- Leading land conversion skills and competencies,

- Bulk, concentrated land ownership in areas of high demand / value,

- Planning and commercial partnerships with eThekwini and KwaDukuza municipalities and other tiers of government,

- Optimising the pace of transition for value in the development cycle,

- The optimisation of land holding value contributions and the minimisation of risk through continuity of agricultural use of land up to final transition to property developments,

- A number of land use and land conversion options,

- Various options for securing cane and maize supplies,

- Opportunities for the land reform process to increase the agricultural base and developmental prospects, and

- The combination of agriculture, agri-processing and property development provides many options of how to satisfactorily deal with land claim issues with Tongaat Hulett able to prove ownership for all developable land dating back to before 1913.

Tongaat Hulett’s land management, planning and development competencies provide the platform for protecting land rights, cane supply to mills and the ability to manage the land reform process. This is coupled with coordinated, holistic large scale and long-term development planning that realises optimal value from agricultural land conversion and enables Tongaat Hulett to manage the pace of land conversion by securing timeous and optimal development rights and bulk infrastructure investment. A key factor in the success of Tongaat Hulett’s conversion of some 2 200 hectares of land over the past 15 years has been the fact that each development, whilst being commercially viable in its own right, has been able to increase the value of the remaining land assets.

Market Review and Operating Environment

Conditions in several property market sectors in which Tongaat Hulett operates were adversely impacted during the first half of 2008 by a number of local factors, which included a backlog in investment in public infrastructure and the National Credit Act and were compounded by deteriorating global market conditions and falling confidence in the latter part of the year. These conditions look set to endure for some time and hence the timing for conversion of agricultural land into office and retail, as well as high-end residential and resort development, is anticipated to remain generally unfavourable.

eThekwini, as one of South Africa’s fastest growing cities and economic centres continues to experience increasing urbanisation combined with an existing and growing backlog in the provision of housing, social facilities and employment. This has stimulated extensive Government investment in economic development infrastructure in the region to the north of eThekwini. With the city’s growth constrained because of its natural topography, its primary development opportunities lie to the north and west of the city.

Tongaat Hulett, with approximately 8 136 gross hectares (5 111 developable hectares), out of a total of 14 142 gross hectares, located in these regions, is uniquely positioned to assist government in the conversion of land for new housing and employment opportunities. These developments create further demand for associated uses and activities such as social amenities that include educational institutions, health and public services and other community services, all of which require further land conversion.

The eThekwini growth corridor to the north of the city, with government infrastructural investment in excess of R8 billion taking place at the new international airport at La Mercy and the surrounding Dube Tradeport, will be a key development node.

Through its partnerships with government and the opportunities that the eThekwini growth corridor provides, Tongaat Hulett concluded sales in 2008 of 160 developable hectares of land in Cornubia for the development of housing by the eThekwini Municipality. These transactions followed extensive engagement with local and provincial government over the past year and have entrenched a cooperative relationship with the eThekwini Municipality. The improved relationship resulted in positive engagements and alignment on strategic planning tools such as the Northern Spatial Development Plan, Local Economic Development Plan for Tongaat and other Local Area Plans.

At the southern end of the eThekwini growth corridor, Bridge City continues to create an improved environment and new opportunities for the surrounding communities with over R700 million being invested by the government in infrastructure, such as the new rail spur and railway station, link roads and interchanges. This is over and above the new shopping centre, provincial hospital and regional magistrates’ court.

Niche opportunities continue to exist in the prime residential, commercial and industrial areas (6 006 gross hectares and 3 978 developable hectares) where the supply of land with development rights remains constrained. Progress is being made in acquiring rights and infrastructure that improve the conversion value of land in these sectors. Opportunities for sales at the right prices and with appropriate risk and working capital profiles will continue to be pursued. During 2008, sales of 21 hectares were achieved in Umhlanga Ridge Town Centre, Ridgeside and Zimbali.

SUSTAINABILITY

Tongaat Hulett is committed to the principles of sustainable development and their integration into all aspects of its business activities. Safety, health and environment, broad based Black Economic Empowerment, human resources and skills development, employment equity, indigenisation and corporate social investment in the communities in which it operates, remain key areas of focus.

In line with the objective of creating a workplace free from injuries, Tongaat Hulett continued with improvements in safety performance in 2008. The Lost Time Injury Frequency Rate reduced to 0,11 from 0,14 in 2007, with a reduction of over 90 percent over the past six years. Regrettably, seven fatal accidents occurred during the year emphasising the importance of the increased focus being paid to the identification and elimination of high risk activities. The sugar operations at Mafambisse in Mozambique and Triangle in Zimbabwe each experienced two fatalities, with the Felixton and Darnall sugar mills in South Africa and the Xinavane operation in Mozambique recording one fatality each. These tragic incidents that cause family suffering and hardship were investigated thoroughly, with action taken to prevent a recurrence of these types of incidents.

As part of a comprehensive programme to eliminate occupational health risks, holistic health programmes are in place at all operations. These primary health care services are provided at company clinics, first aid centres and the high quality company hospital in Zimbabwe and include risk assessment and control measures, hygiene surveys and medical surveillance. Given the extent of the HIV and AIDS pandemic in the areas in which the company operates and its impact on the associated economies and communities, these primary health programmes are underpinned by a comprehensive HIV and AIDS programme focusing on the prevention, treatment, care and support for the disease. Employees are actively encouraged to participate in voluntary counseling and testing (VCT). During 2008, progress continued to be made across all countries in the number of employees participating in VCT, resulting in the South African operations achieving a record level of 80 percent of employees who know their HIV and AIDS status. Support for employees affected by HIV and AIDS continued, with 1 767 employees receiving free anti-retroviral treatment, up from the 1 152 in 2006. In the Mozambique, Swaziland and Zimbabwe operations, malaria remains a significant health risk. In order to mitigate the effects of the disease, integrated malaria control programmes are in place in these operations.

Tongaat Hulett continues to focus on initiatives that minimise the depletion of natural resources, reduce waste generation and the overall impact of its operations on the environment. Operational targets have been set in respect of primary water use, energy use, greenhouse gas emissions, air quality (sulphur dioxide emissions), land use and biodiversity. As global awareness of the impact of fossil fuels on global warming increases, a number of initiatives and projects, which will have a positive impact on the company’s carbon footprint and greenhouse gas emissions, have been implemented. Ongoing progress is being made in harnessing the potential of sugar cane as a source of renewable energy generation, with new projects for electricity cogeneration and biofuel production under investigation. The use of gas as opposed to coal as a source of cleaner energy has also advanced within operations.

The principles of sustainable development and good corporate governance and their integration into all aspects of Tongaat Hulett’s business activities are described in more detail in the sustainability and governance reports included as part of this annual report.

BROAD BASED BLACK ECONOMIC EMPOWERMENT AND INDIGENISATION

Transformation, equal opportunity, the creation of a diverse employee profile and indigenisation remain a key performance area in each geographical region in which Tongaat Hulett operates.

Tongaat Hulett’s proud history of numerous meaningful and sustainable broad based BEE initiatives for the benefit of all stakeholders, continued in 2007 with the introduction of 25 percent BEE equity participation in Tongaat Hulett. This equity participation included strategic partners, the disadvantaged communities surrounding its property developments and the small-scale cane grower communities surrounding the South African sugar mills. In recognition of the key roles played by its employees in the sustainability of Tongaat Hulett, the equity participation also includes BEE management and employee share ownership schemes. During 2008, Tongaat Hulett and its strategic partners have focused on how best to utilise the service agreements established as part of the transaction to enhance the company’s competitive position in the areas of cane procurement, land restitution, development approvals and local government funding support.

The first broad based BEE rating was conducted in 2007 by the National Empowerment Rating Agency with Tongaat Hulett being categorised as a Level Three Contributor with an overall score of 75,16 percent. The second audit was conducted in 2008 and resulted in Tongaat Hulett being awarded an overall score of 70,38 percent resulting in a Level Four Contributor status allowing entities purchasing from Tongaat Hulett to recognise 100 percent of the value of their Tongaat Hulett purchases on the procurement element of their scorecards. Reductions occurred in the ownership score because of the impact of the current global financial markets on equity prices whilst the preferential procurement score declined following legislation changes that resulted in a new sampling process in respect of black suppliers. An increase in compensation costs because of a large increase in the value of share incentive schemes exercised pursuant to the unbundling gave rise to a decrease in the skills development score. These reductions offset the improvements made in the elements of enterprise development, employment equity and management control.

Tongaat Hulett recognises the value that a diverse human resource base brings to its businesses and is continuing with the strong employment equity culture that has been fostered over many years. Particular focus areas remain the employment of Africans and black females, the acceleration of the racial and gender mix at all levels within the organisation and the accommodation of people with disabilities. Currently, black employees fill 54 percent of management and 78 percent of skilled and supervisory positions. Within the South African operations, 66 percent of the 531 graduates are black employees, with women constituting 38 percent. In its Zimbabwe and Mozambique operations the employee base consists almost exclusively of local citizens. The Mozambique operations continue to experience a skills shortage resulting in higher numbers of foreign nationals being employed in that country than might be expected. Plans are being developed to employ and train local citizens to gradually replace these foreign nationals.

A key element in the long-term sustainable growth of the Southern Africa region and Tongaat Hulett is the transformation and indigenisation of the agricultural sector. Building on the strong platform established by the sale of some 11 871 hectares of Tongaat Hulett sugar cane land in South Africa to 98 black farmers as part of its Medium Scale Farm programme, the organisation continues to focus on increasing the pace at which subsistence farming amongst rural communities migrates to sustainable commercial farming practices and ownership. Tongaat Hulett’s emphasis and approach to its role and support for the transition differs in each of the countries in which it operates.

In Zimbabwe, the focus remains on working with more than 500 outgrowers in order to rehabilitate cane supply utilising the Euro 45 million in EU Adaption Aid Funding. Utilising the Mozambican expansion project as a catalyst, the operations in Mozambique are implementing an indigenous outgrower programme that will see an initial 7 farmers at Mafambisse and 1 163 farmers at Xinavane being assisted in farming sugar cane on 2 091 hectares of land. The focus in South Africa has been on the post settlement aspect of the land reform process for sugar cane land supplying its mills. This entails working with the claimant communities in order to assist them with business management and the development of successful farming practices, both during the transitional period prior to the settling of the claim and once the claimant community has taken ownership of the land.

In the area of maize farming, Tongaat Hulett, in partnership with the Buhle Farm Academy, has developed a five year programme to train black commercial maize farmers. Highlights in 2008 included the continuation of this programme with the second intake of emerging black farmers beginning their practical training at Tongaat Hulett’s Kliprivier maize farm. The initial graduates from the successful 2007 programme have been established on a fully equipped 3 000 hectare maize farm in the Balfour area to conduct maize farming on a commercial scale. During 2008, 1 500 hectares of land were prepared and maize was planted. The farming operations are expected to yield in excess of 5 000 tons of maize.

CONCLUSION

Outlook

Tongaat Hulett has the advantage, in the prevailing global economic turbulence, of operating in a number of less affected market sectors, having specific opportunities in its operations and being favoured by a weaker Rand.

Land and property development sales in the short-term are expected to come from the growth corridor north of Durban that commences inland of Umhlanga/Umdloti, extends around the new international airport at La Mercy and includes the greater Tongaat region. Tongaat Hulett owns 6 086 gross hectares in this corridor. Given the housing backlog and Government’s commitment to infrastructure spend, there is both opportunity and socio-economic urgency to establish communities with affordable housing in this area and to accelerate land conversion for airport services and support logistics, niche industrial, health care, education and social facilities. In the present economic conditions, few hectares are likely to be converted to development in the high value, prime locations on the coastline (Tongaat Hulett’s 6 006 hectares) and to the west of eThekwini(2 050 hectares) and the focus is on securing infrastructure and development rights, for conversion at the appropriate time.

Current developments in Zimbabwe are encouraging. In normalised conditions the Zimbabwean sugar operations would have twice the capacity of the expanded Mozambique operations, with similar market access and lower costs. The South African sugar milling, agriculture and refining operations will be influenced by the size of the current crop and the cane supply dynamics in northern KwaZulu-Natal. In Mozambique, sugar production in 2009 is targeted to be more than double the production in 2008, as the expansions come on stream, moving towards the 300 000 ton per annum level by 2010 and benefiting from preferential access to the EU market at premium prices. Following the anticipated cash absorption in the Mozambique expansion continuing into 2009, cash inflow is expected to commence in the latter part of 2009 and early 2010.

The starch operations have the prospect of a full year with maize prices close to the world price. Approximately 70 percent of the operation’s maize requirements for 2009 have already been procured on this basis and there are good weather and planting indications for the current maize season.

Acknowledgments

The 2009 year will see the retirement of two of the longest serving members of the Tongaat Hulett board, both having reached the mandatory retirement age.

After 31 years of loyal and dedicated service to Tongaat Hulett, Cedric Savage, a board member since 1981 and the company’s chairman since the year 2000 will retire at the company’s AGM on the 29 April 2009. During his time as Chief Executive from 1991 to 2002, Cedric presided over a major streamlining of the business that has culminated in Tongaat Hulett, as we know it today. Tongaat Hulett and the board have truly benefited from Cedric’s support and guidance and he leaves the company in good health and poised for a new phase in its development. Tongaat Hulett is grateful to him for his contribution over many years and we wish Cedric well in his retirement.

Elisabeth Bradley will also retire at the company’s AGM on the 29 April 2009 after being appointed to the Tongaat Hulett board in 1987. She has for a number of years, chaired the Audit and Compliance Committee and the company has benefited greatly from Elisabeth’s extensive corporate and board level experience.

I wish to pay tribute to the employees of Tongaat Hulett and to thank them for their continuing dedication and commitment. Working together, we have established a competitive platform that will stand us in good stead into the future.

The support and guidance that we have received from the board is highly valued. Tongaat Hulett has benefited from their wise counsel and experience over a number of years.

Peter Staude

Chief Executive Officer

Amanzimnyama

Tongaat, KwaZulu-Natal

19 February 2009